Avantor Inc (AVTR) Q1 2024 Earnings: Adjusted EPS Exceeds Estimates Despite Sales Decline

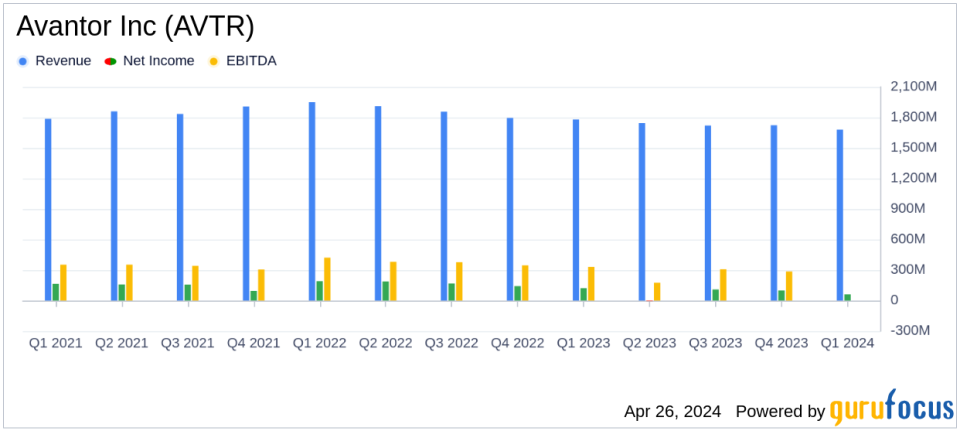

Reported net sales: $1.68 billion, a decrease of 5.6% year-over-year, falling short of estimates of $1.68 billion.

Net income: $60 million, down from $121.5 million in the prior year, significantly below estimates of $135.14 million.

Diluted GAAP EPS: $0.09, with adjusted EPS at $0.22, surpassing the estimated EPS of $0.20.

Operating cash flow: Reported at $142 million with free cash flow of $107 million.

Adjusted EBITDA: $283 million, with an Adjusted EBITDA margin of 16.8%.

Organic sales decline: Reported a 6.3% decrease on an organic basis.

Segment performance: Laboratory Solutions net sales decreased by 3.8% to $1.157 billion; Bioscience Production net sales fell by 9.5% to $523 million.

On April 26, 2024, Avantor Inc (NYSE:AVTR), a key player in the life sciences and advanced technology industries, disclosed its financial outcomes for the first quarter of 2024 through its 8-K filing. The company reported a net income of $60 million on net sales of $1.68 billion, which represents a 5.6% decrease in sales compared to the previous year. This decline was slightly steeper than anticipated, with an organic sales decline of 6.3%. Despite the sales downturn, Avantor achieved an adjusted EPS of $0.22, surpassing the analyst estimate of $0.20.

Avantor serves a global market with a focus on biopharma, healthcare, and technology sectors, providing essential products and services. The company operates under well-known brands such as NuSil and Macron Fine Chemicals, primarily generating revenue from the Americas.

Financial Highlights and Segment Performance

The first quarter saw Avantor facing challenges, particularly in its Bioscience Production segment, where net sales saw a 9.5% decrease to $523 million. The Laboratory Solutions segment also experienced a downturn, with sales declining by 3.8% to $1,157 million. Adjusted operating income for these segments was reported at $148 million and $127 million respectively, indicating pressure on profitability.

Despite these challenges, Avantor's management remains optimistic. President and CEO Michael Stubblefield emphasized the company's resilient market position and strategic initiatives, stating,

The year is off to a good start as first quarter organic revenue growth was in line with our guidance and disciplined execution drove outperformance on margins and profitability."

He highlighted the implementation of a new operating model and a multi-year cost transformation initiative aimed at enhancing efficiency and alignment with customer needs.

Operational and Financial Metrics

Avantor reported an operating cash flow of $142 million and a free cash flow of $107 million for the quarter. The adjusted EBITDA stood at $283 million with a margin of 16.8%, reflecting a robust operational performance despite revenue setbacks. The company's adjusted net leverage was calculated at 4.0x as of March 31, 2024.

From a balance sheet perspective, Avantor showed a solid financial position with total assets amounting to $12.76 billion. The company's efforts to manage its debt were evident, with a current portion of the debt at $299.1 million and long-term debt, net of current portion, at approximately $5.02 billion.

Looking Ahead

Avantor reaffirmed its fiscal year 2024 guidance, signaling confidence in its strategic plans and market conditions. The company's focus remains on leveraging its global scale, optimizing its portfolio, and driving operational efficiencies to support long-term growth.

For investors and stakeholders, Avantor's ability to exceed adjusted EPS estimates in a challenging quarter is a positive sign. However, the decline in organic sales and the pressures faced in key segments will be critical areas to monitor in upcoming quarters.

For more detailed information and analysis on Avantor Inc's financial performance and strategic direction, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Avantor Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance