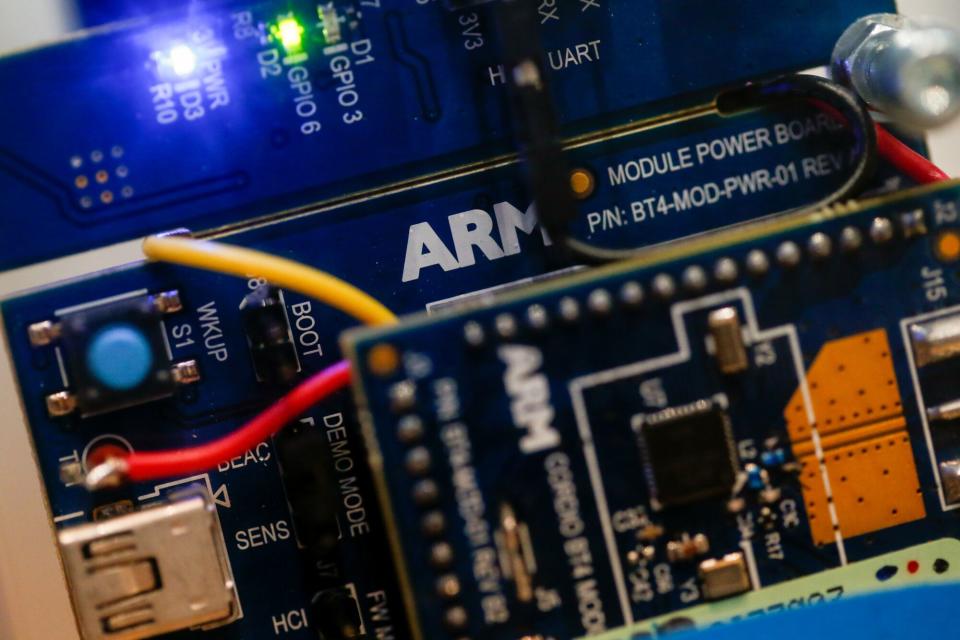

Arm Banks Set for $100 Million Payday From Chip Designer’s IPO

(Bloomberg) -- Investment banks working on Arm Holdings Ltd.’s initial public offering are set to share upwards of $100 million in fees from the chip designer’s listing, according to people familiar with the matter.

Most Read from Bloomberg

US Probes Made-in-China Chip as Tensions Flare Over Technology

Everything Apple Plans to Show on Sept. 12: iPhone 15, Watches, AirPods

Hong Kong to Ease Shutdown After Record Rain Overwhelms City

Apple’s 2-Day Slide Nears $200 Billion on China IPhone Curbs

The SoftBank Group Corp.-owned company is poised to pay the banks 2% of the $5 billion to $5.4 billion it is seeking to raise in the IPO, the people said. The fee pool would consist of about a 1.75% base fee and a 0.25% incentive fee awarded at the firm’s discretion, the people said, asking not to be identified as the information isn’t public.

Based on previous estimates of how much of Arm could be sold in the offering, the listing could value the company at $50 billion to $54 billion, Bloomberg calculations show. A 2% share of an IPO of up to $5.4 billion would amount to as much as $108 million.

As the banks leading the offering, Barclays Plc, Goldman Sachs Group Inc., JPMorgan Chase & Co. and Mizuho Financial Group will each receive 17.5% of the fee pool, the people said. Some of the banks in less active roles will receive about 3% each, and the remainder will be divided among those lower down the hierarchy. The chip firm’s listing filing lists a total of 28 banks working on the IPO.

Read More: All About Arm and Why It’s The Biggest IPO of 2023

Preparations for the listing are ongoing and details could change, the people said. Representatives for Arm, Barclays, Goldman Sachs, JPMorgan, Mizuho and SoftBank declined to comment.

Arm’s share sale could be the year’s largest, even as both the size and valuation are reduced from the company’s original targets, Bloomberg News has reported. The firm has lined up some of its biggest customers — Apple Inc., Nvidia Corp., Intel Corp. and Samsung Electronics Co. — as strategic investors, but the stock debut will depend on how investors more broadly weigh factors including China risks, a slowing smartphone market and artificial intelligence adoption.

Read More: Arm IPO Expectations Tempered as Roadshow Kicks Off

Arm is considering pricing its shares on Sept. 13 with trading to start the next day, Bloomberg News has reported. Taking a page from Alibaba Group Holding Ltd.’s landmark listing almost a decade ago, the chip firm is splitting underwriter fees evenly among the four banks leading its IPO. Last year, SoftBank asked banks jostling for roles on its IPO to underwrite a margin loan of about $8 billion. Many of the banks involved in the IPO took part in that financing.

--With assistance from Min Jeong Lee, Swetha Gopinath and Taiga Uranaka.

Most Read from Bloomberg Businessweek

Huawei’s Surprise Phone Gives Ammo to Biden Doubters on China

Lyme Disease Has Exploded, and a New Vaccine Is (Almost) Here

©2023 Bloomberg L.P.

Yahoo Finance

Yahoo Finance