Applied Materials (AMAT) Boosts Semiconductor Presence With EPIC

Applied Materials AMAT announced a multi-billion-dollar investment to build a facility, namely Equipment and Process Innovation and Commercialization (EPIC) Center for collaborative semiconductor process technology and manufacturing equipment research and development (R&D).

The company strives to accelerate the development and commercialization of foundational technologies via its new facility. This, in turn, will help it to address the need for such technologies across the global semiconductor and computing industries.

Notably, AMAT’s investment in EPIC is estimated to reach $4 billion over the next seven years.

Further, EPIC Center, which will be located in Silicon Valley and be completed by 2026, is expected to create 2,000 engineering jobs and 11,000 jobs across other industries.

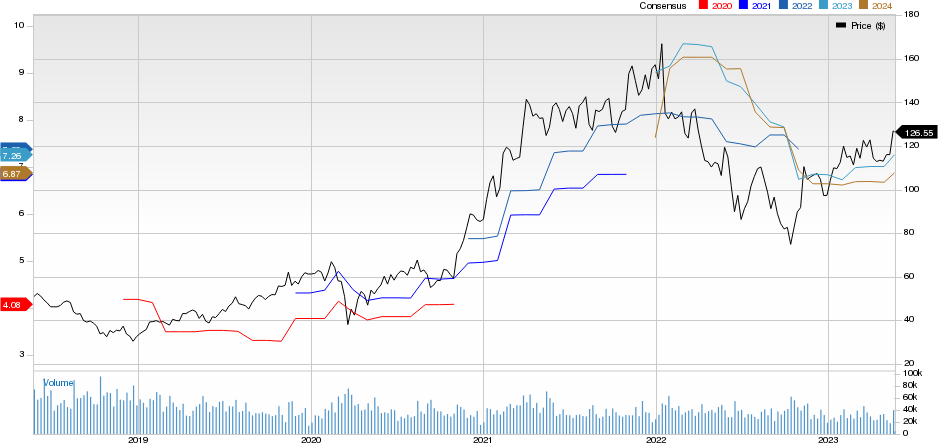

Applied Materials, Inc. Price and Consensus

Applied Materials, Inc. price-consensus-chart | Applied Materials, Inc. Quote

Delving Into the Headlines

The facility will provide chipmakers with dedicated space within an equipment company's R&D fab, offering early access to next-generation processes and equipment to accelerate product roadmaps.

Additionally, the EPIC Center will enable university researchers to validate new ideas on industrial-scale equipment and contribute to talent development.

Further, the facility is expected to reduce the time required to bring a technology from concept to commercialization, increase the success rate of new innovations and enhance the return on R&D investments for the semiconductor industry.

Thus, EPIC will help Applied Materials to cater to evolving needs of the semiconductor industry.

Growth Prospects

Applied Materials' latest move demonstrates the company's commitment to strengthening its position in the $1 trillion semiconductor industry.

Per a Fortune Business Insight report, the global semiconductor market size is expected to reach $1.38 trillion by 2029. The report also states that the market is likely to witness a CAGR of 12.2% between 2022 and 2029.

According to a report by Vantage Market Research, the underlying market revenues are expected to reach $908.92 billion by 2030, exhibiting a CAGR of 8.7% during the forecast period of 2023 to 2030.

We believe the strengthening efforts of Applied Materials in this promising market will help it in winning investors’ confidence in the near term.

Shares of AMAT have been up 30% in the year-to-date period, outperforming the Computer and Technology sector’s rise of 26.6%.

Zacks Rank and Stocks to Consider

Currently, Applied Materials carries a Zacks Rank #3 (Hold).

Investors interested in the broader Zacks Computer & Technology sector can consider some better-ranked stocks like Ciena CIEN, CrowdStrike CRWD and AMETEK AME. Ciena, CrowdStrike and AMETEK each carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Ciena shares have lost 14.9% in the year-to-date time frame. The Zacks Consensus Estimate for CIEN’s fiscal year 2023 earnings is pegged at $2.81 per share, suggesting an increase of 47.9% from the prior year’s reported figure.

CrowdStrike shares have risen 27% in the year-to-date period. The Zacks Consensus Estimate for CRWD’s 2023 earnings is pegged at $2.30 per share, suggesting an increase of 49.4% from the prior year’s reported figure.

AMETEK shares have rallied 3.4% year to date. The Zacks Consensus Estimate for AME’s 2023 earnings is pegged at $6.11 per share, suggesting an increase of 7.57% from the prior year’s reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ciena Corporation (CIEN) : Free Stock Analysis Report

AMETEK, Inc. (AME) : Free Stock Analysis Report

Applied Materials, Inc. (AMAT) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance