Arthur J. Gallagher (AJG) Q3 Earnings Top, Revenues Miss

Arthur J. Gallagher & Co.’s AJG third-quarter 2022 adjusted net earnings of $1.72 beat the Zacks Consensus Estimate by 3% and our estimate of $1.70. The bottom line increased 29.3% on a year-over-year basis.

Arthur J. Gallagher’s performance was driven by lower expenses and higher revenues across the Brokerage and Risk Management segments.

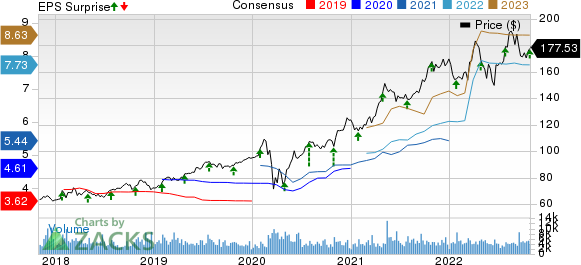

Arthur J. Gallagher & Co. Price, Consensus and EPS Surprise

Arthur J. Gallagher & Co. price-consensus-eps-surprise-chart | Arthur J. Gallagher & Co. Quote

Operational Update

Total revenues of $2 billion missed the Zacks Consensus Estimate by 1.3%. The top line declined 4.7% year over year.

Arthur J. Gallagher’s total expenses decreased 9.3% year over year to $1.7 billion in the reported quarter due to lower depreciation and change in estimated acquisition earnout payables. The figure is higher than our estimate of $1,662.3 million.

Adjusted earnings before interest, tax, depreciation and amortization and change (EBITDAC) in estimated acquisition earnout payables increased 7.5% from the prior-year quarter to $508.7 million. The figure, however, was lower than our estimate of $610.1 million.

Segmental Results

Brokerage: Revenues of $1.7 billion increased 15.8% year over year on higher commissions, fees, supplemental revenues, contingent revenues and investment income and net gains on divestitures. The figure missed the Zacks Consensus Estimate of $1,822.9 million

Expenses jumped 17.2% from the year-ago quarter to $1.4 billion due to higher compensation, operating expense, amortization and depreciation.

Adjusted EBITDAC climbed 1.5% from the year-ago level to $488.5 million. Margin contracted 120 basis points (bps) to 32.3%.

Risk Management: Revenues were up 9.6% year over year to $307.5 million, mainly owing to higher fees.

Expenses rose 7.9% from the prior-year period to $270.9 million on higher compensation and operating expenses.

Adjusted EBITDAC improved 8.2% year over year to $47.3 million and the margin contracted 130 bps to 18.2%.

Corporate: Total revenues were $0.3 million versus $337.3 million in the year-ago quarter.

EBITDAC was a negative $27.1 million compared with a negative $51.5 million in the year-ago quarter.

Financial Update

As of Sep 30, 2022, total assets were $38.7 billion, up 16% from the 2021-end level.

At the end of the quarter, cash and cash equivalents of $553.7 million increased 37.5% from the 2021-end level.

As of Sep 30, 2022, shareholders’ equity increased 0.8% to $8.6 billion from the level on Dec 31, 2021.

Dividend Update

AJG paid out a quarterly cash dividend of 51 cents per share.

Acquisition Update

In the quarter, Arthur J. Gallagher closed six acquisitions with estimated annualized revenues of about $20.4 million.

Zacks Rank

Arthur J. Gallagher carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurance Brokers

Brown & Brown, Inc.’s BRO third-quarter 2022 adjusted earnings of 50 cents per share missed the Zacks Consensus Estimate by 16.7% and decreased 13.8% year over year. Total revenues of $927.6 million missed the Zacks Consensus Estimate by 1.9% but improved 20.4% year over year.

Organic revenues improved 6.7% to $799.1 million. BRO’s adjusted EBITDAC was $289.8 million, up 5.8% year over year. EBITDAC margin contracted 440 bps year over year to 31.2%.

Willis Towers Watson Public Limited Company WTW delivered third-quarter 2022 adjusted earnings of $2.20 per share, which beat the Zacks Consensus Estimate by 2.8% and improved 27.2% year over year. Adjusted revenues of $1.9 billion declined 1% year over year and missed the Zacks Consensus Estimate by 1.6%.

WTW’s adjusted operating income was $384 million, up 7.5% year over year. Margin expanded 110 bps to 14.5%. Adjusted EBITDA was $408 million, down 1.7% year over year. Adjusted EBITDA margin was 20.9%, down 10 bps.

Willis Towers expects to deliver mid-single-digit organic revenue growth and adjusted operating margin expansion for 2022.

Marsh & McLennan Companies, Inc. MMC reported third-quarter 2022 adjusted earnings per share of $1.18 that outpaced the Zacks Consensus Estimate by 1.7% and rose 9% year over year. Revenues amounted to $4.8 billion, which grew 4% year over year but fell short of the consensus mark by 1.7%.

MMC’s consolidated adjusted operating income of $851 million climbed 12% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marsh & McLennan Companies, Inc. (MMC) : Free Stock Analysis Report

Arthur J. Gallagher & Co. (AJG) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

Willis Towers Watson Public Limited Company (WTW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance