Average price tag on a home falls by more than £2,000 in November

The average price of a home coming to market dipped by more than £2,000 in November, according to a property website.

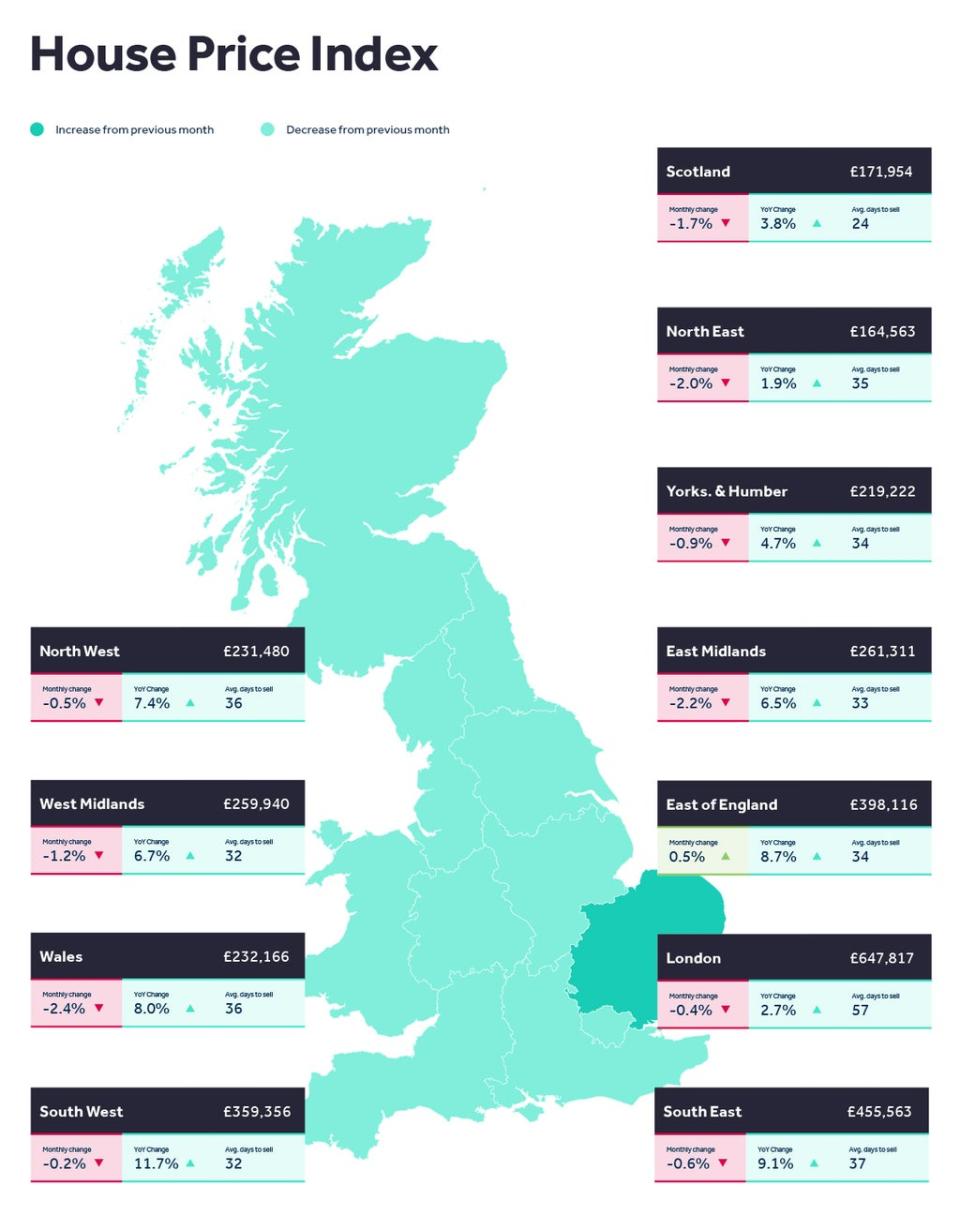

Across Britain the average price tag now stands at £342,401 – £2,044, or 0.6%, less than in October – as sellers seek to attract buyers’ attention ahead of the traditional pre-Christmas lull.

The figures were released by Rightmove which said this month’s price drop was the largest monthly fall since January, when there was a 0.9% decline.

Rightmove said December is traditionally the quietest month for buyer activity, and interest from house-hunters tends to bounce back on Boxing Day.

It added that, last year, there were more than 51 million visits to its website between Boxing Day and the first working day of the new year.

Tim Bannister, Rightmove’s director of property data, said: “New sellers have given buyers an early Christmas present by dropping their average asking prices by 0.6%.

“Sellers who come to market this close to the distractions of Christmas often have a pressing reason to sell, so naturally price more attractively to grab the attention of prospective buyers who may be otherwise occupied.

“We expect this downward price trend to be relatively short-lived, though sellers who are in a hurry will continue to need to attract buyers for most of December as well.

“As soon as Christmas Day is out of the way, there’s a boom in people searching for property on Boxing Day, perhaps with time available during the holiday season and a resolve to enjoy their next Christmas in new surroundings.

“That is likely to push prices higher again, and increase the competition from other buyers.”

Simon Bradbury, managing director at Thomas Morris Sales & Lettings said: “With the holiday season coming up fast, sellers planning to enter the market might be tempted to put off beginning the process of putting their home on the market until the New Year.

“However, Boxing Day is historically the start of a busy period of both new sellers coming to market, and a resurgence of prospective buyers browsing properties. So, if they wait until January to begin the selling process, they may have missed out on a valuable period of time to attract buyers.”

Richard Palfreeman, managing director at Northfields Estate Agency, said: “We often find in November and December that there are vendors who are motivated to secure a sale, and there are some great bargains to be had for buyers.”

Read More

All I want for Christmas… is cash

Legitimate claimants asked to pay Universal Credit cash back, claims charity

Warning to ‘think twice’ about gift cards this Christmas

What could plans for the takeover of LV= mean for members?

Number of homeowners in mortgage arrears edges down

‘Lack of properties on estate agent books pushing house prices up’

Yahoo Finance

Yahoo Finance