Attention Priceline Bulls: Watch This Important Resistance Level

Priceline Group Inc (NASDAQ: PCLN) is the only S&P 500 company with a four-digit stock price.

Amazon.com, Inc. (NASDAQ: AMZN) did touch and top the $1,000 mark intraday on Tuesday as well as Wednesday, although it failed to close above the level in both these sessions.

Priceline shares have been on a broader uptrend post the Great Recession of 2007, although the trend has been interspersed by mini-pullbacks. Over the past year, the stock has gained roughly 50 percent.

Q1 Earnings Trigger a Pullback

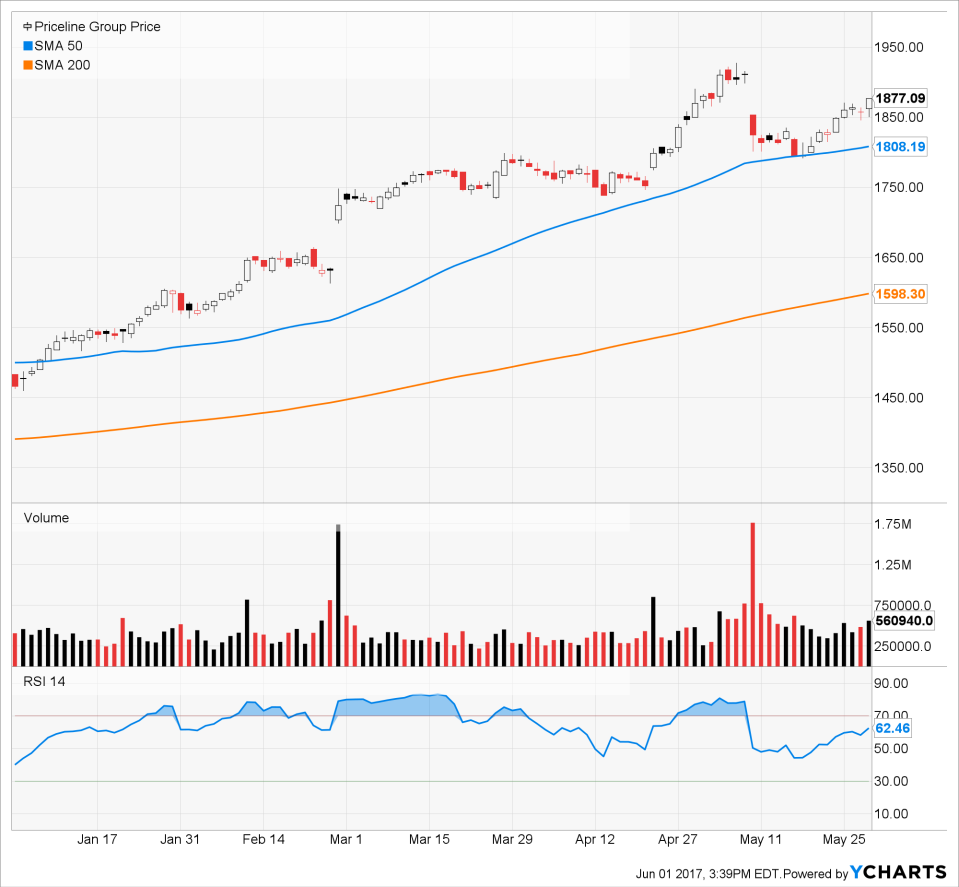

Following its first-quarter results, released after the market close on May 9, Priceline stock fell 4.5 percent to $1,824.77 on May 10, with volumes being over six times the average. Intraday, the stock touched a low of $1,801 and never managed to break above the opening high of $1,853.78 throughout the session. It may be noted that ahead of the results, on May 8, the stock hit an all-time high of $1,927.13, and the next day it scaled to a record closing high of $1,911.13.

Source: Y Charts

The negative reaction could be traced back to the mixed first-quarter results the company rang in, which gave a reason for taking profits. The online travel and related services provider reported first quarter non-GAAP net income per share of $9.88, more than $9.20 in the year-ago period and the consensus estimate of $8.82. Revenues rose 12.5 percent to $2.42 billion, shy of the $2.45-billion consensus estimate. For the second quarter, the company expects non-GAAP earnings per share of $13.30-$14, below the $15 per share consensus estimate.

Basing Around $1,800 Area

Over the next seven sessions following its May 10 pullback, the stock hit lows around the $1,800 mark in four sessions — May 11 ($1,800.71), May 17 ($1,793.60), May 18 ($1,791.40) and May 19 ($1,799.67). With the stock ably supported around the $1,800 area, a graveyard doji candle formed on May 18 and signaled the stalling of the downtrend and the beginning of an uptrend.

A graveyard doji candle is formed when the stock opens and closes near the day's low, suggesting the demand and supply are in balance. The pattern is usually formed at the bottom of a downtrend. In the near-term past, the area around $1,800 has served as support for the stock. For three consecutive sessions in April, on April 25 ($1,795.31), April 26 ($1,793.20) and April 27 ($1,800.28), the stock moved around this support region before taking a leg up.

The recovery seen after the post-earnings slump is expected to be tested, as the stock approaches its post-earnings-slump lows of $1,898.04. A break above the level could place the stock on track to retest its all-time highs. In the eventuality of the stock failing to break above the level, investors might have to brace for a reversal toward the support area around $1,800.

Joel Elconin contributed to this report.

Related Links:

Priceline Slapped With A ,000 Price Target Priceline Presents A Compelling Risk/Reward For Investors

4 Takeaways From Priceline's Q1

See more from Benzinga

Mixed Auto Sales Results For May Despite Heavy Holiday Promotion

Corporate Heavyweights Throw Their Weight Behind The Paris Agreement On Climate Change

© 2017 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Yahoo Finance

Yahoo Finance