Asure Software Inc (ASUR) Q1 2024 Earnings Analysis: Mixed Results Amidst Revenue Growth and ...

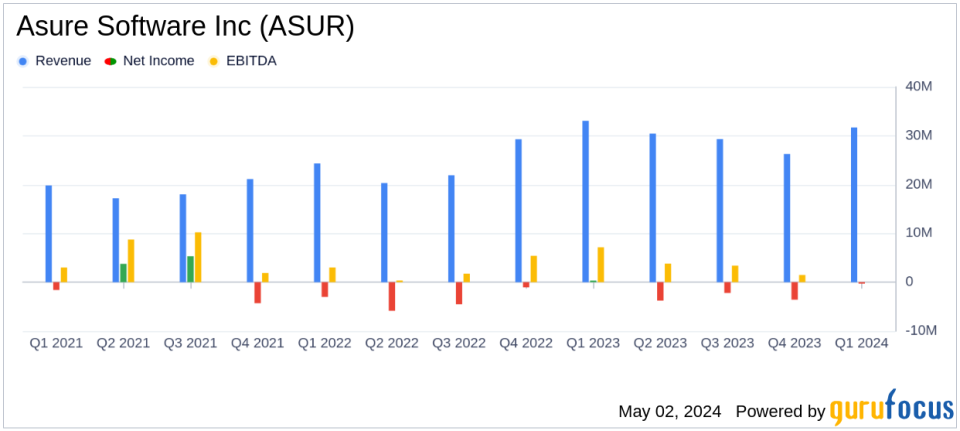

Reported Revenue: $31.7 million, a decrease of 4% year-over-year, exceeding estimates of $31.07 million.

Net Loss: Reported a net loss of $0.3 million, compared to a net income of $0.3 million in the previous year, falling short of net loss estimates of $5.10 million.

Recurring Revenue: Increased to $30.3 million, up 8% year-over-year, highlighting consistent growth in core business operations.

Gross Profit: Totaled $22.6 million, down from $24.4 million year-over-year, with a gross margin decline reflecting increased cost pressures.

Adjusted EBITDA: $6.8 million, down from $8.2 million in the prior year, indicating tighter operational efficiency amidst challenging conditions.

2024 Revenue Guidance: Reiterated at $125.0 million to $129.0 million, aiming for growth despite current economic pressures.

Strategic Developments: Launched new employee self-service features and expanded AI capabilities in payroll tax management, enhancing product offerings and customer experience.

Asure Software Inc (NASDAQ:ASUR) disclosed its financial outcomes for the first quarter ended March 31, 2024, via its recent 8-K filing. The company reported a slight revenue increase to $31.7 million, surpassing the estimated $31.07 million. However, it experienced a net loss of $0.3 million, contrasting with the expected net income of $5.10 million. This performance underscores the volatility in Asure's operational efficiency while highlighting its ability to generate revenue amidst challenging conditions.

Asure Software Inc, a prominent provider of cloud-based Human Capital Management (HCM) solutions, focuses on aiding small and mid-sized businesses enhance their human capital management through its comprehensive suite, AsureHCM. The suite includes various services from payroll and tax management to HR consulting, primarily catering to the U.S. market.

Financial Performance and Strategic Highlights

For Q1 2024, Asure reported a 4% year-over-year decrease in total revenue, with recurring revenue growing by 8% to $30.3 million. This growth in recurring revenue, excluding ERTC, was up by 9% compared to the previous year, indicating a strengthening core business despite the cessation of one-time ERTC revenue in 2023. However, the company faced a downturn in net income, swinging to a $0.3 million loss from a $0.3 million profit year-over-year, and saw a decline in EBITDA from $6.8 million to $4.4 million.

The company's strategic initiatives included launching new employee self-service features and integrating with major platforms like Workday, which signifies potential future growth in its client base and service capabilities. Asure also introduced new employer tax credit services, reflecting its focus on expanding value-added services for its clients.

Balance Sheet and Cash Flow Insights

Asure's balance sheet as of March 31, 2024, shows a total asset value of $469.338 million, with a significant portion tied up in client fund obligations and intangible assets. The company's cash and cash equivalents saw a decrease to $23.166 million from $30.317 million at the end of 2023. This financial position points to a robust asset base but also highlights the need for careful cash management moving forward.

The cash flow statements reveal a net cash used in operations of $3.947 million, a stark contrast to the $4.588 million provided by operations in the same quarter of the previous year. This shift could impact Asure's operational sustainability and its ability to fund future growth initiatives.

Future Outlook and Management Commentary

Looking ahead, Asure's management reiterates its full-year 2024 revenue guidance in the range of $125.0 million to $129.0 million, reflecting confidence in the company's growth trajectory. Adjusted EBITDA is expected to be between $20 million and $21 million. Asure's CEO, Pat Goepel, expressed optimism about the company's strategic direction, emphasizing the role of new product launches and technology enhancements in driving future revenue growth.

In conclusion, Asure Software Inc's first quarter of 2024 presents a mixed financial landscape with notable revenue growth countered by operational challenges leading to a net loss. The company's strategic initiatives and market positioning suggest potential for recovery and growth, contingent on effective management of operational efficiencies and cash flow. Investors and stakeholders will likely watch closely how Asure navigates these challenges in the upcoming quarters.

Explore the complete 8-K earnings release (here) from Asure Software Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance