ArcelorMittal's (MT) Q3 Earnings and Revenues Top Estimates

ArcelorMittal MT recorded profits of $993 million or $1.11 per share in the third quarter of 2022, compared with $4,621 million or $4.17 in the year-ago quarter.

Barring one-time items, earnings per share came in at $1.54, beating the Zacks Consensus Estimate of $1.26.

Total sales fell around 6% year over year to $18,975 million in the quarter. The figure surpassed the Zacks Consensus Estimate of $17,216.5 million. Sales were hurt by lower iron ore prices and reduced steel shipments.

Total steel shipments declined around 7% year over year to 13.6 million metric tons in the reported quarter.

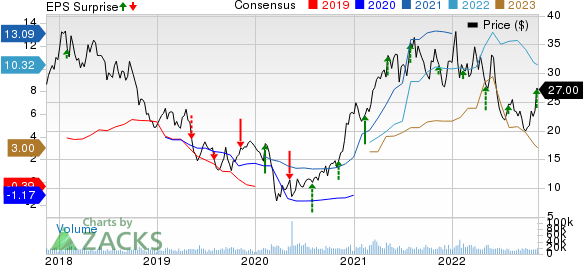

ArcelorMittal Price, Consensus and EPS Surprise

ArcelorMittal price-consensus-eps-surprise-chart | ArcelorMittal Quote

Segment Review

NAFTA: Sales were essentially flat year over year at $3.4 billion in the reported quarter. Crude steel production increased roughly 7% year over year to 2.1 million metric tons. Steel shipments rose around 3% year over year to 2.3 million metric tons. The average steel selling price declined roughly 9% year over year to $1,191 per ton.

Brazil: Sales fell around 3% year over year to $3.5 billion. Crude steel production declined roughly 5% year over year to 3 million metric tons. Shipments were flat year over year at 2.8 million metric tons. Average steel selling price fell around 5% year over year to $1,137 per ton.

Europe: Sales decreased around 5% year over year to $10.7 billion. Crude steel production fell roughly 12% year over year to 8 million metric tons in the reported quarter. Shipments fell around 6% year over year to 7.1 million metric tons. Average steel selling price went up roughly 5% year over year to $1,150 per ton.

Asia Africa and CIS (ACIS): Sales fell around 35% year over year to $1.6 billion. Crude steel production totaled 1.8 million metric tons, down about 39% year over year. Shipments declined around 29% year over year to around 1.7 million metric tons. Average selling prices declined around 11% year over year to $773 per ton.

Mining: Sales fell around 36% year over year to $742 million. Iron ore production totaled 6.9 million metric tons, up around 1% from the year-ago quarter’s levels. Iron ore shipments were stable year over year at 6.9 million metric tons.

Financials

At the end of the quarter, ArcelorMittal had cash and cash equivalents of around $5.1 billion, up around 16% year over year. The company’s long-term debt was around $6.4 billion, down roughly 2% on a year-over-year basis.

Net cash from operating activities fell around 19% year over year to $1,981 million for the third quarter.

Outlook

The company noted that it has adapted its capacity for the fourth quarter to address the weak apparent demand environment and higher energy costs, especially in Europe. It expects apparent demand conditions to improve once the current destocking phase reaches maturity. ArcelorMittal is also adapting its cost base during this period of low capacity utilization, optimizing energy consumption and lowering fixed costs of unproductive capacity.

The company expects real consumption to grow in the United States in 2022, However, a greater impact than earlier expected from destocking is predicted to lead to a modest contraction of apparent consumption by up to -1%.

Inflation is leading to slower albeit positive real consumption growth in 2022 in Europe. However, the impact of destocking is expected to lead to a contraction of apparent consumption by up to -7%, the company noted.

The ongoing economic weakness due to the pandemic-led restrictions and the soft construction sector are forecast to lead to a decline in apparent demand of around -3.5% in China.

Price Performance

Shares of ArcelorMittal have declined 11.3% in the past year compared with a 1.3% fall of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

ArcelorMittal currently carries a Zacks Rank #5 (Strong Sell).

Better-ranked stocks worth considering in the basic materials space include Sociedad Quimica y Minera de Chile S.A. SQM, Commercial Metals Company CMC and Reliance Steel & Aluminum Co. RS.

Sociedad has a projected earnings growth rate of 538.1% for the current year. The Zacks Consensus Estimate for SQM’s current-year earnings has been revised 1.2% upward in the past 60 days.

Sociedad has a trailing four-quarter earnings surprise of roughly 27.2%. SQM has rallied roughly 60% in a year. The company currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Commercial Metals currently carries a Zacks Rank #1. The Zacks Consensus Estimate for CMC's current-year earnings has been revised 3.8% upward in the past 60 days.

Commercial Metals’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 19.7%, on average. CMC has gained around 40% in a year.

Reliance Steel, currently carrying a Zacks Rank #2 (Buy), has a projected earnings growth rate of 29.7% for the current year. The Zacks Consensus Estimate for RS's current-year earnings has been revised 0.1% upward in the past 60 days.

Reliance Steel’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 13.6%, on average. RS has gained around 22% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ArcelorMittal (MT) : Free Stock Analysis Report

Reliance Steel & Aluminum Co. (RS) : Free Stock Analysis Report

Sociedad Quimica y Minera S.A. (SQM) : Free Stock Analysis Report

Commercial Metals Company (CMC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance