Should artnet Be Disappointed With Their 43% Profit?

It might be of some concern to shareholders to see the artnet AG (FRA:ART) share price down 16% in the last month. But that doesn’t change the fact that the returns over the last three years have been pleasing. To wit, the share price did better than an index fund, climbing 43% during that period.

See our latest analysis for artnet

We don’t think that artnet’s modest trailing twelve month profit has the market’s full attention at the moment. We think revenue is probably a better guide. As a general rule, if the market is looking past earnings to focus on revenue, there is a hope for, or expectation of, strong growth. The main reason for this is that fast revenue growth can be readily extrapolated into a profitable future, but stagnant revenue cannot.

Over the last three years artnet has grown its revenue at 4.0% annually. That’s not a very high growth rate considering it doesn’t make profits. The modest growth is probably broadly reflected in the share price, which is up 13%, per year over 3 years. The real question is when the business will generate profits, and how quickly they will grow. In this sort of situation it can be worth putting the stock on your watchlist. If it can become profitable, then even moderate revenue growth could grow profits quickly.

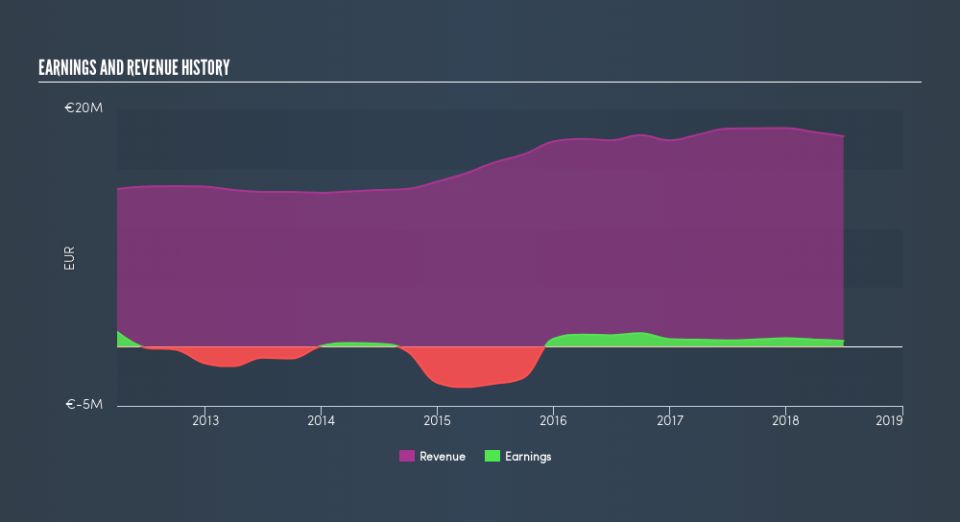

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

Balance sheet strength is crucual. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While the broader market lost about 6.0% in the twelve months, artnet shareholders did even worse, losing 16%. Having said that, it’s inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn’t be so upset, since they would have made 1.8%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Before forming an opinion on artnet you might want to consider these 3 valuation metrics.

We will like artnet better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance