Aston Martin gears up for flotation but sales slip as new cars launched

Aston Martin has taken a hit from sterling's fluctuating value caused by uncertainty over Brexit, with headline profits at the luxury car maker halving in the first quarter.

Pre-tax profit dropped almost 50pc compared to the last time round on a statutory basis to £2.8m as sterling’s weakness hit the Gaydon-based business. Stripping out currency movements, pre-tax profit was up almost 50pc at £7.4m.

But on an underlying basis profits at Aston - which is understood to have hired banks ahead of an expected flotation - kicked up a gear, despite it selling fewer cars than in the same period last time round.

Earnings before interest, tax, depreciation and amortisation climbed 3pc to £43.7m, despite revenues slipping 1.5pc to £185.4m.

The marque favoured by James Bond reported sales of 963 of its upmarket cars in the first quarter, down 20pc on the same period a year ago.

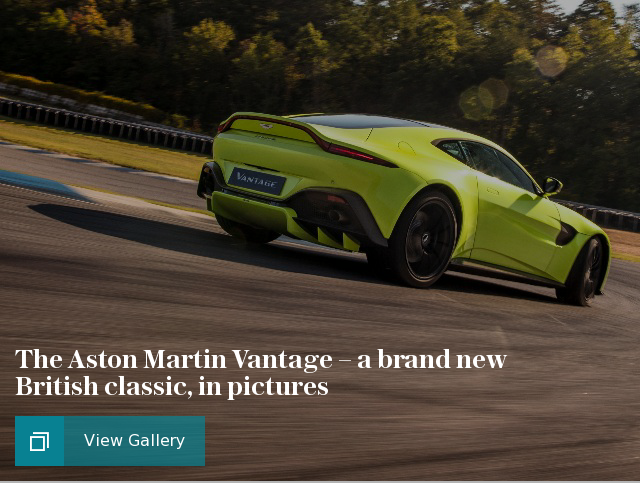

Andy Palmer, chief executive, said the company delivered a “positive” quarter, especially with Aston running down production levels as it introduces new models such as the new DB11 Volante, Vantage, and the successor to the Vanquish, the DBS Superleggera, at the end of the year.

Aston is also increasing investment in new products such as the re-introduction of the Lagonda marque, which will be all-electric, as well as building a factory in Wales for the company’s first SUV, the DBX.

Buyers are also looking for more personalisation of their cars, said finance chief Mark Wilson, adding that the average selling price of an Aston has risen by £11,000 to just over £160,000.

“The order book is very strong,” he said. “Demand exceeds production: it’s very difficult to get your hands on an Aston but we are not going to chase every single car. We have to balance supply and demand to retain our exclusivity.”

Current capacity for the business is 7,000 units at its Gaydon base, though this could be boosted to 10,000 vehicles a year by adding a third shift of production staff.

The new factory in St Athan, in Wales, is expected to increase total production capacity to about double current levels when in opens in 2019.

However, Mr Wilson would not be drawn on Aston’s expected flotation, despite reports banks Deutsche, Goldman Sachs and JP Morgan have been hired to run the process, which could see the company valued at £4bn, with a listing in London, or potentially New York.

“All options remain open,” the finance chief said. “It’s a decision for our shareholders.”

Aston Martin is controlled Italy’s Investindustrial and Kuwait’s Investment Dar.

Yahoo Finance

Yahoo Finance