RBA Discussed Rate Hike, Pledges Vigilance on Sticky Inflation

(Bloomberg) -- Australia’s central bank discussed the case to raise interest rates on Tuesday before deciding to maintain current settings at a 12-year high as policymakers try to balance sticky inflation against a weakening economy.

Most Read from Bloomberg

What to Know About the Deadly Flesh-Eating Bacteria Spreading in Japan

Stocks Rise After Solid US Industrial Production: Markets Wrap

Citi Pitches Money-Moving ‘Crown Jewel’ as Central to Revamp

Flesh-Eating Bacteria That Can Kill in Two Days Spreads in Japan

These Are the World’s Most Expensive Cities for Expats in 2024

The Reserve Bank held its cash rate at 4.35% for a fifth straight meeting and restated that it wasn’t “ruling anything in or out,” a signal that a hike isn’t out of the question. Many economists described the accompanying statement and subsequent press conference by Governor Michele Bullock as “hawkish.”

In response, the currency rose and the yield on policy-sensitive three year bonds climbed while money markets pared expectations for a rate cut by December to a roughly one-in-four chance, down from one-in-two.

“The path is really complex,” Bullock told reporters about the future direction of monetary policy. “The recent data have been mixed, but overall, they’ve reinforced the need to remain vigilant to the upside risks to inflation.”

The central bank’s goal is to bring consumer prices back within its 2%-3% target while holding onto significant job gains made since the pandemic. Bullock reiterated that the economy was still on a narrow path, while adding that the track “does appear to be getting a bit narrower.”

A comparison of Tuesday’s statement against May’s release showed a change in the RBA’s language around inflation. It described CPI as “above target” and “proving persistent” compared with “high” and “falling more gradually than expected” previously. The line “will do what is necessary” to return inflation to target was also reintroduced.

The central bank next meets Aug. 5-6, when it will also release a quarterly update of economic forecasts in the Statement on Monetary Policy. Ahead of that, policymakers will get second-quarter inflation data on July 31, which Bullock today described as important because it gives a comprehensive overview of prices, particularly in the services sector.

“The RBA remains a reluctant hiker,” said Su-Lin Ong, chief economist for Australia at Royal Bank of Canada. “The RBA is wisely keeping maximum optionality as it awaits key second-quarter CPI and further labor market data and updates its macro forecasts for the August meeting and SoMP. It will continue to jawbone until then.”

When asked if the case for a hike has increased, Bullock said it hasn’t, though recent data have made the board “alert to upside risks.”

“I really genuinely feel that we’re in quite a complex situation here,” Bullock said. “We’ve got balancing risks on both sides. Earlier on when we were raising rates, it was obvious what we had to do, it’s not so obvious now.”

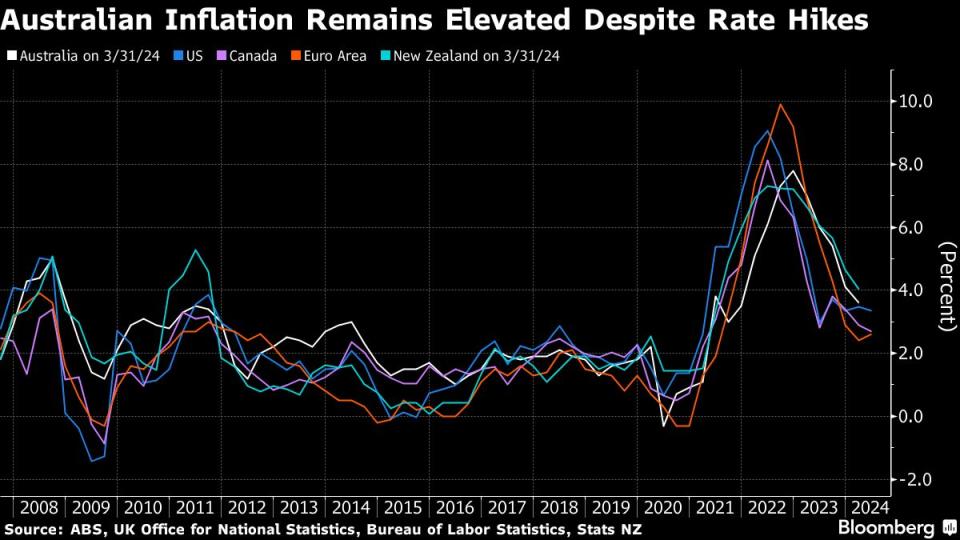

That assessment puts it on the hawkish side of a diverging global policy outlook. The Bank of Canada lowered its benchmark rate by 25 basis points earlier in June, making it the first Group of Seven central bank to kick off an easing cycle. The European Central Bank soon followed, while the Swiss National Bank made its move to cut in March.

By contrast, the Federal Reserve pared back projections for monetary easing and policymakers from Norway to New Zealand are also signaling — or likely to — that they’re still not sufficiently convinced about disinflation to start cutting. In the UK, a looming election and lingering price pressures are adding to the case for the Bank of England — which meets on Thursday — to wait at least until August before lowering rates.

Bullock has repeatedly pushed back against speculation of near-term easing, reflecting forecasts that inflation will only return to target in late 2025. When asked on Tuesday if a rate cut was on the table at the meeting, she said it wasn’t discussed.

“The governor sounded more worried about inflation than the labor market,” said Josh Williamson, an economist at Citigroup Inc. “In an absolute sense, the RBA is a dovish central bank, reluctant to hike despite sticky inflation and a tight labor market. But relative to its peers, the RBA will be hawkish if it continues to keep policy rates unchanged while global central banks embark on an easing cycle.”

Williamson believes that financial markets are probably “under-pricing” the likelihood of an August rate hike.

--With assistance from Matthew Burgess and Garfield Reynolds.

(Updates markets, adds comments from economists.)

Most Read from Bloomberg Businessweek

Google DeepMind Shifts From Research Lab to AI Product Factory

Coke—and Dozens of Others—Pledged to Quit Russia. They’re Still There

Trump’s Planned Tariffs Would Tax US Households, Economists Warn

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance