Australia’s Next Door Neighbor Shows RBA What Restrictive Means

(Bloomberg) -- As Australia’s central bank contemplates whether its monetary policy is “sufficiently restrictive,” a glance across the Tasman Sea might prove instructive.

Most Read from Bloomberg

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

Archegos’ Bill Hwang Convicted of Fraud, Market Manipulation

NATO Singles Out China Over Its Support for Russia in Ukraine

New Zealand’s Reserve Bank on Wednesday unexpectedly opened the door to interest rate cuts, with its tighter policy stance curbing demand across the economy and boosting confidence that inflation will return to target. By contrast, traders see a real risk that the Reserve Bank of Australia will raise rates at its next decision on Aug. 6 as inflation is stickier than anticipated.

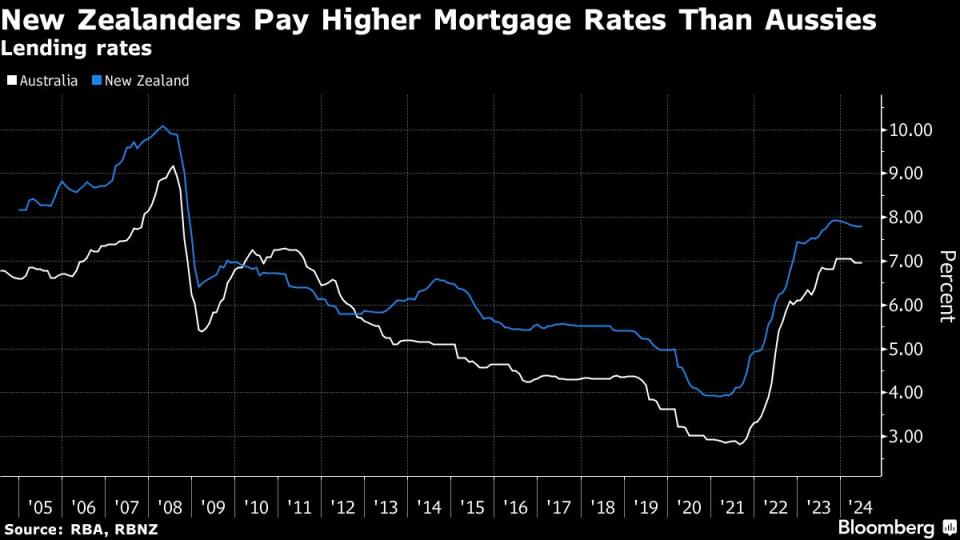

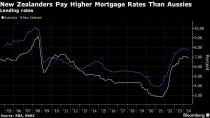

The two central banks plotted different courses during the post-pandemic inflation battle. The RBA moved cautiously on the way up, taking its cash rate to 4.35% in November 2023 from 0.1% in 2022 for a total of 4.25 percentage points of hikes. The RBNZ moved sooner, faster, and hiked by 5.25 points.

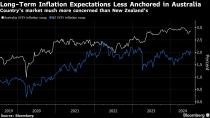

The following charts show how monetary policy has gained more traction in New Zealand.

While the consensus among economists is still that the RBA will hold rates at 4.35% this year, some believe a hike cannot be ruled out, especially if a second-quarter inflation report on July 31 surprises on the upside.

Australian households “will need to grapple with another interest rate hike,” said Josh Williamson, economist at Citigroup Inc. in Sydney. “This could take the wind out of the consumer in the second half.”

One problem for the RBA is that inflation expectations in Australia haven’t remained as anchored as they have in New Zealand. The minutes of the RBA’s June board meeting last week showed policy makers are “closely monitoring” longer-term inflation expectations, saying a drift higher would require “significantly higher interest rates.”

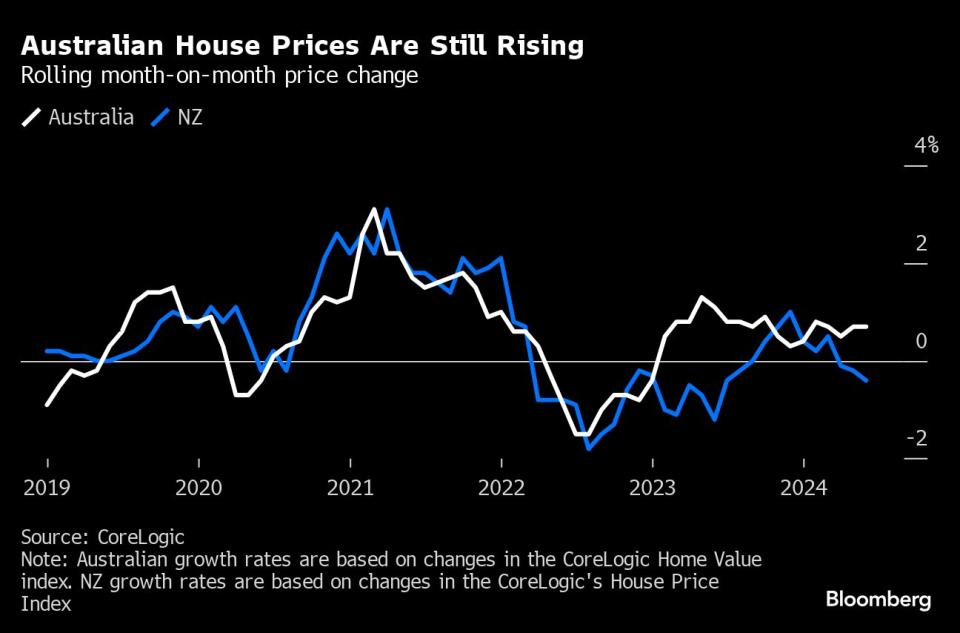

The RBNZ’s policy tightening has taken the wind out of New Zealand’s housing market, where prices declined for the third straight month in June after falling for most of last year. Home-building costs in the country dropped for the first time in at least 12 years in the June quarter.

In Australia, home prices have been rising since February 2023, with bellwether Sydney at a record high.

An RBA rate rise “could certainly slow demand and signal to the market that interest rates are not yet at peak or at the very least, are likely to take longer to reduce,” said Eliza Owen, head of research at CoreLogic Inc. She estimates another rate hike would push monthly mortgage repayments to over A$4,000 ($2,700) on current median dwelling values.

The RBA describes Australia’s labor market as still tight, though some leading indicators such as job vacancies and applications per job ad are pointing to slack ahead.

The unemployment rate in New Zealand, while still low, has risen relatively sharply over the past year in a sign monetary policy is having more impact there.

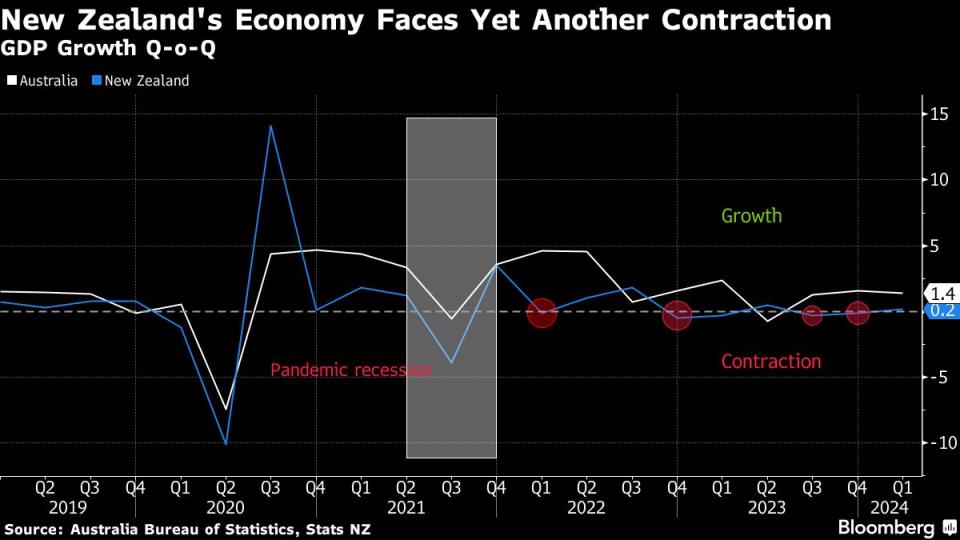

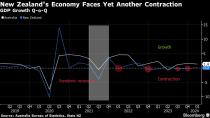

New Zealand has suffered a double dip recession and the economy likely contracted again in the three months through June, which would mean gross domestic product has declined in five of the past seven quarters. Excluding the pandemic contraction, Australia has not had a recession since the 1990s.

In fact, the RBA assesses that aggregate demand in Australia continues to exceed the economy’s capacity to supply. By contrast, the RBNZ said Wednesday there is “now more evidence of excess productive capacity emerging” in New Zealand.

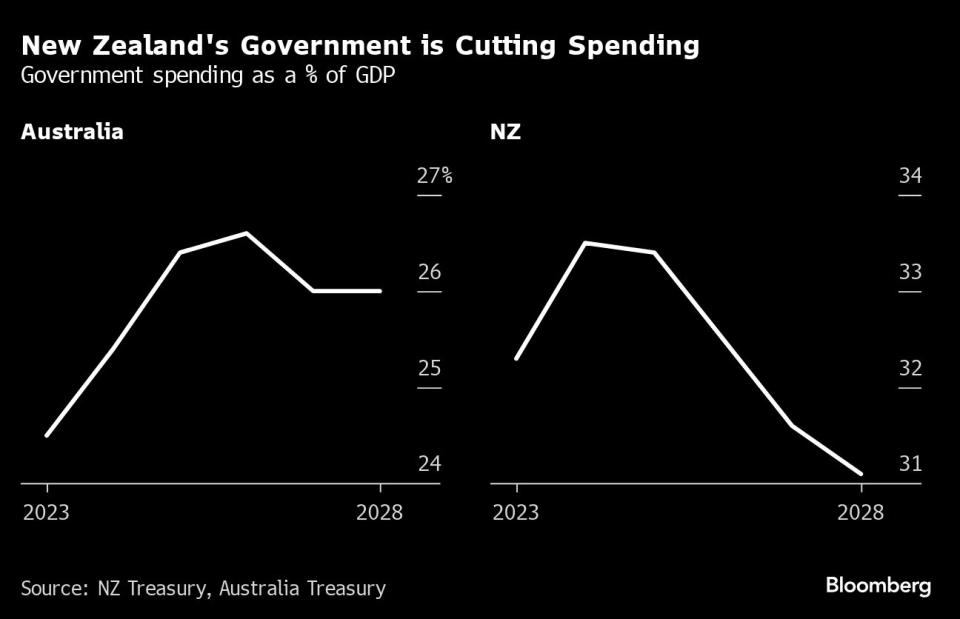

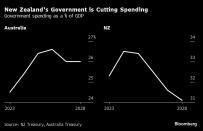

They say monetary policy needs fiscal support. That’s more the case in New Zealand than it is in Australia. Net government spending in Australia is seen boosting aggregate demand by a chunky 2.2 percentage points of GDP in the year ending June 2025, driven by big-spending state governments, according to Westpac Banking Corp.

“Fiscal policy in Australia, mostly – but not exclusively – at the state government level has not helped,” said Stephen Miller, investment strategist at GSFM in Sydney. “With excess demand a primary driver of inflation, that government contribution is problematic.”

New Zealand’s government, on the contrary, is focused on reducing spending as it forecasts a return to budget surplus in 2028.

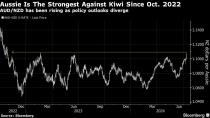

The Australian dollar is at its highest level against the Kiwi since 2022 due to the diverging monetary policy outlooks. Money markets now see at least two RBNZ rate cuts this year, with a 50/50 chance that the easing cycle begins as soon as August. In Australia, swaps traders are pricing a roughly one-third chance of a rate hike in August.

“Amazing to think that the RBA could possibly hike in August, and the RBNZ could possibly cut,” said Andrew Ticehurst, a strategist at Nomura Holdings Inc. in Sydney, who sees the Aussie further strengthening against the Kiwi this year. “Neither are our current base case, but that is the risk, and the contrast is striking.”

--With assistance from Garfield Reynolds and Matthew Burgess.

Most Read from Bloomberg Businessweek

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

Ukraine Is Fighting Russia With Toy Drones and Duct-Taped Bombs

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance