ArcelorMittal (MT) Advances Green Steel With Gijon EAF Project

ArcelorMittal S.A. MT recently commenced the construction of an electric arc furnace (EAF) for long products at its Gijon plant, with the first heat production expected in the first quarter of 2026. This €213-million (nearly $230 million) investment marks the inaugural major EAF project within the European decarbonization program and represents a pivotal step toward low-carbon steelmaking in Asturias.

The transition to the new process will significantly reduce CO2 emissions by shifting from a hot metal production method reliant on fossil fuels to one utilizing scrap and direct reduced iron, powered by electricity from wind and solar sources when available. This new EAF steel production will lower CO2 emissions by more than 35%, potentially reaching a reduction of 1 million tons of CO2 equivalent annually once the transition phase is complete.

This project positions the Long Products division in Asturias at the forefront of European decarbonization efforts, being the first major investment under ArcelorMittal’s decarbonization strategy on the continent. The installation of this advanced technology will enable the production of high-value rails and wire rods while adhering to the highest safety standards.

The investment will bring the latest EAF technology to Gijon, enabling MT to meet the increasing demand for low-carbon emissions rails and wire rods from sectors such as automotive, construction and rail infrastructure, especially those with strict carbon criteria for public procurement contracts.

The company expressed gratitude for the support from all stakeholders involved in the project. They have achieved this milestone thanks to the backing of public administrations, customers, partners and the entire project team. This collective effort is driving progress toward establishing a more sustainable industry in Asturias.

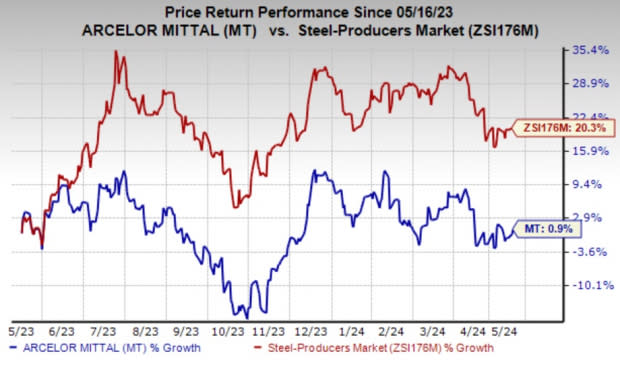

ArcelorMittal’s shares have inched up 0.9% in the past year against the industry’s 20.3% rise.

Image Source: Zacks Investment Research

In 2024, ArcelorMittal anticipates that low inventory levels, particularly in Europe, will result in a rebound in apparent demand with any actual demand increase. The company projects global steel consumption growth (excluding China) of 3-4%, with expected increases of 1.5-3.5% in the United States, 2-4% in Europe, 0.5-2.5% in Brazil and 6.5-8.5% in India.

Optimistic about medium to long-term steel demand prospects, ArcelorMittal is confident in its growth strategy and commitment to providing shareholder returns. MT plans capital expenditures of $4.5-$5 billion for this year, with $1.4-$1.5 billion dedicated to strategic growth projects.

ArcelorMittal Price and Consensus

ArcelorMittal price-consensus-chart | ArcelorMittal Quote

Zacks Rank & Key Picks

ArcelorMittal currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are ATI Inc. ATI and Carpenter Technology Corporation CRS, each sporting a Zacks Rank #1 (Strong Buy), and Ecolab Inc. ECL, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

ATI’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 8.34%. The company’s shares have surged 72.6% in the past year.

CRS’ earnings beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, with the average earnings surprise being 15.1%. The company’s shares have soared 130.8%% in the past year.

The Zacks Consensus Estimate for Ecolab's current year earnings is pegged at $6.59 per share, indicating a year-over-year rise of 26.5%. The Zacks Consensus Estimate for ECL’s current-year earnings has been going up in the past 30 days. ECL beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 1.3%. The stock has rallied nearly 34.4% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

ArcelorMittal (MT) : Free Stock Analysis Report

ATI Inc. (ATI) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance