Automated Guided Vehicle (AGV) Market Analysis 2024-2030 Featuring Profiles of Swisslog, Dematic, Bastian Solutions, Daifuku Co, JBT, and More

Global Automated Guided Vehicle Market

Dublin, June 06, 2024 (GLOBE NEWSWIRE) -- The "Automated Guided Vehicle Market Size, Share & Trends Analysis Report By Vehicle Type, By Navigation Technology, By Application, By End-use Industry, By Component, By Battery Type, By Mode Of Operation, By Region, And Segment Forecasts, 2024 - 2030" report has been added to ResearchAndMarkets.com's offering.

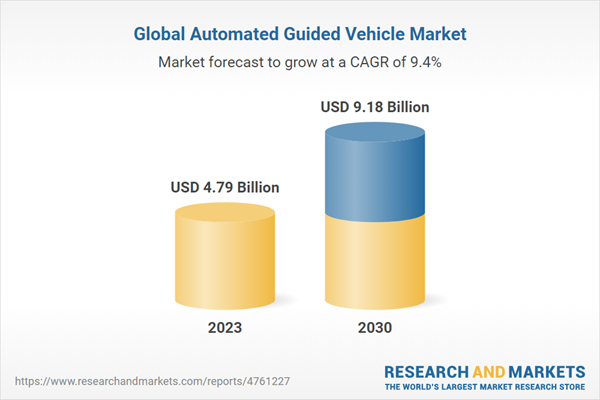

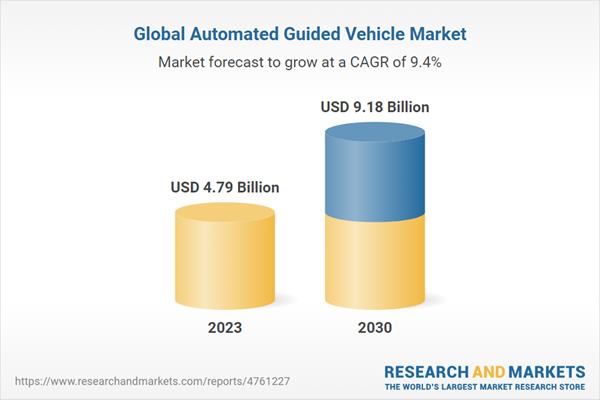

The global automated guided vehicle market is expected to reach USD 9.18 billion by 2030, registering a CAGR of 9.4% from 2024 to 2030. Automated guided vehicles (AGVs) have transformed the way materials can be moved within the manufacturing and distribution facilities. In a production environment where several operations are carried out simultaneously, these vehicles ensure a predictable and reliable transfer of raw materials and manufactured products from one point to another within the facility, thereby eliminating any potential disruption in production.

These vehicles can operate safely around structures, machinery, and employees, as they are equipped with accessories, such as camera vision and LiDAR sensors, which help detect junctions, identify floor signs, and avoid collisions with any obstacle. For instance, in November 2021, Quanergy Systems, Inc., a U.S.-based company that offers an AI-powered LiDAR platform, launched the new M1 Edge 2D LiDAR sensors for automation. The newly launched LiDAR sensor is light in weight, broad 360, with a sensing capability of up to 200 meters used in mobile robotics, AGVs, warehouse logistics applications, and port automation.

Several manufacturing plants and warehouses deploy material handling equipment for various activities, such as locating stock, picking orders, and moving products and raw materials. Transportation and logistics firms are mainly focusing on deploying such equipment to boost the efficiency of their operations in line with the growing demand for their services. For instance, in March 2023, MasterMover Ltd, a prominent manufacturer of electric tug and tow solutions, announced a collaboration with BlueBotics, a navigation, robotics, and industrial automation company.

The partnership intends to offer best-in-class Autonomous Navigation Technology (ANT) technologies for MasterMover's range of AGVs. In February 2021, Scott (Transbotics Corporation), a prominent solution provider for AGVs, partnered with KUKA AG, a German manufacturer of robots, to coordinate the industrial robots of KUKA AG into material handling systems. Further, these robots would also benefit the warehouse team in assembling, packaging, welding, storing, and shipping. Also, material handling solutions are used to increase transportation efficiency, decrease physical damage to the material, and reduce overheads by limiting the number of employees.

The AGV market is witnessing a progressive switch from lead-acid to lithium-ion batteries. Lithium-ion batteries offer several advantages over lead-acid batteries. They tend to be lighter and more compact. They can charge faster, provide longer runtimes, and support more charge cycles. Hence, they are ideal for AGVs, as they need not be charged frequently during operating shifts or in 24x7 operating environments, and AGVs running on lithium-ion batteries can offer higher round-trip efficiencies. For instance, in March 2021, Nissan Motor Co., Ltd, a global manufacturer of automobiles, buses, and trucks, stated that they use lithium-ion batteries to power their automated guided vehicles, which no longer need a worker to remove the battery and plug them in it charges faster. These batteries let AGVs last longer and bring significant innovations to their warehouse.

Automated Guided Vehicle Market Report Highlights

The unit load carrier segment is expected to grow at the fastest CAGR from 2024 to 2030 owing to its ability to handle multiple items simultaneously, reducing the number of trips required and, potentially, handling costs

The natural navigation segment is expected to register the fastest CAGR over the forecast period as it enables businesses to easily modify and expand the guide path of the AGV

The assembly segment is expected to grow at the fastest CAGR over the forecast period as assembly line AGV are replacing traditional mechanical production lines

The manufacturing segment dominated the market in 2023 and accounted for a revenue share of over 76%. The growing adoption of automated guided vehicles across various industries can be attributed to the benefits offered by AGVs in terms of productivity, safety, and accuracy

The service segment is predicted to foresee significant growth in the coming years. This growth can be attributed to the rising demand for various services, which include preventive and corrective maintenance, vehicle and software health check, and training employees directly or indirectly with the operation of AGVs

The AGV market in Europe is expected to witness significant growth over the forecast period. Rising investments in the manufacturing sector's technological advancement are expected to improve the AGV market in Europe

Key Attributes

Report Attribute | Details |

No. of Pages | 213 |

Forecast Period | 2023-2030 |

Estimated Market Value (USD) in 2023 | $4.79 Billion |

Forecasted Market Value (USD) by 2030 | $9.18 Billion |

Compound Annual Growth Rate | 9.4% |

Regions Covered | Global |

Key Topics Covered

Chapter 1. Automated Guided Vehicle Market: Methodology and Scope

Chapter 2. Automated Guided Vehicle Market: Executive Summary

2.1 AGV - Industry Snapshot & Key Buying Criteria, 2017-2030

2.2.1 Global Automated Guided Vehicle Market, 2017-2030

2.2 Segmental Outlook

2.2.1 Vehicle Type Outlook

2.2.2 Navigation Technology Outlook

2.2.3 Application Outlook

2.2.4 End-Use Industry Outlook

2.2.5 Component Outlook

2.2.6 Battery Type Outlook

2.2.7 Regional Outlook

Chapter 3. Automated Guided Vehicle Market: Industry Outlook

3.1 Market Segmentation

3.2 Market Size and Growth Prospects

3.3 Future of AGV

3.4 Case Studies

3.4.1 Case Study 1

3.4.2 Case Study 2

3.5 AGV - Value Chain Analysis

3.5.1 Raw Material Trends

3.5.1.1 Major Raw Materials Market Analysis

3.5.2 Key End-Users

3.6 Vendor Landscape

3.6.1 Key Takeaways

3.6.1.1 Swisslog Holding AG

3.6.1.2 Dematic

3.6.1.3 Bastian Solutions, Inc.

3.6.1.4 Daifuku Co. Ltd.

3.6.1.5 JBT

3.6.1.6 Seegrid Corporation

3.6.1.7 TOYOTA INDUSTRIES CORPORATION

3.6.1.8 Hyster-Yale Materials Handling, Inc.

3.6.1.9 BALYO

3.6.1.10 E&K Automation GmbH

3.6.1.11 Kollmorgen

3.6.1.12 KMH Fleet Solutions

3.6.1.13 ELETTRIC80 S.p.A.

3.6.1.14 Fetch Robotics, Inc.

3.6.1.15 Invia Robotics, Inc.

3.6.1.16 Locus Robotics

3.6.1.17 Schaefer Systems International, Inc.

3.6.1.18 System Logistics S.p.A.

3.6.1.19 Scott

3.7 AGV Market Dynamics

3.7.1 Supplier/Vendor Trends

3.7.2 Buyers/Application Trends

3.7.3 Technology Trends

3.7.4 Regulatory Trends

3.8 Market Driver Analysis

3.8.1 Increasing Demand for Automation and Material Handling Equipment in Various Process Industries

3.8.2 Replacement of Conventional Batteries with Lithium-Ion Batteries

3.8.3 High Labor Costs

3.8.4 Manufacturers Introducing Vision Guided Vehicles and Mobile Robots

3.8.5 Rapidly Growing e-Commerce Industry

3.8.6 Enhanced Safety at Workplaces

3.9 Market Restraint Analysis

3.9.1 High Initial Cost

3.9.2 Singular Use and Lack of Flexibility

3.10 Market Opportunity Analysis

3.10.1 Manufacturers Providing Intelligent AGV

3.11 Industry Analysis - Porter's Five Forces Analysis

3.11.1 Supplier Power

3.11.2 Buyer Power

3.11.3 Substitution Threat

3.11.4 Threat From New Entrant

3.11.5 Competitive Rivalry

3.12 AGV - PEST Analysis

3.12.1 Political Landscape

3.12.2 Economic Landscape

3.12.3 Social Landscape

3.12.4 Technology Landscape

3.12.5 Legal Landscape

3.13 Technology Overview

3.13.1 Technology Evolution

3.13.2 Wire Guidance

3.13.3 Magnetic Guidance

3.13.4 Laser Guidance (Laser Triangulation Navigation System)

3.13.5 Vision Guidance

3.14 Major Deals & Strategic Alliances Analysis

3.14.1 Mergers And Acquisitions

Chapter 4. AGV Market: Vehicle Type Estimates and Trend Analysis

4.1 AGV Market Share By Vehicle Type, 2023 & 2030

4.1.1 Tow Vehicle

4.1.2 Unit Load Carrier

4.1.3 Pallet Truck

4.1.4 Forklift Truck

4.1.5 Hybrid Vehicles

4.1.6 Others

Chapter 5. AGV Market: Navigation Technology Estimates & Trend Analysis

5.1 AGV Market Share By Navigation Technology, 2023 & 2030

5.1.1 Heat Map For Choosing Navigation

5.1.2 Laser Guidance

5.1.3 Magnetic Guidance

5.1.4 Vision Guidance

5.1.5 Inductive Guidance

5.1.6 Natural Navigation

5.1.7 Others

Chapter 6. AGV Market: Application Estimates & Trend Analysis

6.1 AGV Market Share By Application, 2023 & 2030

6.1.1 Logistics and Warehousing

6.1.2 Assembly

6.1.3 Packaging

6.1.4 Trailer Loading & Unloading

6.1.5 Raw Material Handling

6.1.6 Others

Chapter 7. AGV Market: End-Use Industry Estimates & Trend Analysis

7.1 AGV Market Share By End-Use Industry, 2023 & 2030

7.1.1 Manufacturing Sector

7.1.2 Wholesale and Distribution Sector

Chapter 8. AGV Market: Component Estimates & Trend Analysis

8.1 AGV Market Share By Component, 2023 & 2030

8.1.1 Hardware

8.1.2 Software

8.1.3 Service

Chapter 9. AGV Market: Battery Type Estimates & Trend Analysis

9.1 AGV Market Share By Battery Type, 2023 & 2030

9.1.1 Lead Battery

9.1.2 Lithium-Ion Battery

9.1.3 Nickel-Based Battery

9.1.4 Others

Chapter 10. AGV Market: Mode of Operation Estimates & Trend Analysis

10.1 AGV Market Share By Mode of Operation, 2023 & 2030

10.1.1 Indoor

10.1.2 Outdoor

Chapter 11. AGV Market: Regional Estimates and Trend Analysis

11.1 AGV Market Share By Region, 2023 & 2030

11.1.1 North America

11.1.2 Europe

11.1.3 APAC

11.1.4 Latin America

11.1.5 MEA

Chapter 12. Competitive Landscape

12.1 Swisslog Holding AG

12.2 Dematic

12.3 Bastian Solutions, Inc.

12.4 Daifuku Co. Ltd.

12.5 JBT

12.6 Seegrid Corporation

12.7 TOYOTA INDUSTRIES CORPORATION

12.8 Hyster-Yale Materials Handling, Inc.

12.9 BALYO

12.10 E&K Automation GmbH

12.11 Kollmorgen

12.12 KMH Fleet Solutions

12.13 ELETTRIC80 S.p.A.

12.14 Fetch Robotics, Inc.

12.15 Invia Robotics, Inc.

12.16 Locus Robotics

12.17 Schaefer Systems International, Inc.

12.18 System Logistics S.p.A.

12.19 Scott

For more information about this report visit https://www.researchandmarkets.com/r/bst47n

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance