AVANGRID's (AGR) Q2 Earnings & Revenues Beat Estimates

AVANGRID, Inc. AGR reported second-quarter 2022 earnings of 46 cents per share, beating the Zacks Consensus Estimate of 33 cents by 39.4%. Earnings per share (EPS) were up 31.4% from the prior-year figure of 35 cents.

GAAP earnings for the second quarter were 48 cents per share, up 71.4% from the prior-year quarter’s 28 cents.

Total Revenues

Total operating revenues for the second quarter were $1,794 million, surpassing the Zacks Consensus Estimate of $1,597 million by 12.3%. Revenues also increased 8.1% from $1,477 million reported in the comparable period of 2021.

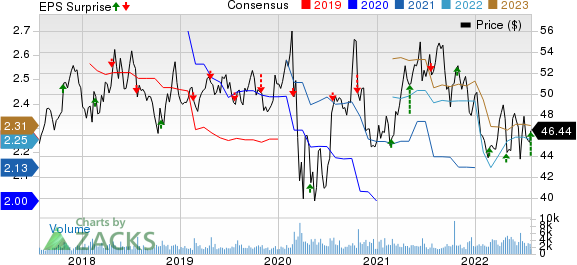

Avangrid, Inc. Price, Consensus and EPS Surprise

Avangrid, Inc. price-consensus-eps-surprise-chart | Avangrid, Inc. Quote

Highlights of the Release

Total operating expenses for the second quarter summed at $1,573 million, up 16.9% from the year-ago quarter’s $1,346 million due to higher purchased power costs and an increase in operating expenses.

Operating income was $221 million, up 68.7% from $131 million in the second quarter of 2021.

AVANGRID continues to add renewable assets to its portfolio in the second quarter. The company commissioned 201 megawatts (MW) in the second quarter in its Renewable segment and is on course to commission in excess of 400 MW of clean assets in 2022.

Guidance

AVANGRID affirmed the 2022 adjusted net income and EPS guidance at $850-$920 million and $2.20-$2.38, respectively, taking into consideration 387 million average shares outstanding. The Zacks Consensus Estimate for earnings of $2.25 per share is lower than $2.29, the mid-point of the company’s guided range.

Zacks Rank

AVANGRID currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

Xcel Energy XEL is scheduled to announce second-quarter 2022 results on Jul 28. The Zacks Consensus Estimate for earnings per share is pegged at 60 cents.

Xcel Energy’s long-term (three to five years) earnings growth is 6.4%. The Zacks Consensus Estimate for 2022 earnings per share indicates year-over-year growth of 6.8%.

Duke Energy Corporation DUK is set to release second-quarter 2022 results on Aug 4. The Zacks Consensus Estimate for earnings per share is pegged at $1.10.

Duke Energy’s long-term earnings growth is projected at 6%. The Zacks Consensus Estimate for 2022 earnings per share indicates year-over-year growth of 4%.

Dominion Energy D is scheduled to announce second-quarter 2022 results on Aug 5. The Zacks Consensus Estimate for earnings is pegged at 77 cents per share.

Dominion’s long-term earnings growth is projected at 6.3%. The Zacks Consensus Estimate for 2022 earnings per share suggests year-over-year growth of 6.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Xcel Energy Inc. (XEL) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

Dominion Energy Inc. (D) : Free Stock Analysis Report

Avangrid, Inc. (AGR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance