Asia and West Africa hurt Dove soap and Marmite-maker Unilever

Unilever (UNA.AS), the maker of Dove soaps and Marmite, on Tuesday warned that it would miss its full-year sales growth targets, blaming weakness in South Asia, West Africa, and North America.

The Anglo-Dutch consumer goods giant said that revenue growth for 2019 would come in “slightly below” its previously guided 3% to 5% range.

The company had already said that growth would come in at the lower end of that range, which is the level of growth the company is hoping to achieve over multiple years.

Unilever also said that growth in the first half of next year would be below 3%, and that full-year growth in 2020 would come in the lower half of the range.

Profits and margins will not be affected, the company said in an unscheduled trading update.

READ MORE: Bank of England: UK banks resilient despite 'global vulnerabilities'

It pointed to “challenges” in the current quarter in some markets, including the economic slowdown in South Asia, which is one of its biggest markets. It said that trading conditions in West Africa remained “difficult”.

Unilever said that the environment in developed markets continued to be challenging. And while it noted that there were “early signs of improving performance in North America”, it said a full recovery there would take time.

“Due to challenges in certain markets, we expect a slight miss to our full year underlying sales growth delivery,” said Alan Jope, the CEO of Unilever, on Tuesday.

The CEO told investors that the slowdown in Asia could be pinned on difficulties in India’s rural markets, but noted that he expected them to bounce back in the second half of 2020.

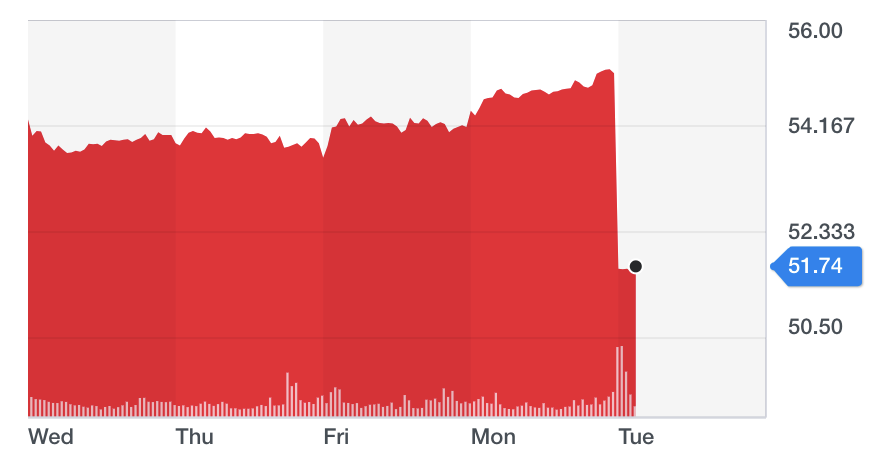

Shares in the company fell by almost 6% in Amsterdam on Tuesday, and the giant was one of the biggest losers on the FTSE 100 (^FTSE).

Jope had previously indicated that he hoped to increase the company’s revenue growth guidance, but a recovery has proven elusive since he took over the job in January 2019.

READ MORE: The true cost of Christmas for UK households

The company has focused on its faster-growing beauty and personal care products, and pulled back from the lower-margin food assets.

“Weaker sales growth is a problem, but lately we have been encouraged that earnings growth is being driven by price rather than volume,” said Neil Wilson, chief market analyst at Markets.com, in a note.

“However, the problem for fast-moving consumer goods giants with the big brand names is that consumers have a lot more choice and are more discerning than ever.”

Yahoo Finance

Yahoo Finance