Atlassian (TEAM) Jumps 10% as Q2 Earnings Beat Estimates

Atlassian TEAM stock rallied 10% in Thursday’s extended trading session after the business collaboration software company delivered better-than-expected second-quarter fiscal 2022 results. The company’s non-IFRS earnings per share (EPS) of 50 cents beat the Zacks Consensus Estimate of 38 cents. The figure improved 35% from the year-ago quarter’s non-IFRS earnings of 37 cents per share.

Atlassian’s fiscal second-quarter revenues surged 37% to $688.5 million and surpassed the consensus mark of $638.6 million. The company witnessed solid demand for its cloud-based products, primarily led by smaller customers. Meanwhile, the cloud migration momentum continued for larger clients. The company added more than 10,000 clients during the quarter.

In the first quarter of fiscal 2022, TEAM modified its revenue reporting style. Based on deployment options, it started reporting revenues under four segments: cloud, data center, server, and marketplace and services. Also, it started excluding Trello single-user accounts while updating its active customer count from the first quarter of fiscal 2022 onward.

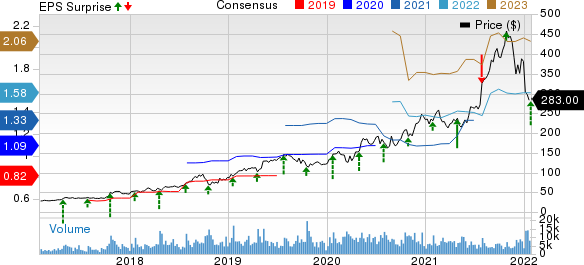

Atlassian Corporation PLC Price, Consensus and EPS Surprise

Atlassian Corporation PLC price-consensus-eps-surprise-chart | Atlassian Corporation PLC Quote

Quarterly Details

During the second quarter of fiscal 2022, Atlassian added 10,021 net new customers, bringing the total count to 226,521 customers on an active subscription or maintenance agreement basis. Around 98% of customers opted for cloud offerings amid the ongoing cloud migration. Such new additions and increased pricing on certain products bolstered the company’s quarterly revenues.

Segment-wise, Subscription revenues surged 64% year over year to $509 million. Sales from the Maintenance business decreased 3.2% year over year to $127.1 million, while Other revenues (which included perpetual license revenues) declined 11.7% year over year to $52.5 million.

During the quarter under review, cloud revenues were $364.1 million, indicating 58% year-over-year growth. Meanwhile, revenues from the data center grew 83% to $139.1 million. Marketplace and services revenues were $49.8 million, reflecting a 20% year-over-year improvement. Revenues from Server declined 12% to $135.5 million.

The company’s non-IFRS gross profit climbed 36.5% year over year to $592.6 million. Non-IFRS gross margin contracted 50 basis points (bps) to 86.1% during the quarter.

Atlassian’s non-IFRS operating income increased 24.5% year over year to $178.3 million, while operating margin contracted 270 bps to 25.9%.

Balance Sheet

The company ended the second quarter of fiscal 2022 with cash and cash equivalents and short-term investments of $986 million, down from $1.6 billion at the end of the first quarter.

During the second quarter, TEAM generated operating and free cash flow of $221.7 million and $197.5 million, respectively. In the first half of fiscal 2022, the company generated operating and free cash flow of $300.1 million and $256.8 million.

Third-Quarter Outlook

For the third quarter of fiscal 2022, the company anticipates revenues between $690 million and $705 million. Atlassian’s fiscal third-quarter revenue guidance is higher than the Zacks Consensus Estimate of $655.3 million.

Non-IFRS gross margin is estimated in the range of 84-85%. Non-IFRS operating margin is projected between 17% and 18%. The company expects to report non-IFRS EPS between 29 cents and 31 cents. The Zacks Consensus Estimate for fiscal second-quarter earnings is pegged at 39 cents per share.

Zacks Rank & Stocks to Consider

Atlassian currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader technology sector include Broadcom AVGO, Advanced Micro Devices AMD and Jabil JBL. While Broadcom sports a Zacks Rank #1 (Strong Buy), Advanced Micro Devices and Jabil each carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Broadcom’s first-quarter fiscal 2022 earnings has been revised upward by 8.1% to $8.15 per share over the past 60 days. For fiscal 2022, earnings estimates have moved upward by 6.5% to $33.03 per share over the past 60 days.

Broadcom’s earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 1.4%. Shares of AVGO have rallied 20.3% in the trailing 12 months.

The Zacks Consensus Estimate for Advanced Micro Devices’ first-quarter 2022 earnings has been revised upward by a penny to 68 cents per share over the past 30 days. For 2022, earnings estimates have moved upward by 3 cents to $3.32 per share in the past 30 days.

Advanced Micro Devices’ earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 14%. AMD stock has rallied 19.8% over the past year.

The Zacks Consensus Estimate for Jabil’s second-quarter fiscal 2022 earnings has been revised upward to $1.47 per share from $1.41 60 days ago. For fiscal 2022, earnings estimates have been revised upward by 25 cents to $6.58 per share in the past 60 days.

Jabil’s earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 18.1%. Shares of JBL have rallied 40.7% over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Jabil, Inc. (JBL) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Atlassian Corporation PLC (TEAM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance