Applied Materials Shares Boosted by A.I. Fueled Rally

Applied Materials is a Magnet for Big Money

So, what’s Big Money? Said simply, that’s when a stock presses higher alongside chunky volumes. It’s indicative of institutions betting on the shares.

Unsurprisingly, Applied Materials has many fundamental qualities that are attractive.

This sets up well for the stock going forward. Paying attention to how the shares trade, suggests there could be more upside.

You see, fund managers are always looking to bet on the next outlier stocks…the best in class. They spend countless hours sizing up companies, reading reports, speaking to analysts…you name it. When they find a company firing on all cylinders, they pounce in a big way.

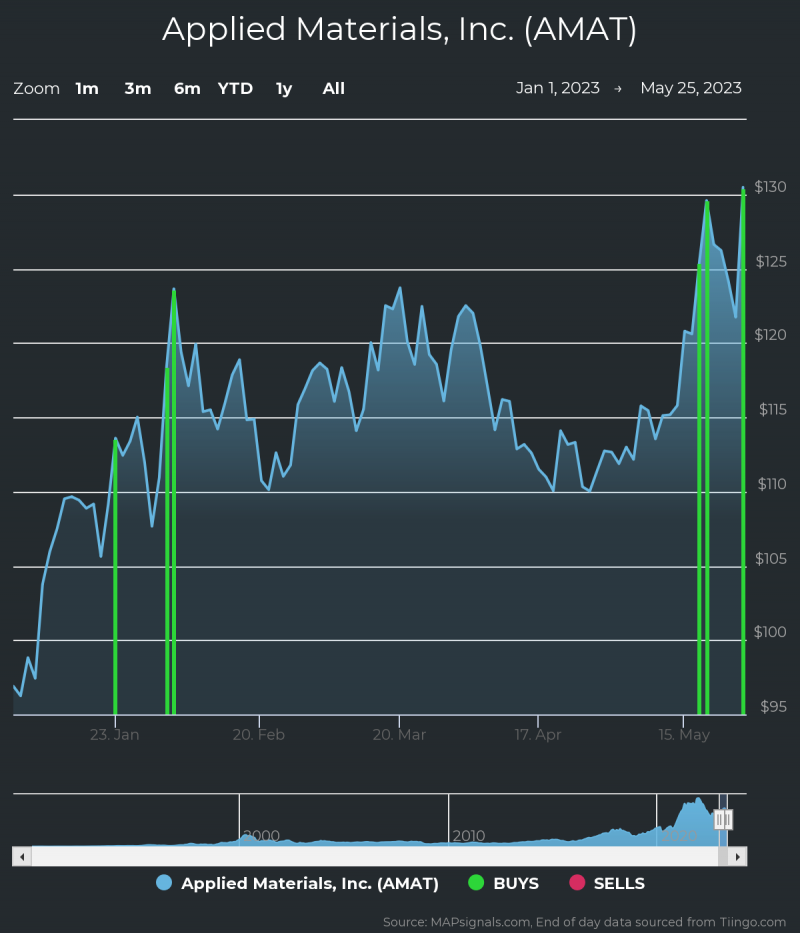

The YTD action tells the story. Each green bar signals big buying volumes as the stock ramped in price:

Since January, the stock attracted chunky Big Money buy signals. Recent green bars could mean more upside is ahead.

Now, let’s check out the technical action grabbing my attention:

Month-to-date outperformance vs. VanEck Semiconductor ETF (+3.05% vs. SMH)

Outperformance is important for leading stocks.

Applied Materials Fundamental Analysis

Next, it’s a good idea to check under the hood. Meaning, I want to make sure the fundamental story is strong too. As you can see, AMAT has had double-digit sales and earnings growth the past 3 years:

3-year sales growth rate (+21.1%)

3-year EPS growth rate (+38.8%)

Source: FactSet

Marrying great fundamentals with technically superior stocks is a winning recipe over the long-term.

In fact, AMAT has been a top-rated stock at MAPsignals for years. That means the stock has had buy pressure, strong technicals, and growing fundamentals. We have a ranking process that showcases stocks like this on a weekly basis.

It’s made the rare Top 20 report numerous times since 2014. The blue bars below show when AMAT was a top pick:

Tracking unusual volumes reveals the power of the MAPsignals process.

Applied Materials Price Prediction

The AMAT rally has been in place for years and recently. Big Money buying in the shares is signaling to take notice. Given the historical gains in share price and strong fundamentals, this stock could be worth a spot in a diversified portfolio.

Disclosure: the author holds no positions in AMAT at the time of publication.

Learn more about the MAPsignals process here.

Contact

https://mapsignals.com/contact/

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance