Aston Martin issues stark profit warning after 'very disappointing' year

British luxury carmaker Aston Martin (AML.L) warned investors today that it faces a sharp drop in annual earnings after a year of plummeting sales, including a 7% fall in wholesale volumes in its European market and weak demand for the Vantage model.

The carmaker said that annual 2019 earnings before interest, tax, depreciation, and amortisation will drop by up to 47% from 2018, to between £130m ($171m) and £140m.

READ MORE: Aston Martin opens new factory in Wales

“From a trading perspective, 2019 has been a very disappointing year,” Aston Martin CEO Andy Palmer said. “Whilst retails have grown by 12%, our best result since 2007, our underlying performance will fail to deliver the profits we planned, despite a reduction in dealer stock levels.”

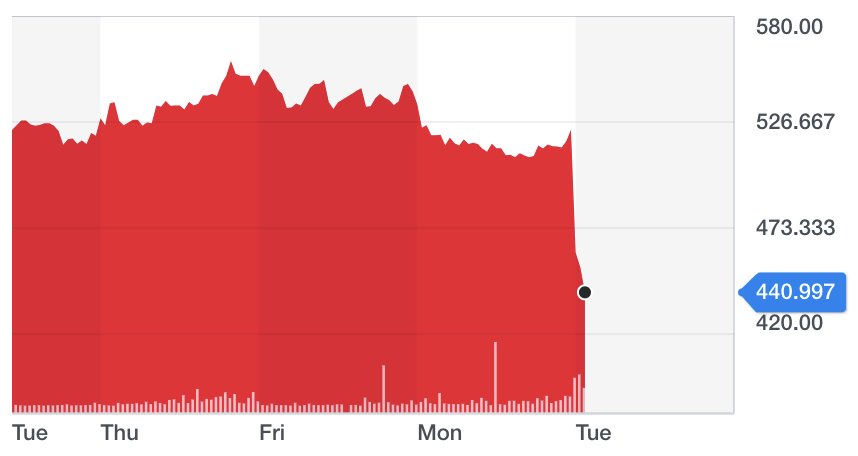

Shares in Aston Martin have tanked over 14% on Tuesday following the announcement.

Aston Martin, which will now kick off a cost-saving program, is pinning its hopes on its new DBX sports utility vehicle to turn the brand’s fortunes around, according to Palmer. Deliveries of the DBX are expected to begin in the second half of 2019 and the company said it currently has 1,800 orders for the high-end SUV.

But the DBX, which will be built at Aston Martin’s St Athan plant in Wales, will already have competition in the luxury SUV segment, going up against Porsche’s popular Cayenne, the Bentley Bentayga, and the Rolls-Royce Cullinan.

READ MORE: Aston Martin raises $150m to finance production of its first SUV

Aston Martin, whose stock market value has nosedived from over £4bn at its stock market debut in October 2018, to its current value of around £1bn, already issued a profit warning in July last year. Aston Martin’s shares opened down more than 10% following the news on Tuesday morning.

The 106-year-old carmaker raised £121m in an expensive bond sale in September 2018, to help it finance production of the DBX. The high interest rate of 12% on some of the bond notes spooked investors, prompting shares to drop by more than 5% on the news.

Yahoo Finance

Yahoo Finance