Assurant (AIZ) to Share More Profits, Ups Dividend by 3%

Assurant, Inc.’s AIZ board of directors recently approved a 3% hike in its quarterly dividend in a bid to enhance shareholder value. The insurer will now pay out a quarterly dividend of 68 cents per share compared with 66 cents paid out in December 2020. The meatier dividend will be paid out on Dec 20, 2021, to shareholders of record as of Nov 29.

The recent hike marked the 17th consecutive dividend increase by Assurant since its initial public offering in 2004.Assurant has consistently hiked its dividend, with the metric witnessing a five-year CAGR (2014-2020) of 16.7%. Based on the stock’s Nov 10 closing price of $159.67, the new dividend will yield 1.6% to Assurant.

The recent dividend hike highlights its commitment toward prudent capital management, reflecting its sustained operational performance over a period of time and its sound financial prospects. This multiline insurer exited the third quarter with liquidity of $1.3 billion, which remains $1.1 billion higher than the insurer’s current targeted minimum level of $225 million.

Besides the regular dividend hike, Assurant remains committed to returning excess cash to shareholders through share repurchases. Traditionally, Assurant has been utilizing 50% of its free cash flow to repurchase shares. Assurant has $1.13 billion remaining under its current share buyback authorization. With the third-quarter dividend payment, the company will complete its $1.35 billion capital return objective from 2019 to 2021. Assurant estimates a higher-than-usual level of buybacks throughout the remainder of the year and into 2022 as it expects to return $900 million in net proceeds from the sale of Global Preneed within the next 12 months.

For 2021, the multi-line insurer expects dividends to approximate segment earnings subject to the growth of the businesses, and rating agency and regulatory capital requirements.

Given a solid capital level of the insurance industry, improving operating backdrop favoring strong operational performance, insurers like Brown & Brown, Inc. BRO, American Financial Group’s AFG and W.R. Berkley Corporation WRB have also resorted to effective capital deployment to enhance shareholders value.

While Brown & Brown hiked its dividend by 10.8%, American Financial Group and W.R. Berkley Corporation approved a special dividend of $4 and $1 per share respectively.

Brown & Brown has a dividend yield of 0.6% and enjoys a strong liquidity position, which not only mitigates balance sheet risks but also paves the way for accelerated capital deployment.

American Financial Group’s 1.5% dividend yield betters the industry average of 0.4%, making the stock an attractive pick for yield-seeking investors. AFG’s robust operating profitability at the property and casualty segment and effective capital management support shareholder returns.

W.R. Berkley’s dividend yield of 0.6% betters the industry average of 0.3%. It should be able to continue boosting shareholders' return banking on a solid balance sheet with sufficient liquidity and robust cash flows.

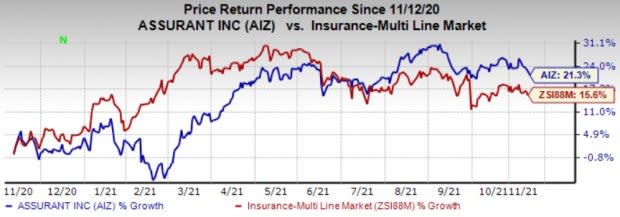

Coming back to Assurant, the stock has gained 21.3% in a year, outperforming the industry’s increase of 15.6%. We expect strong segmental performance along with a robust capital position to continue driving the stock in the near term.

Image Source: Zacks Investment Research

In the past year, shares of Brown & Brown, American Financial and W.R. Berkley have gained 36.5%,75.2% and 18.9% respectively.

Assurant currently carries Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

W.R. Berkley Corporation (WRB) : Free Stock Analysis Report

Assurant, Inc. (AIZ) : Free Stock Analysis Report

American Financial Group, Inc. (AFG) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance