Array Technologies Inc (ARRY) Q1 2024 Earnings: Misses EPS Estimates Despite Revenue Beat

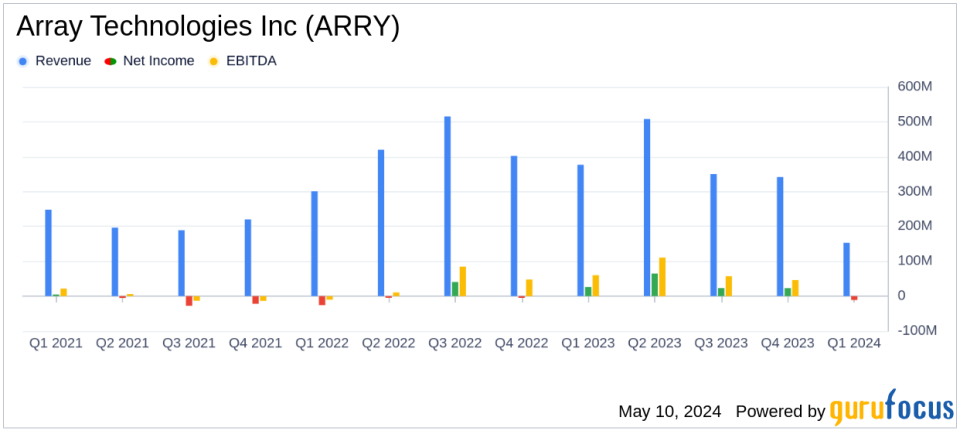

Revenue: Reported $153.4 million, surpassing the estimated $140.11 million.

Net Loss: Recorded at $11.3 million, significantly above the estimated loss of $3.72 million.

EPS: Basic and diluted net loss per share was $0.07, worse than the estimated loss per share of $0.03.

Gross Margin: Achieved a record gross margin of 35.9% and an adjusted gross margin of 38.3%.

Adjusted EBITDA: Amounted to $26.2 million, reflecting robust operational efficiency.

Free Cash Flow: Demonstrated strong liquidity with $45.1 million in free cash flow, driven by effective collections and increased customer deposits.

Future Guidance: Reaffirmed full-year revenue expectations ranging between $1,250 million to $1,400 million and adjusted EBITDA between $285 million to $315 million.

On May 9, 2024, Array Technologies Inc (NASDAQ:ARRY), a prominent manufacturer of solar tracking solutions, disclosed its financial outcomes for the first quarter of 2024 through an 8-K filing. The company reported a revenue of $153.4 million, surpassing analyst expectations of $140.11 million. However, it recorded a net loss of $11.3 million, translating to a basic and diluted net loss per share of $0.07, which did not meet the anticipated earnings per share of -$0.03.

Company Overview

Array Technologies Inc specializes in ground-mounting systems for solar energy projects, featuring an integrated system of steel supports, motors, gearboxes, and controllers. These components form a single-axis tracker that optimizes solar panel orientation to enhance energy production. With operations spanning the United States, Australia, Spain, Brazil, and other regions, the U.S. remains its largest revenue contributor.

Financial Highlights and Challenges

The first quarter saw ARRY achieving a record adjusted gross margin of 38.3%, attributed to strategic cost enhancements and a one-time benefit from a supplier settlement. Despite these gains, the company faced a net loss, primarily due to higher operating expenses and interest costs. This loss underscores potential challenges in managing costs and maximizing profitability amidst competitive and economic pressures.

Strategic Achievements and Market Position

ARRY's strategic initiatives, including the launch of Hail Alert Response software and structural cost enhancements, have strengthened its market position. The company also reported robust free cash flow of $45.1 million, reflecting effective cash management and customer engagement. These achievements are crucial for sustaining growth and competitiveness in the rapidly evolving solar technology market.

Detailed Financial Analysis

The detailed financial statements reveal a mixed picture. While revenue increased, the cost of revenue also rose, leading to a net income decline compared to the previous year. The balance sheet shows a healthy cash position of $287.6 million, up from $249.1 million at the end of 2023, providing ARRY with solid financial flexibility.

Operating activities generated $47.5 million in cash, supported by significant improvements in accounts receivable and deferred revenue. However, financing activities reflected a net cash usage, primarily due to debt repayments and equity issuance costs, highlighting the ongoing capital management adjustments.

Future Outlook and Guidance

Looking ahead, ARRY reaffirmed its full-year 2024 revenue guidance ranging between $1,250 million and $1,400 million, with adjusted EBITDA expected to be between $285 million and $315 million. This guidance reflects management's confidence in the company's strategic direction and market demand dynamics.

Overall, while Array Technologies faces challenges in turning operational success into net profitability, its strategic initiatives and strong market demand position it well for future growth. Investors and stakeholders will likely watch closely how the company navigates cost management and capitalizes on emerging market opportunities in subsequent quarters.

Conference Call and Additional Information

Array Technologies will host a conference call to discuss these results and provide further insights into its operations and strategy. Details and access to the webcast are available on the company's investor relations website.

For more detailed financial information and future updates, please visit Array Technologies' investor relations page.

Explore the complete 8-K earnings release (here) from Array Technologies Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance