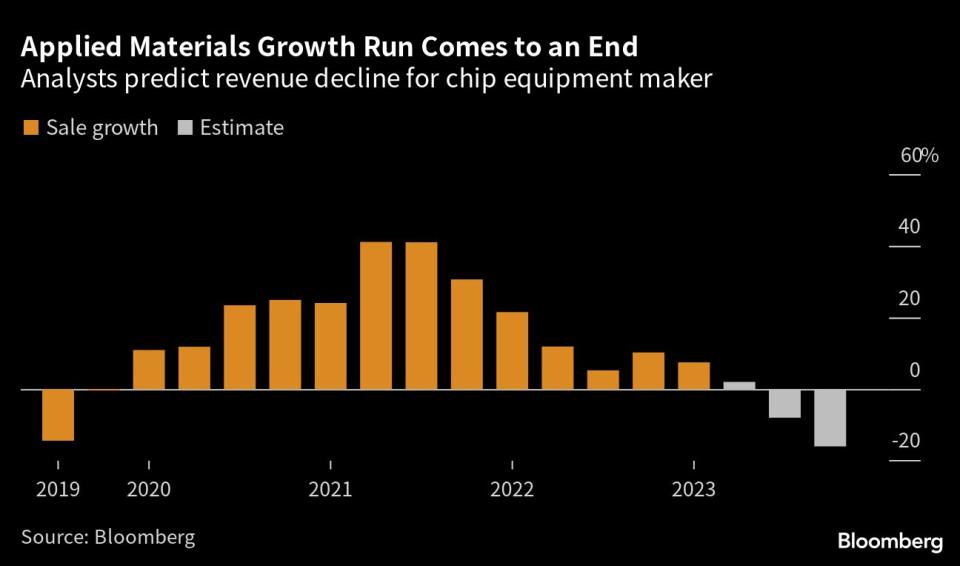

Applied Materials Sees Sales Drop as Chipmakers Pull Back Spending

(Bloomberg) -- Applied Materials Inc. expects sales to decline in the current quarter as it grapples with a memory-chip slump, though the drop won’t be as sharp as some analysts had feared.

Most Read from Bloomberg

Fiscal third-quarter sales will be about $6.15 billion, the company said in a statement Thursday, compared with $6.52 billion a year earlier. Analysts had estimated $5.97 billion.

Makers of memory chips are struggling with a historic glut of inventory, forcing them to cut spending on equipment upgrades and new factories. That’s hurt orders for companies like Applied Materials, threatening a pandemic-era growth run. The Santa Clara, California-based company, the biggest maker of semiconductor-manufacturing machinery, said that memory customers’ spending is tracking at its lowest level in more than a decade.

“Certainly there’s some challenging macro conditions,” Chief Executive Officer Gary Dickerson said in an interview.

Still, Applied Materials is benefiting from the rush to make more chips for cars and factory equipment. That’s helping offset a slowdown in orders for machines that produce components for smartphones and personal computers. Consumer demand for those devices hasn’t recovered, making semiconductor suppliers reluctant to invest in new equipment.

Applied Materials shares slipped 1% in late trading after the results were released. They earlier closed at $129.92 in New York, leaving them up 33% this year.

Excluding some items, earnings will be $1.56 to $1.92 a share in the current quarter, versus a projection of $1.63 a share.

Dickerson said demand for machines needed to make chips for the automotive and industrial markets “remains pretty robust.” That’s helping cushion slower spending on gear used for memory chips in particular.

Demand for less sophisticated chips has held up better than those made with the latest techniques. That’s because automakers and industrial-equipment producers are using simpler kinds of semiconductors to add new functions to their products. Such devices don’t need to be made with cutting-edge gear, unlike the key chips found in smartphones and personal computers.

Chinese customers also are rushing to add new capacity for older types of production. Companies in that country are subject to US government restrictions on their access to the most advanced production gear.

Buoyed by government subsidies, demand for that type of gear is gaining momentum in the US, Japan and Europe, and will overtake the growth rate in China, Dickerson said.

Second-quarter profit was $2 a share, excluding some items. Sales rose 6.2% to $6.63 billion in the period. Analysts estimated earnings of $1.83 a share and revenue of $6.37 billion.

(Updates with CEO’s comments starting in fourth paragraph.)

Most Read from Bloomberg Businessweek

The Man Who Spends $2 Million a Year to Look 18 Is Swapping Blood With His Father and Son

Maasai Are Getting Pushed Off Their Land So Dubai Royalty Can Shoot Lions

©2023 Bloomberg L.P.

Yahoo Finance

Yahoo Finance