Applied Optoelectronics Inc (AAOI) Q1 2024 Earnings Miss Analyst Forecasts Amid Revenue Decline

Revenue: Reported at $40.7 million, falling short of the estimated $43.59 million.

Net Loss: GAAP net loss widened to $23.2 million, significantly above the estimated net loss of $11.18 million.

Earnings Per Share (EPS): Non-GAAP EPS stood at -$0.31, slightly below the estimated -$0.29.

Gross Margin: Non-GAAP gross margin decreased to 18.9% from 23.2% in the same quarter the previous year.

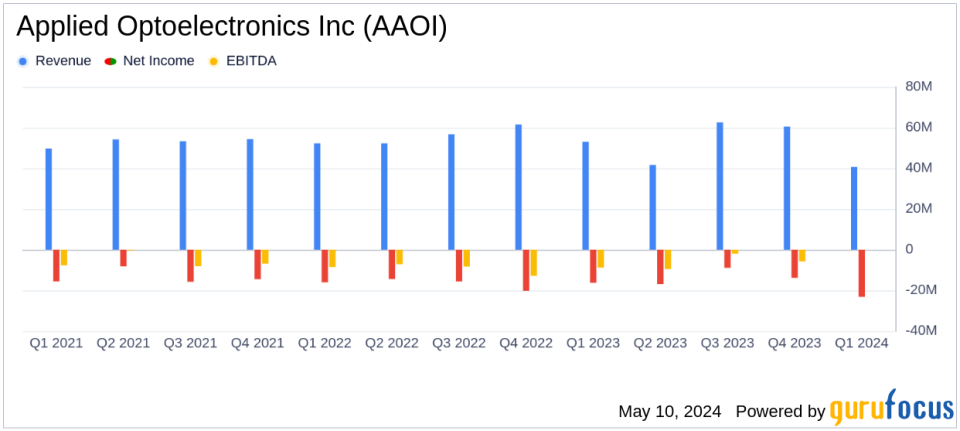

Year-over-Year Comparison: Revenue decreased from $53.0 million in Q1 2023, reflecting a challenging quarter.

Future Outlook: Expects Q2 2024 revenue between $41.5 million and $46.5 million with improved non-GAAP gross margins of 25.5% to 27.5%.

Stock Performance: Non-GAAP net loss expected to range between $11.6 million to $13.5 million in Q2 2024.

On May 9, 2024, Applied Optoelectronics Inc (NASDAQ:AAOI), a leader in fiber-optic access network products, disclosed its financial outcomes for the first quarter ended March 31, 2024, through its 8-K filing. The company reported a decline in revenue and a net loss that exceeded analyst expectations, attributing the downturn to an unfavorable product mix and market challenges.

Applied Optoelectronics Inc is renowned for its development and manufacturing of advanced optical products, serving key markets such as internet data centers, cable broadband, telecom, and FTTH. The company operates globally with significant facilities in the United States, Taiwan, and China, focusing on high-demand sectors driven by increasing bandwidth needs.

Financial Performance Highlights

The reported GAAP revenue for Q1 2024 stood at $40.7 million, a significant decrease from $53.0 million in Q1 2023 and from $60.5 million in Q4 2023. This decline in revenue was below the analyst estimate of $43.59 million for the quarter. The GAAP net loss deepened to $23.2 million, or $0.60 per basic share, compared to a net loss of $16.3 million, or $0.56 per basic share in the same period last year. This loss was notably higher than the estimated loss of $11.18 million.

The company's gross margin also saw a reduction; the GAAP gross margin was 18.7%, down from 35.7% in the previous quarter. Non-GAAP gross margin followed a similar trend, registering at 18.9%, a decrease from 36.4% in Q4 2023.

Operational and Market Challenges

Dr. Thompson Lin, Founder, President, and CEO of Applied Optoelectronics, acknowledged the challenges faced in the quarter, citing a suboptimal product mix and slower market conditions. Despite these hurdles, management remains optimistic about a recovery in the upcoming quarters, supported by strong long-term demand across their markets.

The company's balance sheet reflects a decrease in total assets from $389.186 million at the end of 2023 to $350.916 million as of March 31, 2024. This reduction is primarily due to a significant drop in cash and cash equivalents, from $55.097 million to $17.405 million.

Looking Ahead

For Q2 2024, Applied Optoelectronics anticipates revenue between $41.5 million and $46.5 million, with a non-GAAP gross margin expected to be between 25.5% and 27.5%. The forecasted non-GAAP net loss is projected to range from $11.6 million to $13.5 million, indicating potential ongoing challenges but also a slight improvement in performance metrics.

The company's strategic focus remains on leveraging its technological advancements and broad market presence to navigate through the current industry downturn and capitalize on future growth opportunities.

Investors and stakeholders will be watching closely to see if Applied Optoelectronics can reverse the downward trend in its financial performance in the coming quarters, as it continues to adapt to the dynamic market conditions.

Explore the complete 8-K earnings release (here) from Applied Optoelectronics Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance