Applied Industrial (AIT) Up on Q2 Earnings Beat, Improved View

Applied Industrial Technologies AIT reported second-quarter fiscal 2023 (ended Dec 31, 2022) earnings of $2.05 per share, beating the Zacks Consensus of $1.71. Our estimate for fiscal second-quarter earnings was $1.69. The bottom line jumped 40.4% year over year.

Net sales of $1,060.3 million also outperformed the Zacks Consensus Estimate of $987.4 million. Our estimate for net sales in the reported quarter was $979.8 million. The top line jumped 20.9% year over year. Acquisitions boosted the top line by 0.5%, while foreign-currency woes had a negative impact of 0.7%. Organic sales increased 21.1%.

Strong fiscal second-quarter performance and improved fiscal 2023 outlook drove shares of the company up 11.4% at the close of business on Jan 26. For fiscal 2023, AIT expects earnings of $8.10-$8.50 per share compared with the prior view of $6.90-$7.55. The Zacks Consensus Estimate for the same stands at $7.52. Sales are estimated to increase 13-15% year over year in fiscal 2023 compared with 5-9% rise anticipated earlier. The EBITDA margin is predicted to be 11.5-11.7% for the same period compared with 10.9-11.2% anticipated earlier.

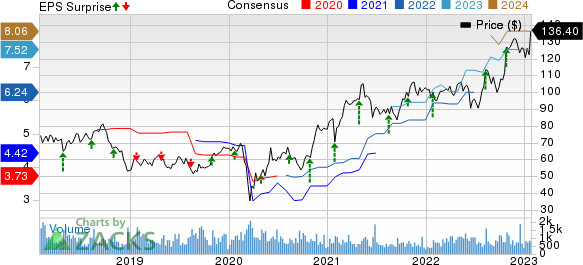

Applied Industrial Technologies, Inc. Price, Consensus and EPS Surprise

Applied Industrial Technologies, Inc. price-consensus-eps-surprise-chart | Applied Industrial Technologies, Inc. Quote

Segmental Discussion

Service Center-Based Distribution’s revenues, which contributed 66.5% to net revenues, totaled $705.4 million in the quarter under review. Our estimate for segmental revenues was $660 million. On a year-over-year basis, the segment’s revenues increased 20.1%. Organic sales grew 21.1%. Foreign currency translation had a negative impact of 1%. Segmental revenues were driven by benefits from break-fix MRO activity, sales process initiatives, pricing actions and investments across the U.S. manufacturing sector.

Engineered Solutions’ (formerly Fluid Power & Flow Control segment) ,, which contributed 33.5% to net revenues, totaled $354.9 million in the reported quarter. Our estimate for Engineered Solutions revenues in the fiscal second quarter was $319.8 million. On a year-over-year basis, the segment’s revenues increased 22.5 %. Organic sales ascended 21.1%, owing to strong automation demand, robust technical and engineering capabilities, backlog and exposure to diverse end markets.

Margin Profile

In the reported quarter, Applied Industrial’s cost of sales increased 21.4% year over year to $751.78 million. Gross profit in the quarter grew 19.7% year over year to $308.51 million, while gross margin decreased 30 basis points to 29.1%. Selling, distribution and administrative expenses (including depreciation) climbed 9% year over year to $195.61 million. EBITDA was $125.50 million, reflecting an increase of 35.6%.

Balance Sheet & Cash Flow

At the end of second-quarter fiscal 2023, Applied Industrial had cash and cash equivalents of $165.54 million compared with $184.47 million at the end of fiscal 2022. Long-term debt was $624.05 million, down 3.9% from fiscal 2022-end.

At the end of the reported quarter, Applied Industrial generated net cash of $88.82 million from operating activities, reflecting an increase of 9.3% from the year-ago period. Capital expenditures totaled $12.82 million, up 70.7% year over year. Free cash flow at the end of the reported quarter increased 3.1% year over year to $76 million.

In the first six months of fiscal 2023, Applied Industrial rewarded shareholders with dividends of $26.26 million, up 3.1% year over year.

Dividend Hike

Applied Industrial’s board approved a dividend hike of 2.9% to 35 cents per share (annually: $1.4), payable to shareholders on Feb 28, of record as of Feb 15. This marks the company’s 14th dividend increase since 2010.

Zacks Rank & Key Picks

Applied Industrial currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks within the broader Industrial Products sector are as follows:

Allegion plc ALLE presently holds a Zacks Rank #2 (Buy). ALLE pulled off a trailing four-quarter earnings surprise of 8.8%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks.

The Zacks Consensus Estimate for Allegion’s 2022 earnings has remained steady in the past 60 days. The stock has gained 8.6% in the past six months.

Valmont Industries, Inc. VMI presently has a Zacks Rank of 2. VMI delivered a trailing four-quarter earnings surprise of 12.5%, on average.

The Zacks Consensus Estimate for Valmont’s 2022 earnings estimate has been revised upward by a penny in the past 60 days. The stock has rallied 22.2% in the past six months.

IDEX Corporation IEX presently has a Zacks Rank of 2. IEX pulled off a trailing four-quarter earnings surprise of 5.7%, on average.

The Zacks Consensus Estimate for IDEX’s 2022 earnings has been revised upward by a penny in the past 60 days. The stock has rallied 13.6% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Valmont Industries, Inc. (VMI) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

IDEX Corporation (IEX) : Free Stock Analysis Report

Allegion PLC (ALLE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance