ArcelorMittal's (MT) Q1 Earnings and Revenues Beat Estimates

ArcelorMittal S.A. MT recorded a net income of $938 million or $1.16 per share in first-quarter 2024 compared with $1,096 million or $1.28 per share in the year-ago quarter. The bottom line surpassed the Zacks Consensus Estimate of 93 cents per share.

Total sales fell around 12% year over year to $16,282 million in the quarter. The figure beat the consensus estimate of $15,824.5 million.

Total steel shipments fell 6.9% year over year to 13.5 million metric tons in the reported quarter. The figure was above our estimate of 11.3 million metric tons.

ArcelorMittal Price, Consensus and EPS Surprise

ArcelorMittal price-consensus-eps-surprise-chart | ArcelorMittal Quote

Segment Review

North America: Sales were flat year over year at $3,347 million in the reported quarter. Crude steel production was also flat year over year at 2,180 million metric tons. Steel shipments decreased around 16% year over year to 2,796 million metric tons, higher than our estimate of 2,169 million metric tons. The average steel selling price rose 4.8% to $1,042 per ton.

Brazil: Sales were flat year over year at $3,051 million. Crude steel production rose 16.7% year over year to 3,564 million metric tons. Shipments increased 8% year over year to 3,180 million metric tons, higher than our estimate of 2,737 million metric tons. Average steel selling prices fell 9.4% to $886 per ton.

Europe: Sales declined around 13.6% year over year to $7,847 million. Crude steel production dropped nearly 1% year over year to 7,604 million metric tons in the reported quarter. Shipments declined around 5% year over year to 7,236 million metric tons, higher than our estimate of 6,134 million metric tons. The average steel selling price declined around 6% year over year to $945 per ton.

Mining: Sales fell 19% year over year to $729 million. Iron ore production totaled 6.5 million metric tons, down around 3% from the year-ago quarter’s levels. Iron ore shipments were down 14.8 year over year to 6.3 million metric tons.

Financials

In the reported quarter, net cash used by operating activities was $100 million compared with $949 million provided in the year-ago quarter. The company’s net debt was around $4.8 billion, up roughly 65.5% sequentially.

Outlook

With low inventory levels, particularly in Europe, any uptick in actual demand could lead to a rebound in apparent demand, MT stated. The company continues to project 3-4% growth in global steel consumption, excluding China, in 2024. This includes a projected increase of 1.5-3.5% in the United States, 2-4% in Europe, 0.5-2.5% in Brazil and 6.5-8.5% in India.

The company is optimistic about the medium to long-term prospects for steel demand. It is confident in its ability to execute its strategy for growth while providing capital returns to shareholders.

Capital expenditures for 2024 are expected to be $4.5-$5 billion, with $1.4 billion to $1.5 billion allocated for strategic growth projects.

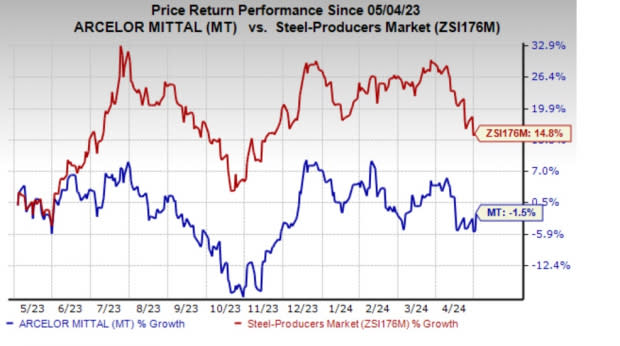

Price Performance

ArcelorMittal’s shares have lost 1.5% in the past year against the industry’s 14.8% rise.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

ArcelorMittal currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Gold Fields Limited GFI, sporting a Zacks Rank #1 (Strong Buy) and L.B. Foster Company FSTR and American Vanguard Corporation AVD, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for GFI’s first-quarter earnings is pegged at 22 cents per share. The Zacks Consensus Estimate for GFI’s first-quarter earnings has been stable in the past 60 days.

L.B. Foster is slated to report first-quarter results on May 7. The consensus estimate for FSTR’s first-quarter earnings is pegged at a loss of 16 cents per share. The company’s shares have surged 111.9% in the past year.

AVD is expected to report first-quarter results on May 14. The consensus estimate for AVD’s first-quarter earnings is pegged at 8 cents per share, indicating a year-over-year rise of 14.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ArcelorMittal (MT) : Free Stock Analysis Report

Gold Fields Limited (GFI) : Free Stock Analysis Report

L.B. Foster Company (FSTR) : Free Stock Analysis Report

American Vanguard Corporation (AVD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance