SoftBank-backed chip maker ARM spends £655m on R&D

The British microchip maker whose designs are used in Apple iPhones poured huge amounts of cash into developing next-generation tech last year, new accounts show.

Accounts filed with the UK’s Companies House this week show ARM Holdings’s research and development (R&D) spending jumped 16% to £655.6m last year.

Management wrote in the accounts that developing intellectual property (IP) was “at the heart” of a “mutli-year strategy” adopted after SoftBank (9986.T) bought the business in 2016. The company said R&D is “of major importance” and around 1,500 of ARM’s 5,900 employees work on developing new technology.

“Key ares of product development include the development of further energy-efficient, high-performance processors,” management wrote, adding that other areas of focus include: “low-power, low-leakage technologies for a range of chip manufacturing processes.”

Revenue rose 1% to £1.38bn last year and the company made a profit of £1bn in the year to March 31, 2019. The profit was largely driven by the sale of a majority stake in ARM’s Chinese business for $775.2m last year.

Without the impact of the China joint venture deal, ARM said profit would have fallen year over year but the company said this was largely due to the focus on R&D.

“The group expects these new technologies will lead to increased revenue growth in the future,” management wrote. “The group can then decide whether to reinvest these new revenues in developing new technology or to allow the increased revenues to feed through into increased profits.”

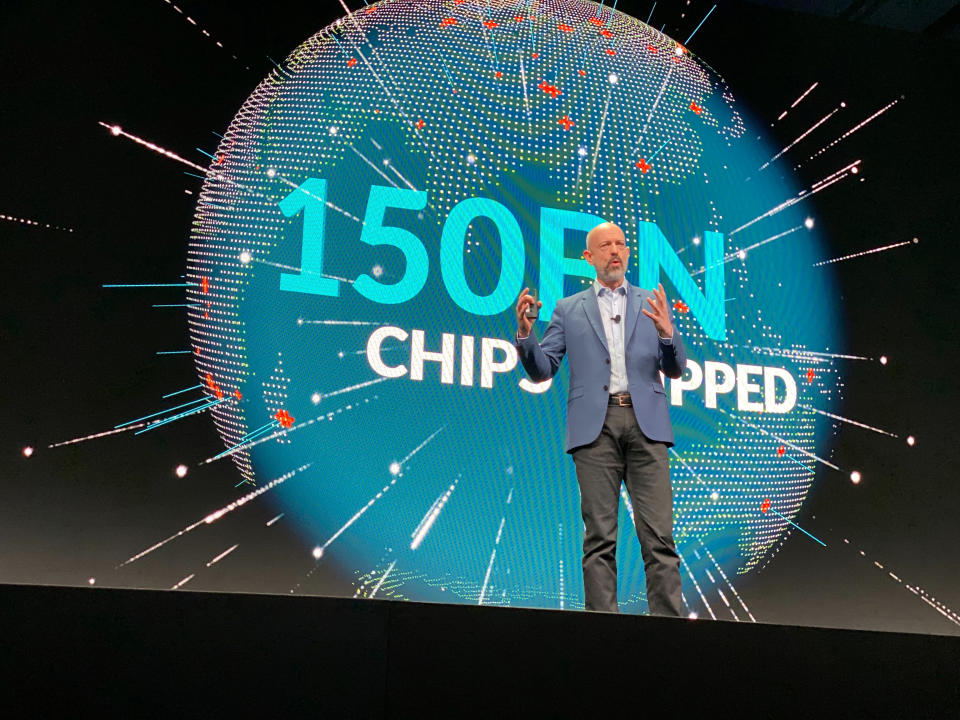

ARM is one of the world’s leading microchip design companies. The company designs chips and then licenses these designs to manufacturers. ARM also earns royalties from devices that use chips it has designed.

ARM chips are among the world’s most most popular and its designs can be found in everything from smartphones to internet-connected cars. Apple iPhones are built on the architecture.

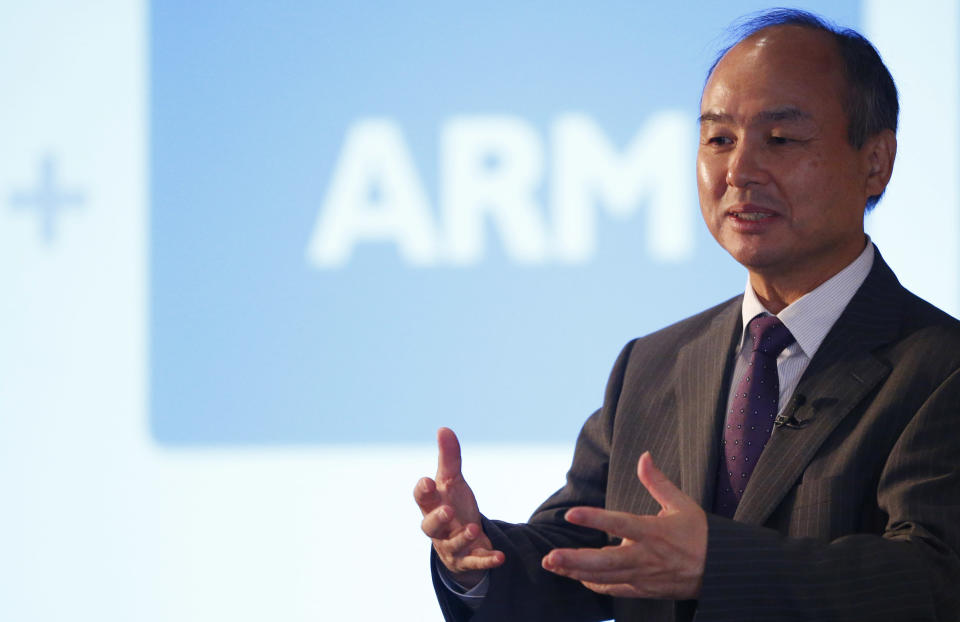

Japan’s SoftBank took the former FTSE 100 company private for £24.3bn in 2016. The deal formed the cornerstone of SoftBank founder Masayoshi Son’s ambitious investment strategy.

Son raised a $100bn venture capital fund, dubbed the Vision Fund, in 2017 and made a series of ambitious bets on fast-growing tech companies. Son hoped ARM could develop new chips that could help the companies he had backed, targeting areas such as robotics, smart homes and cities, and big data analytics

Son’s strategy has been criticised this year after the poor performance of several bets. Uber (UBER), a Vision Fund investment, disappointed with its public market debut and WeWork, another Son-backed company, was forced to pull its IPO and slash its valuation after a frosty reception.

Yahoo Finance

Yahoo Finance