AutoZone (AZO) to Report Q2 Earnings: Here's What to Expect

AutoZone AZO is slated to release second-quarter fiscal 2024 results on Feb 27, before the opening bell. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings and revenues is pegged at $26.08 per share and $3.85 billion, respectively.

The Zacks Consensus Estimate for AZO’s fiscal second-quarter earnings per share has moved down 10 cents in the past seven days. The bottom-line projection indicates year-over-year growth of 5.84%. The Zacks Consensus Estimate for quarterly revenues implies a 4.40% rise from the prior-year level.

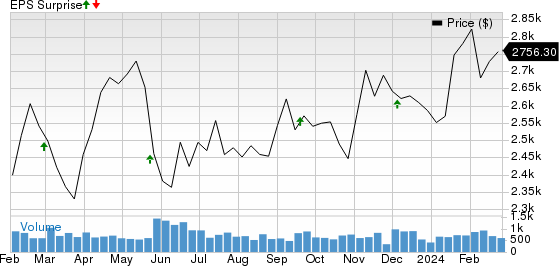

The automotive parts retailer posted earnings of $32.55 per share for first-quarter fiscal 2024, which improved 18.6% from the prior-year figure and topped the Zacks Consensus Estimate of $31.01. The company beat on earnings in each of the trailing four quarters, delivering an average surprise of 8.88%. This is depicted in the graph below:

AutoZone, Inc. Price and EPS Surprise

AutoZone, Inc. price-eps-surprise | AutoZone, Inc. Quote

What Does Our Model Say?

Our proven model does not conclusively predict an earnings beat for AutoZone this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is not the case here.

Earnings ESP: AutoZone has an Earnings ESP of -0.23%. This is because the Most Accurate Estimate is pegged at $26.02, which is lower than the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: AutoZone currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Things to Note

AutoZone’s omni-channel efforts to improve customer shopping experiences are reaping profits. The company’s e-commerce efforts that are driving traffic to its website are likely to have positively impacted performance in the second quarter of fiscal 2024. Our projection for domestic store sales is pegged at $3.28 billion, implying an uptick of around 2% year over year. Our projection for sales from Mexico and Brazil stores indicates year-over-year growth of 18.6%.

Inventory assortment improvements, technological advancements, fast delivery and high-quality products, the solid reputation of the Duralast brand across the professional customer base, maintenance of competitive pricing and greater engagement from store-operating teams are expected to have driven the company’s growth in the to-be-reported quarter.

Discouragingly, the company anticipated challenges in its DIY sales during the second quarter. On the domestic retail front, the company observed a 1.6% decrease in traffic, partially mitigated by a 1.5% increase in ticket growth. Looking ahead, AZO anticipates a modest decline in transaction counts. Further, AutoZone’s technology investments to improve the electronic catalog might limit cash inflows. We anticipate the company’s operating SG&A expenses to increase 4.6% year over year in fiscal 2024. The decline in DIY sales and rising expenses are likely to have hurt AZO’s result in the to-be-reported quarter.

Peer Releases

O’Reilly Automotive, Inc. ORLY reported fourth-quarter 2023 results on Feb 7. Its adjusted earnings per share of $9.26 beat the Zacks Consensus Estimate of $9.07. The bottom line increased from $8.37 in the prior-year quarter. The automotive parts retailer registered quarterly revenues of $3,832 million, which missed the Zacks Consensus Estimate of $3,838 million. The top line, however, increased 5.2% year over year. During the quarter, comps grew 3.4%. The company opened 47 new stores in the United States and Mexico. The total store count was 6,157 as of Dec 31, 2023.

ORLY had cash and cash equivalents of $279.1 million at the end of the reported quarter, up from $108.6 million recorded as of 2022-end. Its long-term debt was $5.57 billion, higher than $4.37 billion as of Dec 31, 2022.

LKQ Corporation LKQ reported fourth-quarter 2023 results on Feb 22. It delivered adjusted earnings of 84 cents per share, which increased from adjusted earnings of 78 cents in the year-ago quarter and surpassed the Zacks Consensus Estimate of 75 cents. LKQ generated quarterly revenues of $3.5 billion, which missed the Zacks Consensus Estimate of $3.51 billion but increased from the year-ago level of $3 billion. Parts and services organic revenues increased 2.8% year over year.

LKQ had cash and cash equivalents of $299 million as of Dec 31, 2023, compared with $278 million as of Dec 31, 2022. Total long-term obligations (excluding the current portion) were $3.66 billion as of Dec 31, 2023, up from $2.62 billion as of Dec 31, 2022.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

O'Reilly Automotive, Inc. (ORLY) : Free Stock Analysis Report

AutoZone, Inc. (AZO) : Free Stock Analysis Report

LKQ Corporation (LKQ) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance