Arm’s Revenue Fell Last Year Ahead of IPO, Draft Filing Shows

(Bloomberg) -- Arm Ltd., a chip designer that is preparing for what would be the biggest initial public offering of 2023, saw its revenue decline about 1% in the last fiscal year, according to a draft filing for its IPO reviewed by Bloomberg.

Most Read from Bloomberg

Nasdaq 100 Drops 2% as Yields Rise Before Powell: Markets Wrap

Wagner Chief Prigozhin Listed Aboard Crashed Jet, Reports Say

NYC’s Most Exciting New Fine Dining Restaurant Is in a Subway Station

BRICS Bloc Grows Heft With Saudi Arabia and Other Mideast Powers

Companies often look to post rising revenue in the periods leading up to stock sales, but Arm’s sales fell to $2.68 billion in the 12 months ended on March 31, according to the filing, which is still subject to change. Japan’s SoftBank Group Corp., which owns Arm, plans an IPO of the company as soon as next month that could value the chip designer at as much as $70 billion.

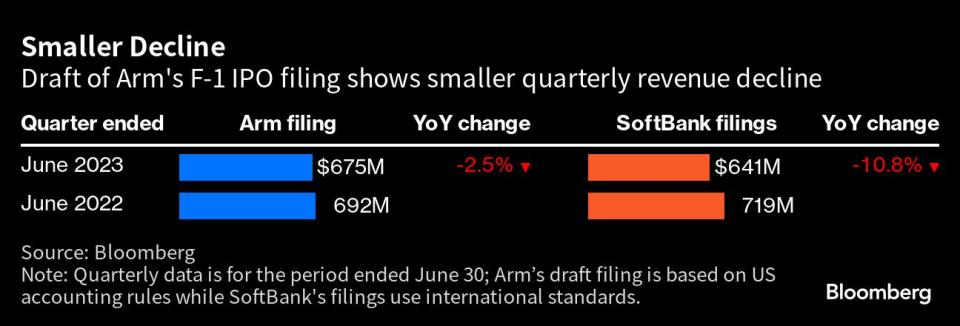

Arm’s draft F-1 filing is based on US accounting rules as the company prepares to list on Nasdaq. In May, SoftBank said sales at the unit had grown 5.7% in the latest fiscal year under international standards. A representative for Arm declined to comment.

US accounting rules and International Financial Reporting Standards have separate thresholds for when revenue can be recognized, among other differences.

The overall chip industry is still emerging from a sales slump triggered by a buildup of excess inventory, especially in the smartphone market — a central focus for Arm. Qualcomm Inc., one of Arm’s biggest partners, gave a disappointing forecast for the latest quarter earlier this month, sending its shares tumbling. And even Apple Inc.’s prized iPhone has seen demand slow.

Arm’s draft filing also shows that sales for the quarter ended June 30 fell 2.5% to $675 million under US standards. That’s a smaller drop than SoftBank reported earlier this month, when it said sales for the unit fell about 11% to $641 million under IFRS.

Arm designs technology including microprocessors, and its intellectual property is used in just about every smartphone in the world. It was publicly traded until 2016, when SoftBank bought it for around $32 billion. The Japanese conglomerate said in 2020 that it was selling the company to Nvidia Corp. for $40 billion, but regulatory pressure forced Nvidia to abandon its bid last year. Arm said in April it had made a confidential filing for a US IPO.

Barclays Plc, Goldman Sachs Group Inc., JPMorgan Chase & Co. and Mizuho Financial Group are set to be listed in the offering’s prospectus as lead underwriters of the IPO when it’s filed publicly, with each receiving an even split of fees, Bloomberg reported this week.

The filing could be made public as early as Monday, people familiar with the matter said. It will include details on how SoftBank has acquired a 25% stake in Arm from the Vision Fund at a $64 billion valuation, one of the people added. A representative for the Vision Fund declined to comment.

Arm is expected to sell about 10% of the company’s shares in the listing, the people said. The Wall Street Journal and Reuters reported some of these details earlier on the stake sale and timing of filing.

--With assistance from Tom Contiliano and Matt Turner.

Most Read from Bloomberg Businessweek

Lyme Disease Has Exploded, and a New Vaccine Is (Almost) Here

China’s Debt-Fueled Housing Market Is Having a Meltdown, Again

Drug Benefit Firms Devise New Fees That Go to Them, Not Clients

©2023 Bloomberg L.P.

Yahoo Finance

Yahoo Finance