AVEO Down 7.7% Since Earnings Report: Can It Rebound?

It has been about a month since the last earnings report for AVEO Pharmaceuticals, Inc. AVEO. Shares have lost about 7.7% in that time frame.

Will the recent negative trend continue leading up to its next earnings release, or is AVEO due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

AVEO Q4 Loss Widens

AVEO reported fourth-quarter 2017 adjusted loss of 8 cents per share (excluding gains due to a change in fair value of warrant liability), wider than the Zacks Consensus Estimate of a loss of 2 cents as well as the year-ago loss of 13 cents. However, including gains related to a change in fair value of warrant liability, the company reported earnings of 3 cents.

AVEO’s top line mainly comprises collaboration revenues, milestone and other payments. Total collaboration revenues in the fourth quarter were approximately $0.08 million, down 20% compared with the year-ago figure. Revenues missed the Zacks Consensus Estimate of $1 million.

Quarterly Highlights

Research & development expenses were down 26% to about $5.7 million. However, general and administrative expenses increased 26.3% year over year to $2.4 million.

2017 Results

Full-year sales stood at $7.6 million, missing the Zacks Consensus Estimate of $11.3 million. However, the top line drastically increased 204% compared with the year-ago figure of $2.5 million.

The full-year earnings of 61 cents per share were narrower than the Zacks Consensus Estimate of 64 cents. However, the bottom line is wider than the year-ago loss of 39 cents.

Cash Guidance

AVEO expects that its present cash resources of $33.5 million will allow the company to fund its planned operations through the first quarter of 2019.

How Have Estimates Been Moving Since Then?

Analysts were quiet during the last two-month period as none of them issued any earnings estimate revisions.

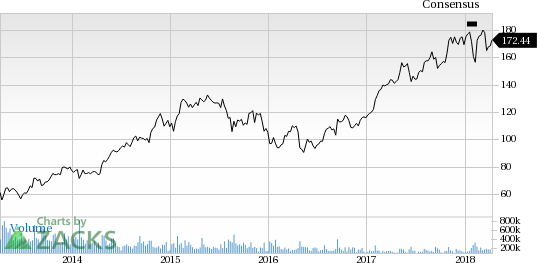

AVEO Pharmaceuticals, Inc. Price and Consensus

AVEO Pharmaceuticals, Inc. Price and Consensus | AVEO Pharmaceuticals, Inc. Quote

VGM Scores

At this time, AVEO has an average Growth Score of C, however its Momentum is doing a lot better with an A. The stock was allocated a grade of F on the value side, putting it in the bottom 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of D. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for momentum investors than growth investors.

Outlook

AVEO has a Zacks Rank #5 (Strong Sell). We expect a below average return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AVEO Pharmaceuticals, Inc. (AVEO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance