Auto-enrolment pensions: what are they and how do they work?

Pension auto-enrolment rules were introduced by the Government in 2012 to get more people saving for their retirement through a workplace pension.

It means that eligible workers are now automatically enrolled into a workplace pension scheme, with employees and employers paying a combined minimum contribution of 8pc.

Previously, it was up to workers to decide whether they wanted to join their employer’s pension scheme.

The aim is that more people will start saving for their retirement at a younger age, giving them a larger income in their twilight years.

Telegraph Money explains how auto-enrolment pensions work, the eligibility criteria and what’s involved in the enrolment process.

What are auto-enrolment pensions?

Auto-enrolment pensions refer to the workplace pension scheme that UK employers are legally required to set up.

Employers must automatically enrol their eligible workers into their workplace pension scheme, and make their own contributions on top.

Auto-enrolment pensions are usually defined contribution pensions.

This means the amount you receive in retirement depends on how much you and your employer have contributed to your pension pot, and how well the investments have performed.

How do they work?

When you start a new job, your employer will automatically enrol you into its workplace pension scheme if you meet the eligibility criteria (more on that below).

Both you and your employer will need to pay in a percentage of your salary each month.

You’ll only pay on the proportion of your annual earnings over £6,240. The minimum contribution is set at 8pc, which is usually split as your employer paying 3pc, while you pay 5pc.

However, your employer may choose to pay more than this, and you can also increase your own contribution.

Your pension contribution will automatically be deducted from your salary, so you won’t need to make any transfers to deposit the money into your pension.

A bonus is that you’ll get tax relief on what you pay in, boosting your pot further.

If you’re a basic-rate taxpayer, you’ll get 20pc tax relief. This means that to make a £100 contribution, you’d only need to pay in £80 and the Government would make up the remaining £20.

If you’re a higher-rate taxpayer, you’ll get 40pc tax relief and for additional-rate taxpayers, it’s 45pc.

However, you’ll need to claim the extra tax relief above the standard 20pc by either submitting a self-assessment tax return, or in some cases you may be able to call or write to HM Revenue & Customs to make the claim.

What’s the eligibility criteria?

You must be automatically enrolled into your workplace pension scheme if you work full or part-time and you:

Work in the UK

Aren’t already in a suitable workplace pension scheme

Are at least 22 years old and under state pension age (currently 66 for men and women, but rising to 67 between 2026 and 2028)

Earn more than £10,000 a year for the 2024-25 tax year

If you meet these conditions and are on a short-term contract or maternity, adoption or carer’s leave, you’ll still be eligible.

Anyone earning less than £10,000 but more than £6,240 for the 2024-25 tax year doesn’t need to be enrolled into a scheme, but you can ask to join.

You won’t be enrolled into a pension scheme if you’re self-employed.

If you don’t want to pay into a workplace pension, you can also opt out of auto-enrolment at any time.

What contributions do you and your employer make?

As a minimum, the contribution from you and your employer must add up to 8pc of your pre-tax salary.

Of this, at least 3pc must be from your employer, so you will need to pay a minimum of 5pc.

However, many employers will pay higher contributions, which means your minimum contribution could be less.

For example, if your employer pays in 5pc, you will only need to pay in 3pc.

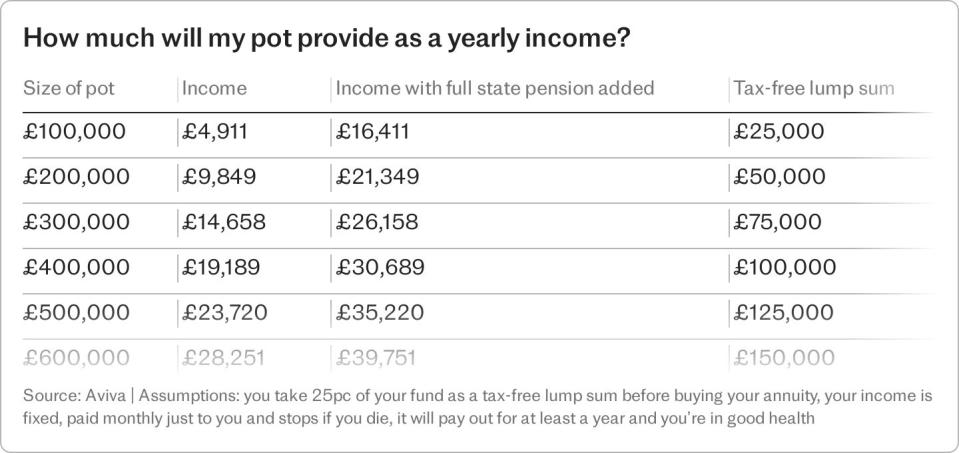

But it’s a good idea to pay in as much as you can, as many experts suggest that 8pc pension contributions are unlikely to leave retirees with enough money to fund a comfortable retirement.

The minimum contribution applies to anything you earn over £6,240 and up to £50,270 for the 2024 to 2025 tax year. These are your qualifying earnings.

If you were earning £25,000, your minimum contribution would be based on £18,760 (£50,270-£6,240). That means at least £1,501 would be paid into your pension (£18,760 x 8pc).

The more you pay into your pension pot and the younger you start, the longer your money has to grow and the more you will have to live off in retirement.

Enrolment process for employees

Your employer must enrol you into a pension scheme on your first day of employment, provided you meet the eligibility criteria.

Your employer must also inform you of how auto-enrolment works and what your choices are.

Once enrolled, both you and your employer will start making contributions.

Make sure you’re clear on your employer’s pension scheme and the contribution they’ll make – while some employers will stick to the minimum 3pc contributions, some will be much more generous, and may opt to match your own contributions up to a certain amount.

Making the most of perks like this could unlock a way to easily double your contributions.

If you would prefer to opt out of auto-enrolment, you will need to get an opt-out form from your pension provider.

Your employer will be able to give you the details. You must then return this form to your employer, not the pension provider.

You can opt out at any time.

But your payments will only be refunded in full if you opt out within the first month.

After this, payments you’ve made will stay in your pension pot until retirement. You can access your pension from age 55, rising to 57 in 2028.

If you are thinking about opting out, it’s worth considering the impact this will have on your retirement savings; stopping payments even for a short time could mean missing out on thousands in your pension savings.

Enrolment process for employers

If you run a business and are hiring employees, you’ll need to choose and set up a workplace pension scheme.

This is even the case if you hire a nanny, as you become their employer. You can get help on The Pensions Regulator’s website or speak to an independent financial adviser or your accountant.

Your next step is to assess employees to see if they are eligible for the scheme. You will need to work out how much each employee earns and how old they are, so you can work out the cost of contributions.

Employers are required to inform their workers about auto-enrolment before they start enrolling them. In some cases, auto-enrolment can be postponed for up to three months for some or all of your workers.

This can be beneficial for employers with temporary staff who will be leaving within three months or those who need longer to set up a pension scheme. But staff must be informed of this postponement.

Employer compliance

Once an employer has set up a workplace pension scheme and enrolled eligible staff, they are required to assess non-eligible employees each pay period. As soon as a non-eligible employee qualifies, they must be automatically enrolled into the workplace pension scheme.

Employers must also check that pension contributions are paid each pay period. Any requests from employees to join the scheme must be dealt with within one month of receiving the request.

Additionally, employers are required to inform The Pensions Regulator (TPR) that they’ve met their auto-enrolment duties and declare their compliance online here.

Every three years, an employer’s workforce must be reassessed for re-enrolment and a declaration of compliance resubmitted. Any employees who previously opted out or left the scheme will be re-enrolled.

Employers that don’t meet these regulations could be fined.

Benefits and options

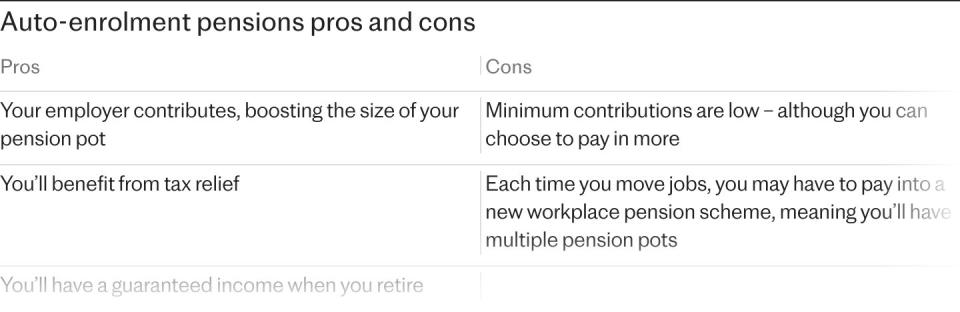

Auto-enrolment essentially gives you free money to help you boost your retirement income. But if you’re struggling financially or already have a retirement plan in place, you might prefer to opt out – at least, for now.

Weigh up the pros and cons to help you decide.

If you’re looking for an alternative way to save for retirement, you could consider a lifetime Isa, a cash or stocks and share Isa, or a self-invested personal pension (Sipp).

However, it can be worth speaking to an independent financial adviser to discuss your options first.

Yahoo Finance

Yahoo Finance