AvalonBay (AVB) Q1 FFO & Revenues Beat Estimates, View Raised

AvalonBay Communities AVB reported a first-quarter 2024 core FFO per share of $2.70, which beat the Zacks Consensus Estimate of $2.64. Moreover, the figure climbed 5.1% from the prior-year quarter’s tally.

The quarterly results reflect better-than-expected performance in the stabilized portfolio. This residential REIT also raised its 2024 core FFO per share, same-store residential revenue and net operating income (NOI) growth outlook following the Q1 FFO beat.

Total revenues in the quarter came in at $712.9 million, which outpaced the Zacks Consensus Estimate of $706.6 million. The figure increased 5.7% on a year-over-year basis.

Quarter in Detail

In the reported quarter, same-store total revenues increased 4.3% year over year to $677.2 million. Same-store residential revenues climbed 4.2% year over year to $669.2 million. Same-store residential operating expenses rose 5.2% to $205.5 million. As a result, the same-store residential NOI climbed 3.7% to $463.7 million from the prior-year period.

Same-store average revenue per occupied home rose to $2,967 in the first quarter, up from $2,842 in the first quarter of 2023. The same-store economic occupancy shrunk 20 basis points year over year to 95.9% and was in line with our projection.

As of Mar 31, 2024, AvalonBay had 17 consolidated development communities under construction (expected to contain 6,064 apartment homes and 59,000 square feet of commercial space). The estimated total capital cost of these development communities at completion is $2.5 billion.

Balance Sheet

AVB had $287.9 million in unrestricted cash and cash equivalents as of Mar 31, 2024. As of the same date, the company did not have any borrowings outstanding under its $2.25 billion unsecured revolving credit facility or $500 million unsecured commercial paper note program.

Additionally, its annualized net debt-to-core EBITDAre for the January-March period was 4.3 times, and the unencumbered NOI for the three months ended Mar 31, 2024 was 95%.

2024 Outlook Raised

For the second quarter of 2024, AvalonBay expects core FFO per share in the range of $2.63-$2.73. The Zacks Consensus Estimate is currently pegged at $2.70, which lies within the guided range.

For the full year, AVB now expects core FFO per share between $10.71 and $11.11, up from the $10.53-$11.03 range guided earlier. This indicates a 2.6% increase at the midpoint compared with 1.4% expected earlier. The Zacks Consensus Estimate presently stands at $10.83, within the projected range.

For the full year, management expects same-store residential revenue growth to be 3.1% at the midpoint, up from 2.6% guided earlier, while operating expenses are projected to increase 5.4%, down from the initial outlook of 5.6%. Same-store residential NOI growth is estimated at 2.1% at the midpoint, ahead of 1.25% projected before.

AvalonBay currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

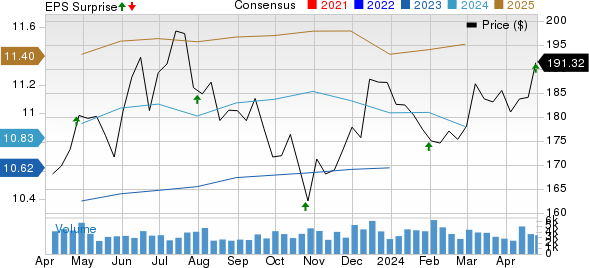

AvalonBay Communities, Inc. Price, Consensus and EPS Surprise

AvalonBay Communities, Inc. price-consensus-eps-surprise-chart | AvalonBay Communities, Inc. Quote

Performance of Another Residential REIT

Equity Residential EQR reported a first-quarter 2024 normalized FFO per share of 93 cents, which surpassed the Zacks Consensus Estimate of 91 cents. The rental income of $730.8 million also beat the consensus mark of $729.8 million. On a year-over-year basis, the normalized FFO per share grew 6.9% from 87 cents, with rental income climbing 3.6%.

Results reflected decent same-store performances, backed by healthy demand, modest supply and a focus on expense efficiency. The company also experienced the lowest quarterly same-store turnover in its history.

Upcoming Earnings Releases of Residential REITs

We now look forward to the earnings releases of residential REITs like Essex Property Trust, Inc. ESS and UDR Inc. UDR. Both UDR and Essex Property Trust are slated for Apr 30.

The Zacks Consensus Estimate for Essex Property Trust’s first-quarter 2024 FFO per share is pegged at $3.74, which suggests 2.47% growth year over year. ESS currently carries a Zacks Rank #3.

The Zacks Consensus Estimate for UDR’s first-quarter 2024 FFO per share stands at 61 cents, which indicates a 1.67% rise year over year. UDR currently has a Zacks Rank #3.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AvalonBay Communities, Inc. (AVB) : Free Stock Analysis Report

Equity Residential (EQR) : Free Stock Analysis Report

United Dominion Realty Trust, Inc. (UDR) : Free Stock Analysis Report

Essex Property Trust, Inc. (ESS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance