April 2024's Top Dividend Stock To Embrace And One To Steer Clear Of

In the quest for reliable income streams, dividend stocks often emerge as attractive options for investors in the United Kingdom, boasting yields that can significantly outpace average returns. However, while some companies consistently reward shareholders with stable or increasing dividends, others present a riskier proposition due to past reductions in their payouts. It's crucial for investors to carefully evaluate each stock's dividend history and financial health before committing funds, as not all dividends are a promise of future performance.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 8.79% | ★★★★★★ |

Keller Group (LSE:KLR) | 4.18% | ★★★★★☆ |

Dunelm Group (LSE:DNLM) | 7.14% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 6.95% | ★★★★★☆ |

DCC (LSE:DCC) | 3.45% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.52% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.60% | ★★★★★☆ |

James Latham (AIM:LTHM) | 3.25% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 4.47% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.50% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results and one of the companies to avoid.

One To Reconsider

Barratt Developments (LSE:BDEV)

Simply Wall St Dividend Rating: ★★★☆☆☆

Overview: The company operates in the housebuilding sector within the United Kingdom, with a market capitalization of approximately £4.42 billion.

Operations: The company's revenue, primarily generated from housebuilding activities, amounts to approximately £4.39 billion.

Dividend Yield: 6.1%

Barratt Developments, despite trading 24.8% below its fair value and offering a high dividend yield of 6.12%, presents concerns for dividend investors. Its dividends are not well supported, evidenced by a payout ratio of 124.7% and a cash payout ratio exceeding 150%, indicating payments are not covered by earnings or cash flows. Additionally, the company's profit margins have dropped from 9.4% to 5%. Recent events include a significant interim dividend cut from 10.2 pence to 4.4 pence per share, alongside disappointing half-year earnings with sales dropping to £1.85 billion from £2.78 billion and net income falling drastically to £68.8 million from £380.5 million year-over-year, challenging the sustainability of future dividends despite the company's intention to maintain its dividend policy.

Top Pick

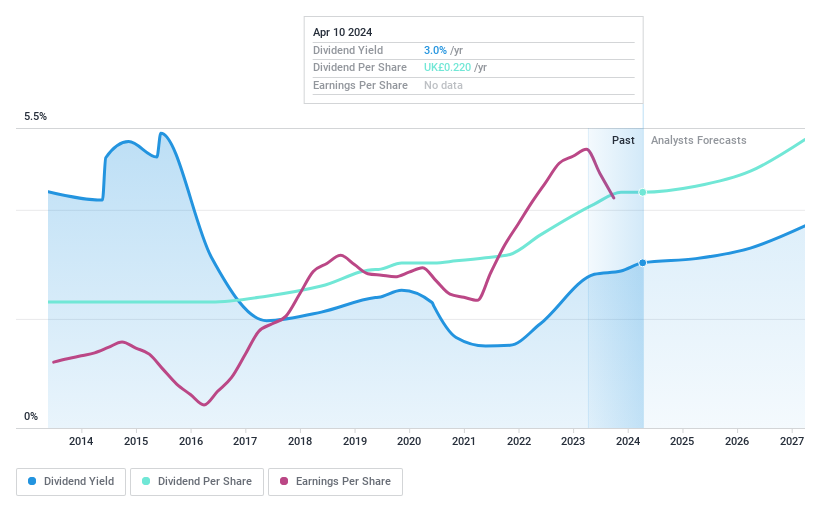

RS Group (LSE:RS1)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: RS Group plc is a global distributor of electronics and industrial products, operating in countries including the United Kingdom, the United States, France, Germany, Italy, and Mexico, with a market capitalization of approximately £3.44 billion.

Operations: The company generates its revenue primarily through Own-Brand Products, contributing £0.41 billion, and Other Product and Service Solutions, accounting for £2.56 billion.

Dividend Yield: 3%

RS Group, despite its recent like-for-like revenue decline of 10% for the quarter and 9% over nine months, remains a compelling option for dividend investors with its stable dividend yield of 3.03%. The company's dividends are well-covered by earnings, with a payout ratio of 44.1%, indicating sustainability. Additionally, RS Group's strategic move to become the exclusive online source for Siemens' next-generation industrial tablet could bolster its market position by cutting operating costs for users by up to 60%, showcasing potential for future growth and stability in dividend payments. However, investors should be cautious of the recent revenue dip when considering this stock.

Unlock comprehensive insights into our analysis of RS Group stock in this dividend report.

Our valuation report unveils the possibility RS Group's shares may be trading at a discount.

Next Steps

Click here to access our complete index of 60 Top Dividend Stocks.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

Explore small companies with big growth potential before they take off.

Fuel your portfolio with fast-growing stocks poised for rapid expansion.

Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance