Automatic Data Processing (ADP) Q3 Earnings Match Estimates

Automatic Data Processing, Inc.ADP third-quarter fiscal 2020 earnings came in line with the Zacks Consensus Estimate while revenues surpassed the same.

Adjusted earnings per share of $1.92 improved 8.5% year over year. Total revenues of $4.04 billion beat the consensus mark by 0.2% and improved 6% year over year on a reported basis as well as on an organic constant-currency basis.

So far this year, shares of ADP have lost 16.2% compared with an 18.3% decline of the industry and 10.8% decline of the Zacks S&P 500 composite.

Let’s check out the numbers in detail.

Segments in Detail

Employer Services revenues of $2.81 billion increased 3% year over year on a reported basis and 4% on organic constant-currency basis. Pays per control rose 1.9% year over year. New business bookings decreased 9%.

PEO Services revenues were up 11% year over year to $1.24 billion. Average worksite employees paid by PEO Services were 595,000, up 7% from the prior-year quarter.

Interest on funds held for clients decreased 5% to $159 million. The company’s average client funds balances climbed 4% year over year to $31.3 billion. Average interest yield on client funds declined 20 basis points to 2%

Margins

Adjusted EBIT came in at $1.09 billion, up 8% on a year-over-year basis. Adjusted EBIT margin rose 60 basis points from the year-ago quarter to 27.1%. Adjusted EBIT margin benefited from continued execution of transformation initiatives and operating efficiencies, which were partially offset by the cost of a one-time global associate assistance payment related to COVID-19 and incremental amortization and PEO pass-through expenses.

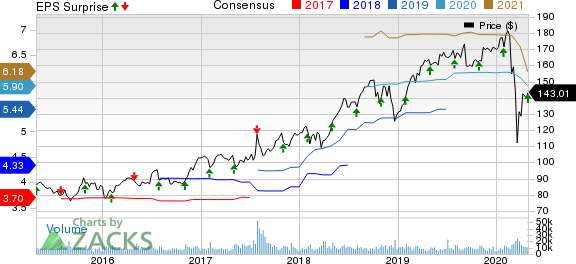

Automatic Data Processing, Inc. Price, Consensus and EPS Surprise

Automatic Data Processing, Inc. price-consensus-eps-surprise-chart | Automatic Data Processing, Inc. Quote

Balance Sheet and Cash Flow

ADP exited third-quarter fiscal 2020 with cash and cash equivalents of $1.71 billion compared with $1.5 billion in the prior quarter. Long-term debt of $1 billion was flat year over year.

The company generated $1.12 billion of cash from operating activities in the quarter. Capital expenditures were $38.6 million. The company paid out dividends worth $392.9 million and repurchased shares worth $391.2 million.

Fiscal 2020 Outlook

ADP expects revenues to register about 3% growth compared with the prior growth rate of 6%. Adjusted earnings per share are anticipated to register 4-7% growth compared with the prior growth rate of 12-14%. The company expects adjusted EBIT margin to be down 25 to up 25 basis points compared to the prior growth guidance of 100-125 basis points. Adjusted effective tax rate is anticipated to be 22.9% compared with the prior rate of 23.2%.

Currently, ADP carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Business Services Companies

The Interpublic Group of Companies, Inc. IPG reported first-quarter 2020 adjusted earnings of 11 cents per share, which beat the consensus mark by 22.2% but remained flat on a year-over-year basis.

Equifax Inc. EFX reported first-quarter 2020 adjusted earnings of $1.40 per share, which beat the consensus mark by 8.5% and improved 16% on a year-over-year basis.

ManpowerGroup Inc. MAN reported first-quarter 2020 adjusted earnings of 71 cents per share, which missed the Zacks Consensus Estimate by 2.7% and slumped 48.9% year over year.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Equifax, Inc. (EFX) : Free Stock Analysis Report

ManpowerGroup Inc. (MAN) : Free Stock Analysis Report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Interpublic Group of Companies, Inc. (The) (IPG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance