Is Automatic Data Processing (NASDAQ:ADP) A Risky Investment?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Automatic Data Processing, Inc. (NASDAQ:ADP) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Automatic Data Processing

What Is Automatic Data Processing's Net Debt?

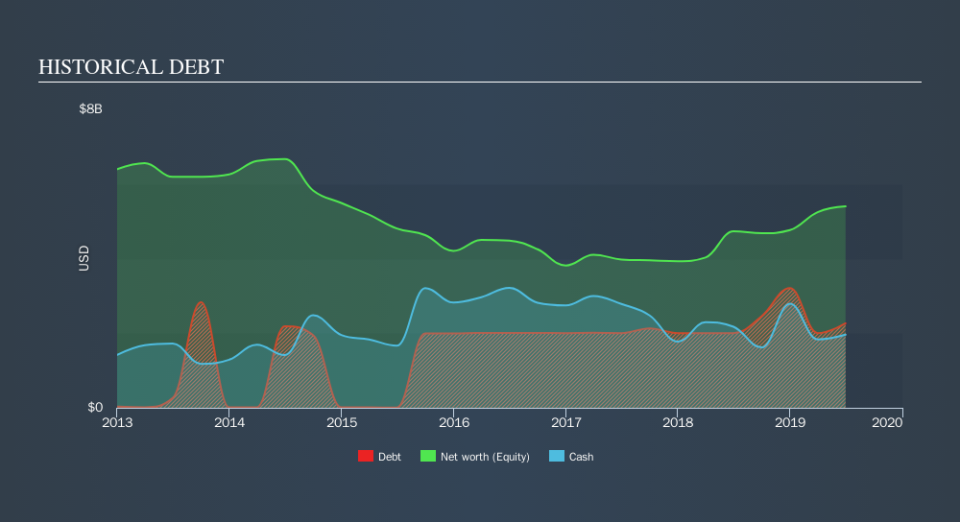

You can click the graphic below for the historical numbers, but it shows that as of June 2019 Automatic Data Processing had US$2.26b of debt, an increase on US$2.00b, over one year. However, it also had US$1.96b in cash, and so its net debt is US$304.5m.

How Strong Is Automatic Data Processing's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Automatic Data Processing had liabilities of US$32.6b due within 12 months and liabilities of US$3.86b due beyond that. Offsetting these obligations, it had cash of US$1.96b as well as receivables valued at US$2.44b due within 12 months. So its liabilities total US$32.1b more than the combination of its cash and short-term receivables.

This deficit isn't so bad because Automatic Data Processing is worth a massive US$69.0b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt. Carrying virtually no net debt, Automatic Data Processing has a very light debt load indeed.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

With debt at a measly 0.087 times EBITDA and EBIT covering interest a whopping 95.4 times, it's clear that Automatic Data Processing is not a desperate borrower. So relative to past earnings, the debt load seems trivial. Also good is that Automatic Data Processing grew its EBIT at 17% over the last year, further increasing its ability to manage debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Automatic Data Processing's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Automatic Data Processing produced sturdy free cash flow equating to 71% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Automatic Data Processing's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But truth be told we feel its level of total liabilities does undermine this impression a bit. Zooming out, Automatic Data Processing seems to use debt quite reasonably; and that gets the nod from us. After all, sensible leverage can boost returns on equity. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Automatic Data Processing's earnings per share history for free.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance