Arm co-founder says China will overtake US in microchip dominance

The co-founder of Arm Holdings, formerly Britain's biggest listed technology company, has said China will easily beat the US in a battle for control of the global semi-conductor market.

Hermann Hauser, a pioneer of the Cambridge chip design scene who founded Arm's parent company Acorn and engineered its spin-out during the 1990s, told the Telegraph China was set to "clearly take over" the US in the industry.

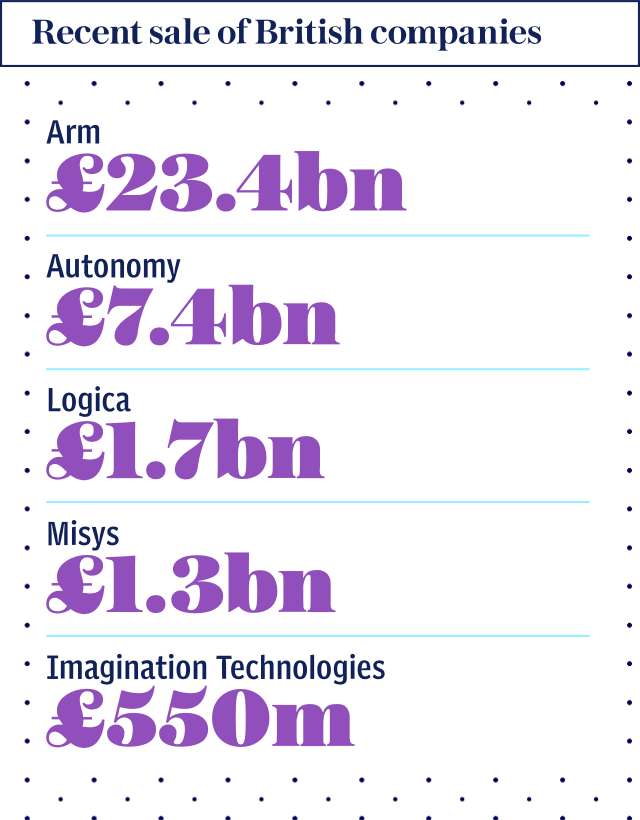

Two years after Arm's sale to Japanese giant Softbank, he also expressed disappointment that the UK's "only globally relevant [semiconductor] company is not European anymore".

Under Softbank's ownership, Arm recently launched a new joint venture in China, spinning off a $1.5bn company with majority backing from Chinese investors.

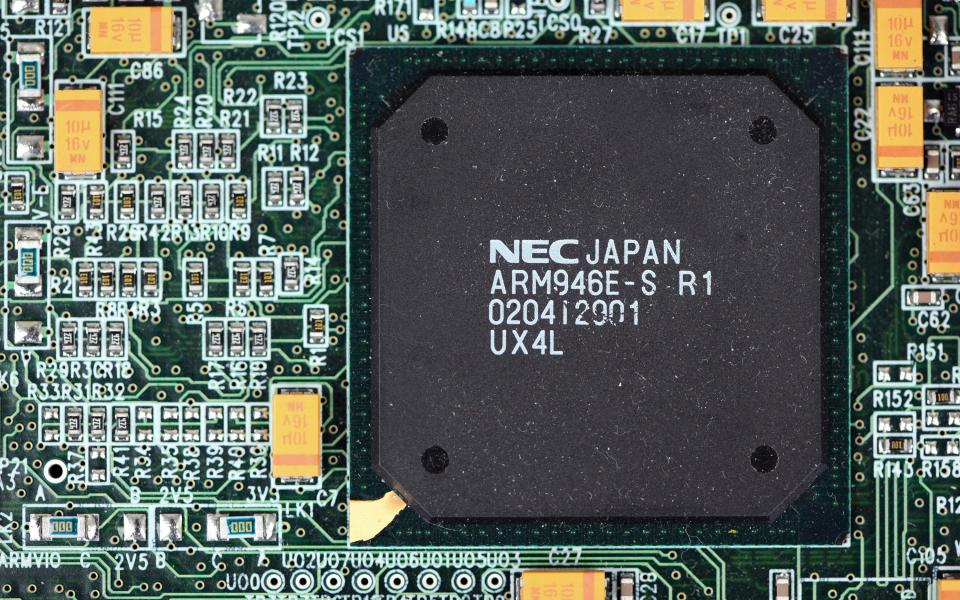

The deal gives China access to Arm's coveted designs and intellectual property, which are used in 90pc of the world's smartphones, giving the country a way to expand its microprocessor industry at a time when US tariffs and a trade war threaten its burgeoning tech sector.

China has been working to bulk out its industries such as semiconductors, microprocessors and 5G. It has set up a $47bn fund, the China Integrated Circuit Industry Investment Fund Co to spur its growth.

But local regulations have also cajoled companies like Arm to form joint ventures with domestic investors, giving China access to crucial intellectual property.

Arm has shown greater international willingness as a private company. My worry is about the longer term consequences

Hermann Hauser, Amadeus Capital

Hauser, a director at venture capital firm Amadeus, said that under Softbank's ownership Arm has shown "greater international willingness as a private company". Arm has made significant investment under Softbank, seeing its profits shrink and costs rise.

The Cambridge-headquartered company, considered one the UK tech sector's crown jewels, has added more than 1,000 staff since it was taken off the London Stock Exchange and recently secured a $600m deal for a US data start-up.

Hauser expressed concern at the time of Arm's takeover that the business would no longer be under British ownership. Softbank entered into an agreement with mergers regulator the Takeover Panel to double Arm's staff numbers in the UK.

"My worry is more about the longer term consequences," Hauser said. "Masa Son [Softbank's chief executive] was retired once already. He wants to create a major Internet of Things vision with Arm. We will see if it continues.

"[But] everything he has done so far has been very supportive of that strategy that he indicated to me, he has been true to his word."

The Internet of Things is a term used to describe a future of millions of web-connected devices - from cars to household appliances, enabled by advances in chip technology and next generation 5G communications.

The Arm deal, which sees Arm form a joint venture with Chinese backing, could give China a strategic advantage in the development of its semi-conductor industry. Meanwhile, attempts to shut down deals by US microchip giants and an ongoing trade-war are threatening American dominance of the sector, Hauser said.

But Arm's recently launched a new venture in China, which is now majority owned by Chinese business, has prompted concerns that the once UK business has been split up.

For one thing, the new business controls about 20pc of Arm's revenue, but was valued at just $1.5bn, according to investor documents, compared to the £24bn Softbank paid for the whole of Arm in 2016.

Sir Vince Cable, leader of the Liberal Democrats, said last month the deal was "exactly what the Government was warned about".

Chinese joint venture rules also force foreign companies to adopt policies that can make it harder to export their intellectual property. The European Union filed a complaint with the World Trade Organisation over the laws in June.

Arm's board now includes a number of key Softbank Group executives. Earlier this year, Arm chief executive Simon Segars told the Telegraph: "Arm may be owned by a Japanese parent company now but we’re still a large employer in tech in the UK, we’re a bigger employer of tech in the UK than we were previously and we’ve grown faster than previously."

Yahoo Finance

Yahoo Finance