Avanos (AVNS) Earnings and Revenues Beat Estimates in Q4

Avanos Medical, Inc. AVNS reported adjusted earnings per share (EPS) of 34 cents in fourth-quarter 2019, which surpassed the Zacks Consensus Estimate of 32 cents. The bottom line rose by a penny year over year.

For 2019, EPS was $1.07, up 30.5% from the 2018 figure.

Revenues of this Zacks Rank #4 (Sell) company were $189.8 million which beat the Zacks Consensus Estimate by 6.7%. Also, the figure improved 11.7% on a year-over-year basis.

Full-year revenues totaled $697.6 million, up 6.9%.

Q4 Segmental Analysis

Chronic Care

Net revenues at this segment of $113.4 million rose 15.5% year over year.

Pain Management

The segment reported net revenues of $76.4 million. The metric improved 6.6% on a year-over-year basis.

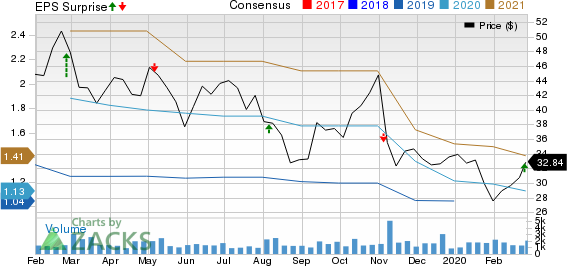

AVANOS MEDICAL, INC. Price, Consensus and EPS Surprise

AVANOS MEDICAL, INC. price-consensus-eps-surprise-chart | AVANOS MEDICAL, INC. Quote

Margin Analysis

Gross profit came in at $109.7 million, up 9.3% from the prior-year quarter figure. Adjusted gross margin was 60% of net revenues, down 40 bps year over year.

Research and development expenses totaled $8.4 million, down 20.8% year over year. Selling, general and administrative expenses amounted to $103.6 million, up 17.9%.

Adjusted operating profit in the fourth quarter was $26 million, up 30% driven by higher sales volumes. The company reported operating loss of $3.2 million in the quarter under review compared with the year-ago quarter’s operating loss of $8.3 million.

Financial Update

As of Dec 31, 2019, cash and cash equivalents totaled $205.3 million.

Net cash from operating activities for the three months ended Dec 31, 2019, amounted to ($2.9) million, narrower than ($7.4 million) in the prior-year quarter.

Guidance

Avanos expects 2020 revenue growth between 5% and 7% compared to 2019. The Zacks Consensus Estimate for the same is pegged at $737.6 million.

Adjusted EPS is expected between a penny and $1.20. The Zacks Consensus Estimate stands at $1.18.

The company expects lower foreign currency impact in 2020 in comparison to 2019.

Summing Up

Avanos exited the fourth quarter on a strong note. The company continues to gain from core segments — Chronic Care and Pain Management. The recent FDA approval for the new 80-Watt COOLIEF Radiofrequency System buoys optimism. Also, the company completed the Endoclear LLC buyout and also entered into an operating partnership with DHL Supply Chain to enhance Avanos’ network achieve greater productivity and maximize warehouse storage utilization.

However, the contraction in gross margin is worrisome. Moreover, being a pure-play MedTech company, it faces stiff competition from other industry players.

Earnings of Other MedTech Majors at a Glance

Some better-ranked companies, which reported solid results this earnings season, include Stryker Corporation SYK, Accuray Incorporated ARAY and IDEXX Laboratories, Inc. IDXX. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stryker reported fourth-quarter 2019 adjusted EPS of $2.49, outpacing the Zacks Consensus Estimate by 1.2%. Revenues of $4.13 billion surpassed the consensus estimate by 0.7%. The company carries a Zacks Rank #2 (Buy).

Accuray reported second-quarter fiscal 2020 adjusted EPS of a penny against the Zacks Consensus Estimate of a loss of 7 cents. Net revenues of $98.8 million outpaced the consensus mark by 0.3%. The company sports a Zacks Rank #1.

IDEXX Laboratories reported fourth-quarter 2019 adjusted EPS of $1.04, which beat the Zacks Consensus Estimate of 91 cents by 14.3%. Revenues were $605.4 million, surpassing the Zacks Consensus Estimate by 0.9%. The company carries a Zacks Rank of 2.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

Accuray Incorporated (ARAY) : Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX) : Free Stock Analysis Report

AVANOS MEDICAL, INC. (AVNS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance