Atrion Corp (ATRI) Reports Mixed Q1 2024 Results Amid Revenue Growth and Margin Pressures

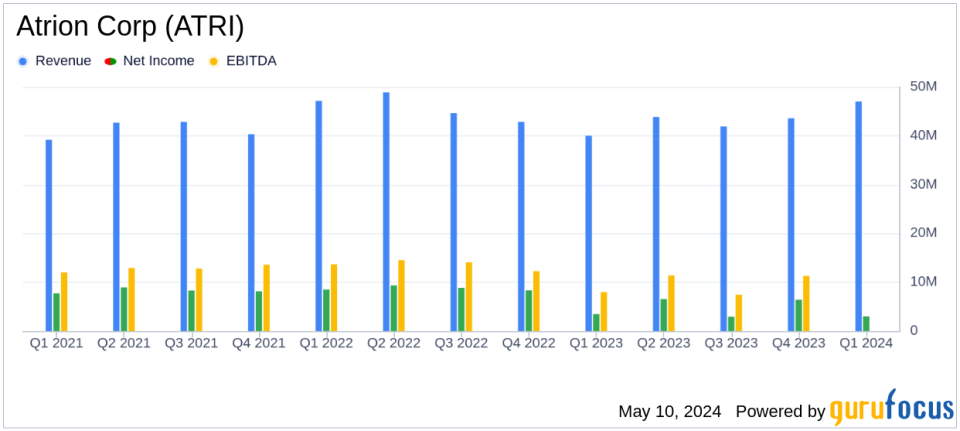

Revenue: $47.3M, up 18% from $40.0M in the same period last year.

Net Income: $2.8M, down 20% from $3.5M in the first quarter of 2023.

Diluted Earnings Per Share: $1.59, decreased from $1.98 year-over-year.

Gross Margin: Reported at 26.1% on a GAAP basis; adjusted to 31.0% excluding a one-time inventory write-off, compared to 37.7% in the previous year.

Operating Income: $3.1M, a decrease from $4.5M in the prior year; adjusted operating income was $5.4M excluding the inventory write-off, marking an increase.

Cash and Investments: Total of $18.7M in cash and short- and long-term investments as of March 31, 2024.

Debt Position: Remains debt-free as reported.

On May 10, 2024, Atrion Corp (NASDAQ:ATRI), a key player in the medical devices and instruments sector, disclosed its financial outcomes for the first quarter ended March 31, 2024, through its 8-K filing. The company reported a revenue increase to $47.3 million, up 18% from $40.0 million in the same quarter the previous year. However, net income and diluted earnings per share saw declines, primarily due to a significant one-time inventory write-off and weaker investment portfolio performance.

Company Overview

Atrion Corp specializes in developing and manufacturing products largely for medical applications. The company's fluid-delivery products, which represent a significant portion of its revenue, include specialized valves used in various medical settings such as anesthesia and oncology. Atrion's cardiovascular segment offers devices like the MPS2 Myocardial Protection System, essential in open-heart surgery. Additionally, the company provides ophthalmic products for contact lens disinfection. Predominantly, Atrion's market presence is strongest in the United States.

Financial Performance Insights

The first quarter of 2024 saw Atrion navigating through several challenges. While revenue growth was robust, driven by strong sales in OEM fluid delivery products and a record number of MPS 3 consoles, profitability metrics were impacted negatively. The gross margin declined to 26.1% on a GAAP basis, down from 37.7% in Q1 2023. Adjusting for a one-time inventory write-off of $2.3 million, the adjusted gross margin stood at 31.0%. This decline was attributed to overproduction in 2023 due to delayed customer orders amid supply chain disruptions, leading to excess inventory that needed to be cleared at lower margins.

Operating income was reported at $3.1 million, a decrease from $4.5 million in the prior year's quarter. Excluding the inventory write-off, adjusted operating income would have shown an increase of 22% year-over-year. The company's net income fell to $2.8 million, or $1.59 per diluted share, compared to $3.5 million, or $1.98 per diluted share in Q1 2023.

Balance Sheet and Cash Flow

As of March 31, 2024, Atrion reported cash and short-term investments totaling $18.7 million, maintaining a robust balance sheet with no debt. This financial stability is crucial as the company navigates through fluctuating market conditions and prepares for anticipated improvements in production and margins in the latter half of the year.

Management Commentary

David Battat, President and CEO of Atrion, commented on the quarterly performance, highlighting the revenue growth and the challenges faced due to inventory levels and product mix. He expressed optimism about resolving supply chain issues and resuming normal production levels by the third quarter of 2024, which is expected to improve profitability margins. Additionally, Mr. Battat noted the temporary impact of excess inventory adjustments and reassured stakeholders of strategic steps being taken to enhance operational efficiency.

Outlook and Strategic Moves

Looking forward, Atrion remains focused on reducing inventory levels and resuming normal production rates. The management's strategy to navigate through current challenges involves not only operational adjustments but also capitalizing on the strong demand for its MPS 3 consoles and other medical devices. The company's debt-free status and solid cash reserves provide a cushion and flexibility to adapt to market demands and potential economic fluctuations.

In summary, Atrion Corp's first quarter of 2024 reflected a complex mix of revenue growth offset by profitability challenges. The company's proactive measures to manage inventory and optimize production levels are expected to play a critical role in its performance in the upcoming quarters.

Explore the complete 8-K earnings release (here) from Atrion Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance