Argo Blockchain's (LON:ARB) Wonderful 982% Share Price Increase Shows How Capitalism Can Build Wealth

Shareholders of Argo Blockchain plc (LON:ARB) might have been startled to see the share price drop -33% in just one week. But that isn't a problem when you consider how the share price has soared over the last year. Few could complain about the impressive 982% rise, throughout the period. Arguably, the recent fall is to be expected after such a strong rise. Of course, winners often do keep winning, so there may be more gains to come (if the business fundamentals stack up).

It really delights us to see such great share price performance for investors.

View our latest analysis for Argo Blockchain

Argo Blockchain wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last twelve months, Argo Blockchain's revenue grew by 359%. That's a head and shoulders above most loss-making companies. But the share price seems headed to the moon, up 982% as previously highlighted. Even the most bullish shareholders might be thinking that the share price might drop back a bit, after a gain like that. But if the share price does moderate a bit, there might be an opportunity for high growth investors.

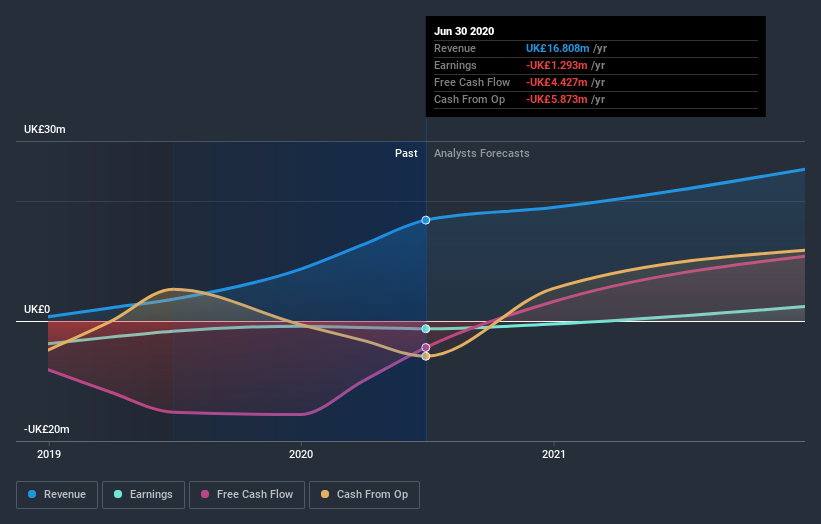

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that Argo Blockchain shareholders have gained 982% over the last year. And the share price momentum remains respectable, with a gain of 966% in the last three months. This suggests the company is continuing to win over new investors. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Argo Blockchain you should know about.

Of course Argo Blockchain may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance