Ashland's (ASH) Q2 Earnings In Line, Revenues Beat Estimates

Ashland Global Holdings Inc. ASH slipped to a loss from continuing operations of $575 million or $9.48 per share in the second quarter of fiscal 2020 (ended Mar 31, 2020) from profit of $45 million or 71 cents per share in the prior-year quarter.

Barring one-time items, adjusted earnings were 84 cents per share, up from 83 cents in the year-ago quarter. The bottom line matched the Zacks Consensus Estimate.

Sales fell 9% year over year to $610 million. The figure squeaked past the Zacks Consensus Estimate of $609.4 million. Sales were hurt by the effects of prior-year business losses in oral care and the legacy Pharmachem business.

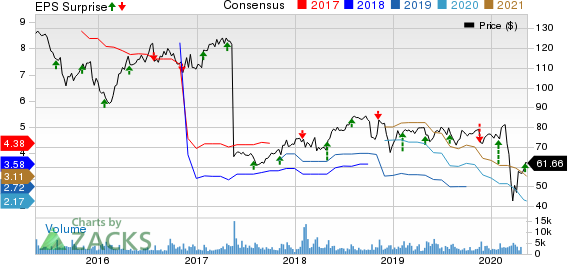

Ashland Global Holdings Inc Price, Consensus and EPS Surprise

Ashland Global Holdings Inc price-consensus-eps-surprise-chart | Ashland Global Holdings Inc Quote

Segment Highlights

Consumer Specialties: Sales in the segment fell 9% year over year to $343 million in the reported quarter, impacted by business losses in oral care and Pharmachem as well as unfavorable currency swings.

Industrial Specialties: Sales in the division slipped 7% year over year to $240 million, hurt by reduced demand in certain industrial end markets and lower pricing.

Intermediates & Solvents: Sales in the segment dropped 16% year over year to $37 million, impacted by reduced pricing and lower intercompany volumes.

Financials

The company ended the quarter with cash and cash equivalents of $353 million, a more than two fold year over year increase. Long-term debt was $1,535 million at the end of the quarter, down 33% year over year.

Cash provided by operating activities from continuing operations was $47 million, up from $15 million in the prior-year quarter.

Outlook

Moving ahead, Ashland expects relative strength across Consumer Specialties and certain end markets within Industrial Specialties in the second half of the year. It expects stable demand for its defensive end markets. The company, however, sees increased global uncertainties to impact demand in more industrial-focused businesses.

Ashland has identified incremental cost-saving opportunities of more than $40 million on an annual basis. It is targeting run rate savings of roughly $40 million by the end of fiscal 2020.

Price Performance

Shares of the company have declined 16.7% in the past year against the industry’s 31.4% growth.

Zacks Rank & Key Picks

Ashland currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks worth considering in the basic materials space are Equinox Gold Corp. EQX, The Scotts Miracle-Gro Company SMG and Newmont Corporation NEM.

Equinox Gold has a projected earnings growth rate of 231% for the current year. The company’s shares have rallied roughly 44% in a year. It currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Scotts Miracle-Gro has an expected earnings growth rate of 17.7% for the current fiscal year. The company’s shares have gained roughly 58% in the past year. It currently carries a Zacks Rank #2 (Buy).

Newmont has a projected earnings growth rate of 85.6% for the current year. The company’s shares have surged around 104% in a year. It currently has a Zacks Rank #2.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.1% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Newmont Corporation (NEM) : Free Stock Analysis Report

Ashland Global Holdings Inc (ASH) : Free Stock Analysis Report

The Scotts MiracleGro Company (SMG) : Free Stock Analysis Report

Equinox Gold Corp (EQX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance