ASX Dividend Stocks To Watch In July 2024

Amidst a generally buoyant Australian market with the ASX200 closing up by 0.9%, all sectors except IT demonstrated positive movement, highlighting an optimistic investor sentiment across diverse industries. Particularly, the Real Estate sector led gains with a 2% increase, suggesting growing confidence in this area as potential interest rate cuts may ease mortgage pressures and boost demand. In such a market environment, dividend stocks can be particularly appealing as they offer the potential for steady income alongside capital appreciation opportunities.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Collins Foods (ASX:CKF) | 3.09% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 4.93% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 7.18% | ★★★★★☆ |

Eagers Automotive (ASX:APE) | 7.08% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 4.04% | ★★★★★☆ |

Fortescue (ASX:FMG) | 8.89% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.64% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.46% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.12% | ★★★★★☆ |

New Hope (ASX:NHC) | 8.69% | ★★★★☆☆ |

Click here to see the full list of 27 stocks from our Top ASX Dividend Stocks screener.

We'll examine a selection from our screener results.

Ampol

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ampol Limited, operating in Australia, New Zealand, Singapore, and the United States, engages in the purchasing, refining, distribution, and marketing of petroleum products with a market cap of approximately A$8.02 billion.

Operations: Ampol Limited generates revenue through three primary segments: Z Energy (A$5.51 billion), Convenience Retail (A$5.99 billion), and Fuels and Infrastructure (A$33.63 billion).

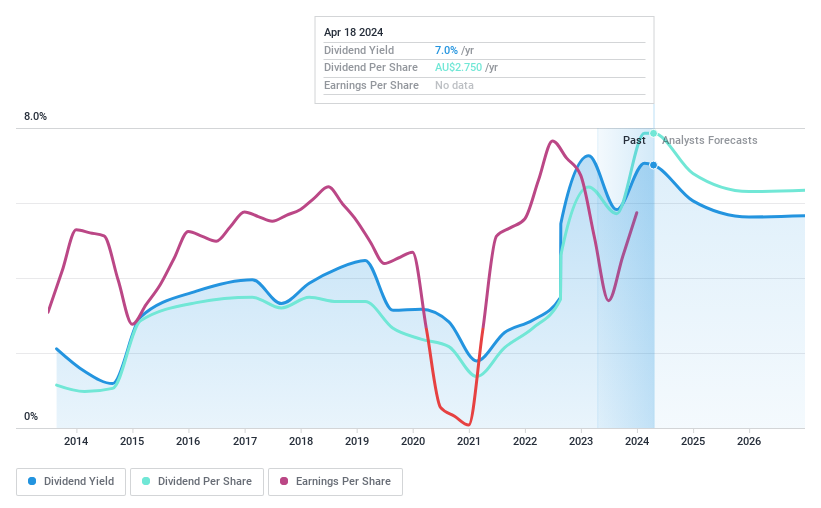

Dividend Yield: 8.2%

Ampol has demonstrated a mixed performance in dividend reliability and coverage. Over the past decade, dividends have shown volatility and are not well supported by earnings, with a high payout ratio of 93.3%. However, dividends are more adequately covered by cash flows at a 68.6% cash payout ratio. Ampol's dividend yield stands at 8.17%, ranking in the top quartile of Australian dividend payers but raises concerns about sustainability given its financial leverage and recent board changes.

Accent Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Accent Group Limited operates in the retail, distribution, and franchise of lifestyle footwear, as well as apparel and accessories across Australia and New Zealand, with a market capitalization of approximately A$1.11 billion.

Operations: Accent Group Limited generates A$1.40 billion in revenue primarily through its multi-channel retail operations focusing on performance and lifestyle footwear.

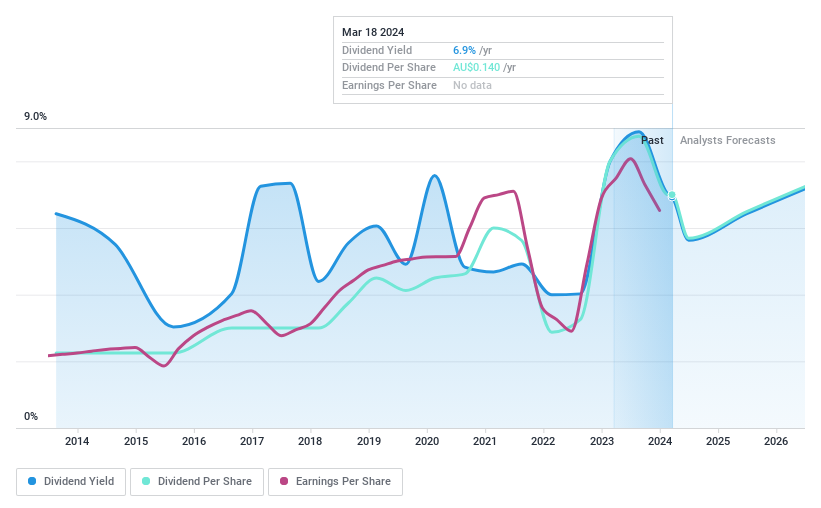

Dividend Yield: 7.1%

Accent Group offers a dividend yield of 7.07%, placing it among the top 25% of Australian dividend payers. However, its dividend sustainability is questionable, with a high payout ratio of 107.2% and past volatility in payments. While dividends are covered by cash flows due to a low cash payout ratio of 39%, earnings forecasts predict growth at 11.85% per year, suggesting potential improvement. The recent appointment of James Anderson as CIO could influence future strategic directions impacting financial health.

Charter Hall Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Charter Hall Group, listed on the ASX under ticker CHC, operates as a prominent Australian property investment and funds management group with a market capitalization of approximately A$5.75 billion.

Operations: Charter Hall Group generates its revenue primarily through funds management and property investments, with contributions of A$515.60 million and A$142.20 million respectively.

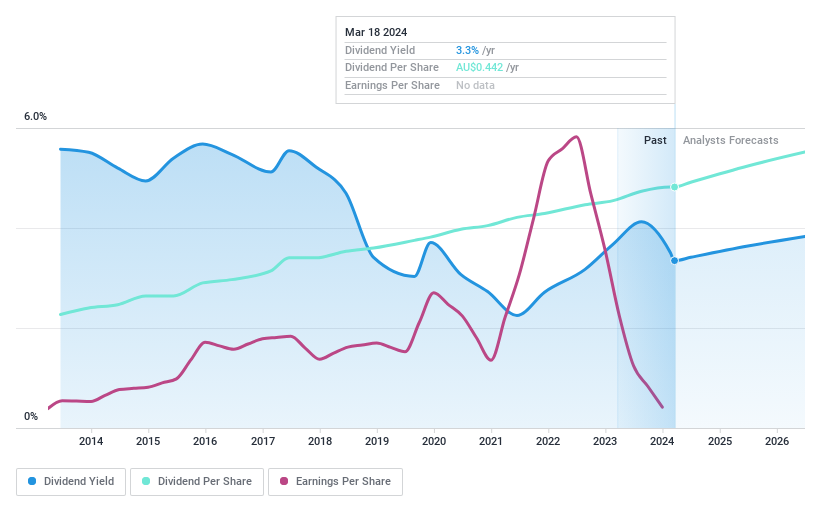

Dividend Yield: 3.6%

Charter Hall Group maintains a stable dividend history over the last decade, with a current yield of 3.64%. Despite trading at 58.3% below estimated fair value and having dividends well-covered by both earnings and cash flows (payout ratios of 43.8% and 45.3%, respectively), its yield is modest compared to the top Australian dividend payers. Recent distributions include A$0.023 and A$0.207 per share on June 27, 2024, reflecting its commitment to returning value to shareholders despite lower profit margins this year.

Next Steps

Click this link to deep-dive into the 27 companies within our Top ASX Dividend Stocks screener.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:ALD ASX:AX1 and ASX:CHC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com