Australian Bonds Slump as Traders Boost Bets on RBA Rate Hike

(Bloomberg) -- Policy-sensitive Australian bonds have slumped to their lowest in seven months as markets increased bets on another interest-rate hike by the central bank.

Most Read from Bloomberg

Bolivia’s President Arce Swears in New Army Chief After Coup Bid

SpaceX Tender Offer Said to Value Company at Record $210 Billion

China’s Finance Elite Face $400,000 Pay Cap, Bonus Clawbacks

YouTuber Dr Disrespect Was Allegedly Kicked Off Twitch for Messaging Minor

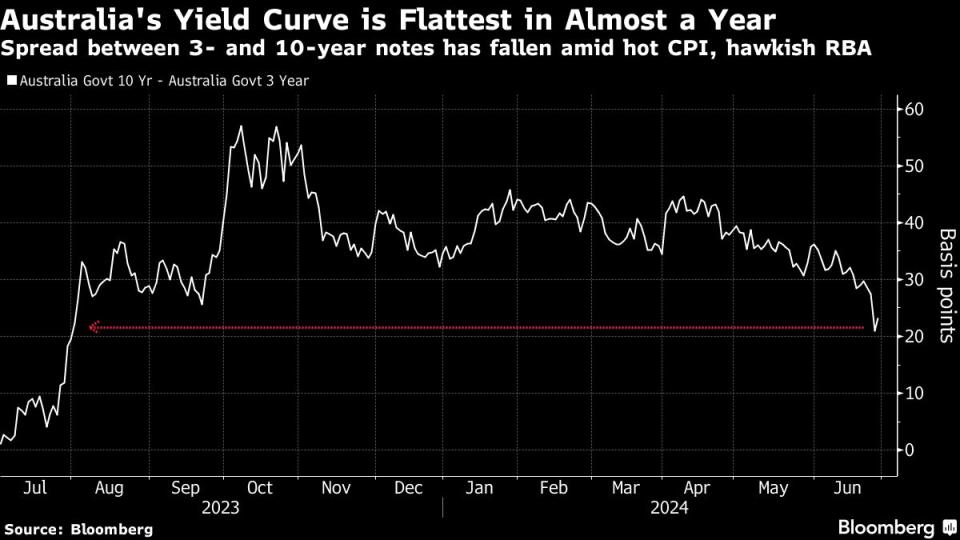

The yield on three-year debt climbed to 4.2% on Thursday, the highest since Nov. 27, extending a rise after a report showed Australia’s inflation accelerated in May. That’s after their discount to the benchmark 10-year shrank to the narrowest in almost a year on Wednesday.

The tightening spread shows traders are taking the risk of a hike more seriously, said Kenneth Crompton, a senior fixed-income strategist at National Australia Bank Ltd. in Sydney.

“An August hike is now 40% priced, which is near to where we’d judge fair value on the risk of a move,” he said.

Rate-hike bets have increased this month as the Reserve Bank of Australia said it discussed tightening further at its June meeting, with inflation running above its target and proving persistent. The May reading caused traders to price an even chance of a rate hike in August, from prior wagers on easing policy by year-end, according to swaps data compiled by Bloomberg.

Deutsche Bank AG on Wednesday shifted its position and now expects a hike at the RBA’s next meeting, saying Australia’s underlying inflation is intolerably high.

More economists may follow suit, said Andrew Ticehurst, a strategist at Nomura Australia Ltd. in Sydney.

“Such a material surprise” like the May inflation reading “often reverberates through markets for a number of days,” Ticehurst said. The gap between three- and 10-year bond yields will probably continue to narrow in the near term as market players adjust their bets accordingly, he said.

Most Read from Bloomberg Businessweek

The FBI’s Star Cooperator May Have Been Running New Scams All Along

How Glossier Turned a Viral Moment for ‘You’ Perfume Into a Lasting Business

How Jeff Yass Became One of the Most Influential Billionaires in the 2024 Election

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance