Auto Stock Roundup: AAP's Impressive Q3 Show, ALV's 3-Year Targets & More

Recalls are rampant in the auto industry across the globe and a steep rise has been noticed in recent years, according to the National Highway Traffic Safety Administration. Last week, auto biggies like Stellantis STLA, Toyota TM and Volkswagen VWAGY issued separate recalls to fix multiple defects. Meanwhile, Advance Auto Parts AAP reported stellar third-quarter 2021 results and lifted the full-year outlook. Autoliv ALV also grabbed eyeballs as it set three-year financial targets.

The European Automobile Manufacturers Association (“ACEA”) released data for passenger car registrations made in October 2021. In a telling sign that the chip shortage continues to wreak havoc on the auto industry, new car registrations tailed off 30.3% year over year to 665,001 units, marking the fourth straight monthly decline. Most of the European Union (EU) markets saw double-digit declines. Registrations in major markets like Spain, Germany, France, and Italy plummeted 20.5%, 34.9%, 30.7%, and 35.7%, respectively. Despite the recent sales drop amid the global chip crunch, cumulative volumes over the first 10 months of 2021 totaled 8.2 million units, up 2.2% year over year.

Last Week’s Key Stories

1. Advance Auto reported adjusted earnings of $3.21 per share for third-quarter 2021 (ended Oct, 2021), increasing 21.6% from the prior-year figure. The reported figure also beat the Zacks Consensus Estimate of $2.78 on higher-than-expected comps growth. For the third quarter, comparable store sales witnessed 3.1% growth, outpacing the consensus mark of 0.2%. The auto parts retailer generated net revenues of $2,621.2 million, topping the Zacks Consensus Estimate of $2,564 million and rising 3.1% from the year-ago reported figure.

Advance Auto has raised its full-year 2021 view. It now estimates full-year net sales in the band of $10.9-$10.95 billion, up from the previous projection of $10.6-$10.8 billion. Comparable store sales growth and adjusted operating income margin are now envisioned in the range of 9.5-10% and 9.4-9.5%, higher than the previous projection of 6-8% and 9.2-9.4%, respectively. AAP expects free cash flow of a minimum of $725 million, up from the previous forecast of a minimum of $700 million.

2. Autoliv set its three-year (2022-2024) financial targets. The company expects to outgrow annual light vehicle production by 4% between 2022 and 2024. Post 2024, sales are envisioned to grow organically by 4-6% per year. The auto equipment provider outlined other key agendas, including its aim for sustainable growth, improvement in efficiency targeting a 12% adjusted operating margin from 2022 to 2024, commitment toward shareholder value creation and cash conversion of at least 80% as well as a new stock repurchase program of up to $1.5 billion over the next three years.

In a separate development, Autoliv and SSAB initiated collaborative research to develop fossil-free steel components for automotive safety products such as airbags and seatbelts. The partnership aims for a new technology that will replace the traditional coking coal with hydrogen and be the world's first fossil-free steelmaking technology with a zero-carbon footprint. Investors should note that ALV is committed to becoming carbon neutral by 2030 and aims for net-zero missions across the supply chain by 2040.

3. Stellantis issued a recall for more than 246,000 Ram Heavy Duty and Chassis Cab trucks, mainly in North America, to replace the fuel pumps that can lead to stalling or failure of the engine due to wear. The initiative covers 2019 and 2020 truck models equipped with 6.7-liter Cummins diesel engines.

According to reports, customer complaints about fuel pump failures and hefty repair bills prompted an investigation by the National Highway Traffic Safety Administration. Stellantis, however, claimed that the recall decision was made before the announcement of the inquiry. Owners can get the pumps repaired from dealers at zero cost and will be notified by next month. STLA currently sports Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

4. Volkswagen is set to recall more than 240,000 Audi vehicles in the United States and Canada. The affected ones include certain Audi A4, RS5, A5, S4, and S5 models built between 2017 and 2020.

Volkswagen notified that an electric cable defect could disable the passenger airbag. The possibility of a faulty cable used in the passenger occupant detection system may put the vehicle’s software at risk of misdiagnosing a problem and disabling the passenger airbag, thereby increasing the chances of injury in a crash.

To fix the problem, dealers will replace the cable and the heating map or the entire seat cover. Letters notifying the same to owners will be sent out starting Jan 7, 2022. The current recall is an expansion of the same problem faced in 2019. Vehicles repaired then will have to be fixed again.

5. Toyota is recalling more than 227,400 Camry sedans that stand the risk of suddenly losing the power assist in the brake system. The recall initiative covers certain 2018 and 2019 midsize sedans models, especially in North America.

Toyota stated that there can be premature wear in some brake system components. The failure of power assistance will not hamper the operation of the brakes. However, it will make the driver more prone to crash. Owners of recalled cars will be notified by mid-January 2022. The dealers will inspect a vacuum pump and repair or replace it in the affected vehicles.

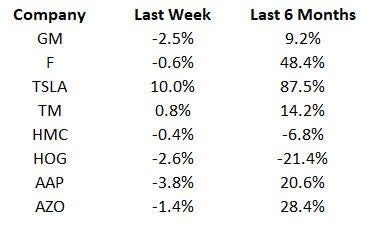

Price Performance

The following table shows the price movement of some of the major auto players over the past week and six-month period.

Image Source: Zacks Investment Research

What’s Next in the Auto Space?

Industry watchers will keep a tab on October commercial vehicle registrations in the EU, likely to be released by the ACEA this week. Also, stay tuned for updates on how automakers will tackle the semiconductor shortage and make changes in business operations.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

Autoliv, Inc. (ALV) : Free Stock Analysis Report

Advance Auto Parts, Inc. (AAP) : Free Stock Analysis Report

Volkswagen AG (VWAGY) : Free Stock Analysis Report

Stellantis N.V. (STLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance