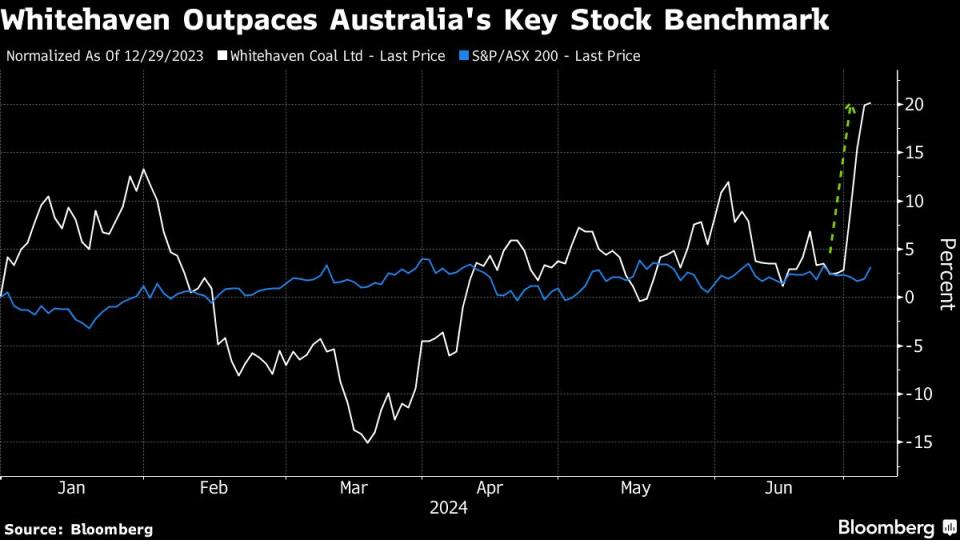

Australian Coal Stocks Rally on Anglo American Mine Explosion

(Bloomberg) -- Australian coal stocks are headed for their best week in years after a fire shut down one of country’s major mines, with Morgan Stanley seeing further upside for the commodity.

Most Read from Bloomberg

Kamala Harris Is Having a Surprise Resurgence as Biden’s Campaign Unravels

Singapore Couples Are Marrying Earlier to Buy Homes, Leading Some to Regret

Biden’s Fourth of July Shrouded by Pressure to Drop 2024 Bid

Newsom Shocks California Politics by Scrapping Crime Measure

Whitehaven Coal Ltd. is poised for a 17% weekly advance, its best since October 2022, with Sydney-listed Coronado Global Resources Inc. and Yancoal Australia Ltd. posting similar gains. Coking coal futures in Singapore hit a two-month high earlier this week after a fire at Anglo American Plc’s biggest metallurgical coal project in Australia halted production.

The fire “may help bring about an earlier tightening of the market balance,” Morgan Stanley analysts including Sara Chan wrote in a July 3 note, adding they expect about 15% upside to year-end coking coal prices. “We see a near-term opportunity in coking or met coal, especially after the recent share price pullback.”

Read: Anglo Coking-Coal Mine Blaze to Have Months-Long Impact

The blaze at Anglo’s Grosvenor mine, which started after a methane explosion on Saturday, took roughly 1% of seaborne coal out of the market and could take months to extinguish. It also coincided with the London-based miner’s plans to sell the asset as part of a turnaround plan.

“This unfortunate event does help competitors as they can continue to produce met coal,” said Jamie Hannah, Sydney-based deputy head of investments and capital markets at Van Eck Associates Corp., which holds Whitehaven and Coronado shares. Whitehaven has expanded their operations in met coal, “so this will no doubt play to their short-term advantage,” he said.

Still, “until we understand the issues at the Anglo mine, it’s too difficult to predict the medium to long-term impact,” he added.

Most Read from Bloomberg Businessweek

Dragons and Sex Are Now a $610 Million Business Sweeping Publishing

For Tesla, a Smaller Drop in Sales Is Something to Celebrate

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance