Australia’s Unemployment Rate Drops to 4% as Hiring Persists

(Bloomberg) -- Australian unemployment dipped last month and job gains exceeded estimates, highlighting the resilience of the country’s labor market to elevated interest rates and high immigration.

Most Read from Bloomberg

Apple to ‘Pay’ OpenAI for ChatGPT Through Distribution, Not Cash

Hunter Biden Was Convicted. His Dad’s Reaction Was Remarkable.

Chinese Trader’s $20 Million Pile of Russian Copper Goes Missing

Gavin Newsom Wants to Curb a Labor Law That Cost Businesses $10 Billion

US Inflation Broadly Cools in Encouraging Sign for Fed Officials

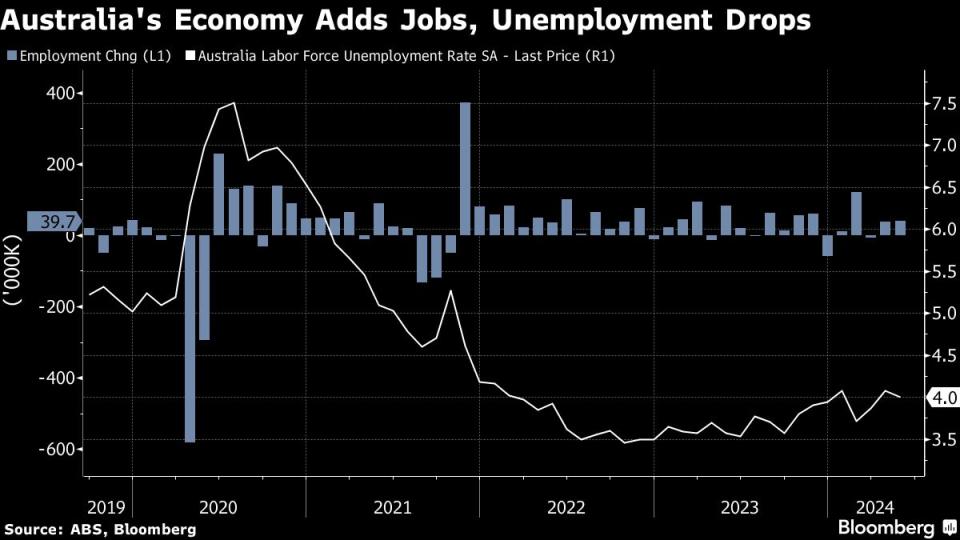

The economy added 39,700 roles — driven by full-time jobs — versus a forecast 30,000 gain, official data showed Thursday. The jobless rate edged down to 4% in May from 4.1%, driven by a large cohort who had been waiting to start work in the previous survey, the ABS said.

Money markets lowered the chance on a rate cut this year to about 30%, with traders seeing the first easing in May 2025. The yield on the policy-sensitive three-year government bond pared an overnight drop while the currency briefly erased an intraday decline before resuming losses.

“Australia’s labor market remains tight, with low unemployment and strong job creation helping households navigate an otherwise challenging economic environment,” said Callam Pickering, economist at global job site Indeed. The “figures appear consistent with the Reserve Bank’s expectations.”

The report comes days before the RBA’s June board meeting, when it is widely expected to hold rates at a 12-year high of 4.35%. The RBA describes its current policy setting as restrictive and one that has already hit consumer spending, while helping cool still-elevated inflation.

The labor market is seen as a bright spot in Australia, which together with other advanced economies has experienced surprisingly low headline unemployment despite synchronized tightening cycles at a number of central banks.

The ABS highlighted that there are now almost 600,000 unemployed people, almost 110,000 less than in March 2020, just prior to the pandemic.

What Bloomberg Economics Says...

“We see the RBA remaining hawkish until rising unemployment and cooling inflation enable a pivot to rate cuts late this year”

— James McIntyre, economist.

For the full note, click here

In a statement after the data, Treasurer Jim Chalmers described the labor market as “resilient” and “an important source of strength in difficult times.”

Last month, both the RBA and Treasury predicted the jobless rate would stay low despite restrictive policy. The RBA expects unemployment to rise to 4.3% by mid-2025 while the government’s budget sees it climbing to 4.5% by then.

“The RBA is likely to be quietly pleased with today’s employment data,” said Devika Shivadekar, economist at consultancy RSM Australia. “The RBA is expected to continue its strategy of cautious non-action.”

Australia’s Job Market Loosens Even as Unemployment Sticks Low

Diana Mousina, deputy chief economist at AMP Ltd., said the pace of jobs growth isn’t sufficient to keep up with the increase in the labor force because of high immigration.

Indeed, Thursday’s data showed annual jobs growth cooled to 2.5% in May from 3.9% a year earlier.

Separate data from the ABS on Thursday showed Australia’s population grew 2.5% to just shy of 27 million in 2023.

Today’s report also showed:

Underemployment held at 6.7% and underutilization was steady at 10.7%

The economy added 41,700 full-time roles while part-time fell 2,100

The participation rate was unchanged at 66.8% after April was revised up

The employment to population ratio remained at 64.1%

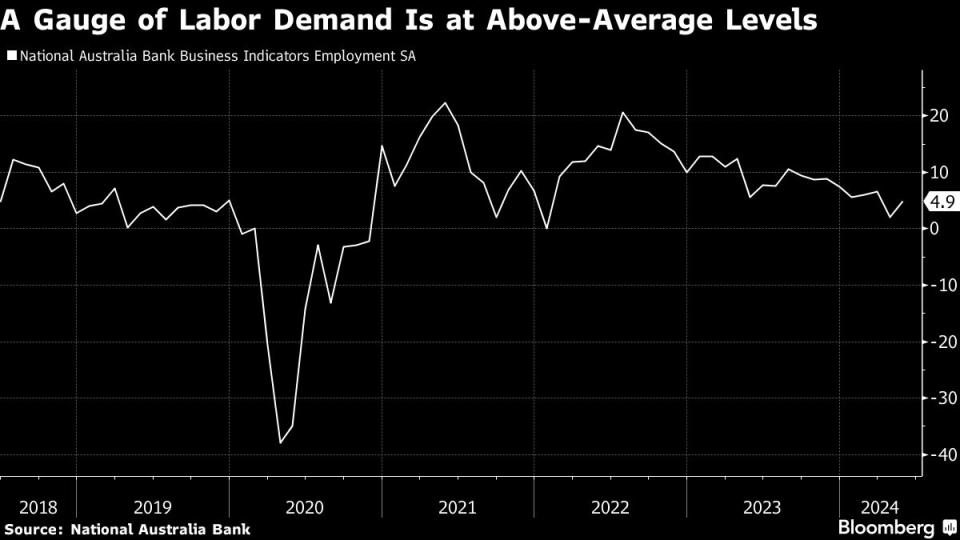

“The employment-to-population ratio and participation rate both continue to be much higher than their pre-pandemic levels,” Bjorn Jarvis, ABS head of labor statistics, said in a statement. “Together with elevated levels of job vacancies, this suggests the labor market remains relatively tight.”

--With assistance from Tomoko Sato and Michael G. Wilson.

(Adds comments from economists.)

Most Read from Bloomberg Businessweek

Israeli Scientists Are Shunned by Universities Over the Gaza War

The World’s Most Online Male Gymnast Prepares for the Paris Olympics

China’s Economic Powerhouse Is Feeling the Brunt of Its Slowdown

Grieving Families Blame Panera’s Charged Lemonade for Leaving a Deadly Legacy

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance