Aptiv's (APTV) Q3 Earnings Beat Estimates, Increase Y/Y

Aptiv PLC APTV reported better-than-expected third-quarter 2022 results.

Adjusted earnings of $1.28 per share beat the Zacks Consensus Estimate by 23.1% and increased more than 100% on a year-over-year basis. The bottom line was hurt by the adverse impacts of pandemic lockdowns in China, continued global inflationary pressures and the worldwide semiconductor shortage.

Revenues of $4.6 billion surpassed the consensus mark by 7.7% and increased 26.3% year over year. The top line registered 31% growth in North America, 29% in Europe and 36% in Asia. Revenues were up 42% in China and 53% in South America.

Aptiv’s shares have declined 50.6% in the past year against the 66.7% loss of the industry it belongs to.

Other Quarterly Numbers

Signal and Power Solutions’ revenues of $3.4 billion were up 27% year over year. Advanced Safety and User Experience revenues increased 25% year over year to $1.2 billion.

Adjusted operating income came in at $525 million, up more than 100% from the figure reported in the year-ago quarter. Adjusted operating income margin came in at 11.4%, up 440 basis points year over year.

Aptiv exited the quarter with a cash and cash equivalents balance of $4.9 billion. Long-term debt was $6.3 billion compared with $6.4 billion at the end of the previous quarter.

Total available liquidity at the end of the quarter was $7.3 billion compared with $7.1 billion recorded at the end of the prior quarter. During the quarter, net cash generated from operating activities was $437 million.

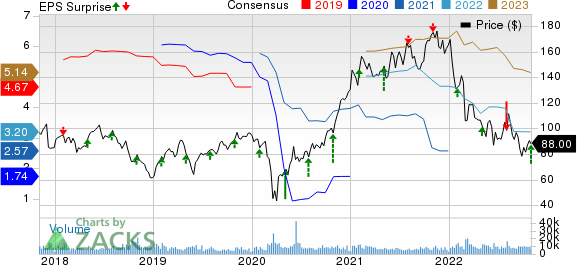

Aptiv PLC Price, Consensus and EPS Surprise

Aptiv PLC price-consensus-eps-surprise-chart | Aptiv PLC Quote

2022 Outlook

The company expects revenues in the range of $17-$17.3 billion, the midpoint ($17.15 billion) of which is below the current Zacks Consensus Estimate of $17.21 billion.

Adjusted EPS is expected between $3.05 and $3.55, the midpoint ($3.3 billion) of which is above the current Zacks Consensus Estimate of $3.2.

The adjusted operating income margin is anticipated to be between 9% and 9.7%. Capital expenditures are expected to be at $800 million.

The adjusted EBITDA margin is expected to be between 12.7% and 13.4%. Adjusted effective tax rate is expected to be 13%.

Currently, Aptiv carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Performance of Some Other Business Services Companies

Equifax EFX reported stellar third-quarter 2022 results, wherein both its earnings and revenues surpassed the respective Zacks Consensus Estimate.

EFX’s adjusted earnings of $1.73 per share beat the Zacks Consensus Estimate by 5.5% but decreased 6.5% on a year-over-year basis. Revenues of $1.24 billion beat the consensus estimate by 2.3% and improved 1.8% year over year.

Omnicom OMC also reported better-than-expected third-quarter 2022 results.

OMC’s earnings of $1.77 per share beat the consensus mark by 7.9% and increased 7.3% year over year. Total revenues of $3.4 billion surpassed the consensus estimate by 3% and increased slightly year over year.

The Interpublic Group of Companies IPG reported third-quarter 2022 adjusted earnings of 63 cents per share, beating the Zacks Consensus Estimate by 6.8%. The bottom line has been constant on a year-over-year basis.

IPG’s net revenues of $2.3 billion beat the consensus estimate by 0.3% but declined 9.7% on a year-over-year basis. Total revenues of $2.64 billion increased 3.8% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

Interpublic Group of Companies, Inc. The (IPG) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

Aptiv PLC (APTV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance