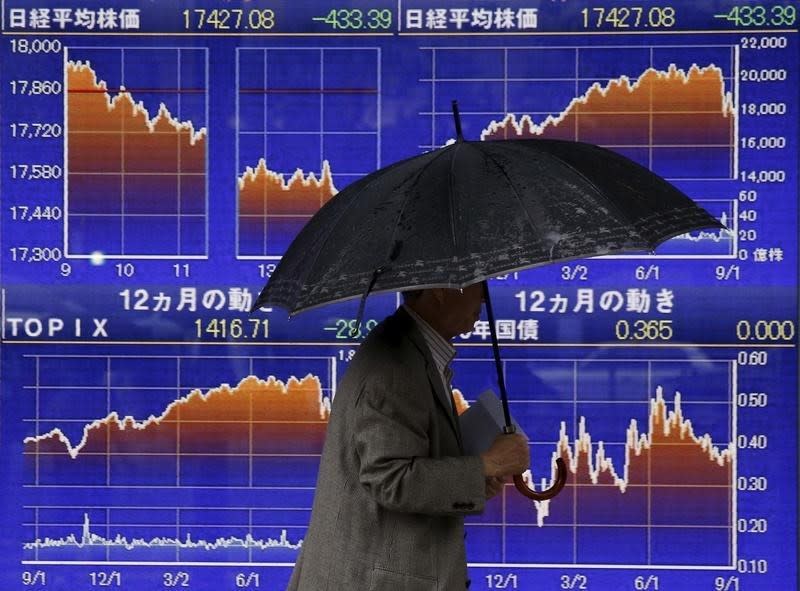

Asia stocks, commodities slide on disappointing China PMI

By Saikat Chatterjee

HONG KONG (Reuters) - Asian stocks looked set for their biggest single-day fall in a month on Wednesday after factory activity in China shrank more than expected, adding to fears of a weakening global economy and sending investors into safer assets such as government bonds.

Financial spreadbetters predicted European markets would follow Asia lower, with Britain's FTSE 100 seen opening down 0.9 percent, Germany's DAX 1 percent and France's CAC 40 0.7 percent.

S&P mini futures fell 1 percent after the weak China report, pointing to a weaker opening on Wall Street.

MSCI's broadest index of Asia-Pacific shares outside Japan fell 2.5 percent, its biggest daily loss since Aug. 24, according to Thomson Reuters data.

China's stocks were among the hardest hit in the region with main indexes down more than 2 percent. Australia fell 2 percent and South Korea shed 1.5 percent. Japanese markets are shut through Wednesday.

"The industrial sector in China remains a concern, indicating that the economy is not out of the woods yet, while the Fed's comments last week indicate a glass half-empty view of the global economy," said Tai Hui, chief Asia markets strategist at JP Morgan Asset Management in Hong Kong.

More evidence of a slowdown in the world's second-biggest economy was evident in the preliminary Caixin/Markit China Manufacturing Purchasing Managers' Index (PMI).

Activity in China's factory sector failed to improve in September as expected, and instead shrank for a seventh straight month to its weakest level in 6-1/2 years, the private survey showed.

The findings could add to fears that China's economy is cooling more sharply than earlier expected, though most analysts still believe a gradual albeit bumpy slowdown is more likely.

On Tuesday, the Asian Development Bank lowered its growth forecast for China to 6.8 percent for 2015.

Sentiment at Asia's biggest companies tumbled at a record pace in the third quarter on worries about China and the risks it poses to global growth, a Thomson Reuters/INSEAD survey showed.

Overnight on Wall Street, the Dow Jones industrial average fell 1.09 percent, the S&P 500 lost 1.23 percent, and the Nasdaq Composite fell 1.5 percent to 4,756.72.

Losses in equities prompted investors to plough funds into fixed-income assets. The benchmark two-year U.S. Treasury yield fell to 0.68 percent, nearing a two-week low.

The spread between the 10-year bond and the 2-year bond has narrowed to 146 basis points from 176 basis points in early July, indicating markets were expecting sub-par economic growth.

Risk aversion was rife in currencies with the higher-yielding Australian dollar, down 0.9 percent at more than one-week lows.

The U.S. dollar consolidated most of its overnight gains. It held firm at 96.275 against a basket of six currencies, after rising by 1 percent. The Japanese yen held firm against the dollar at 120.24 as investors shied away from adding risky bets.

U.S. crude futures rose 0.5 percent to $46.16 per barrel, while Brent futures were 0.3 percent firmer at $48.74.

Copper extended losses and neared four-week lows after the China PMI report. Overnight it posted its biggest one-day drop in more than two months as fund and speculative selling pushed prices down. A 19-commodity Thomson Reuters/Core Commodity CRB Index held at two-week lows.

Broader risk aversion failed to lift demand for precious metals with both spot gold and silver nursing big overnight losses.

(Additional reporting by Samuel Shen in SHANGHAI; Editing by Kim Coghill)

Yahoo Finance

Yahoo Finance