Average price tag on a home jumped by £852 in January, says Rightmove

The average price tag on a home jumped by £852 or 0.3% month-on-month in January, according to a property website.

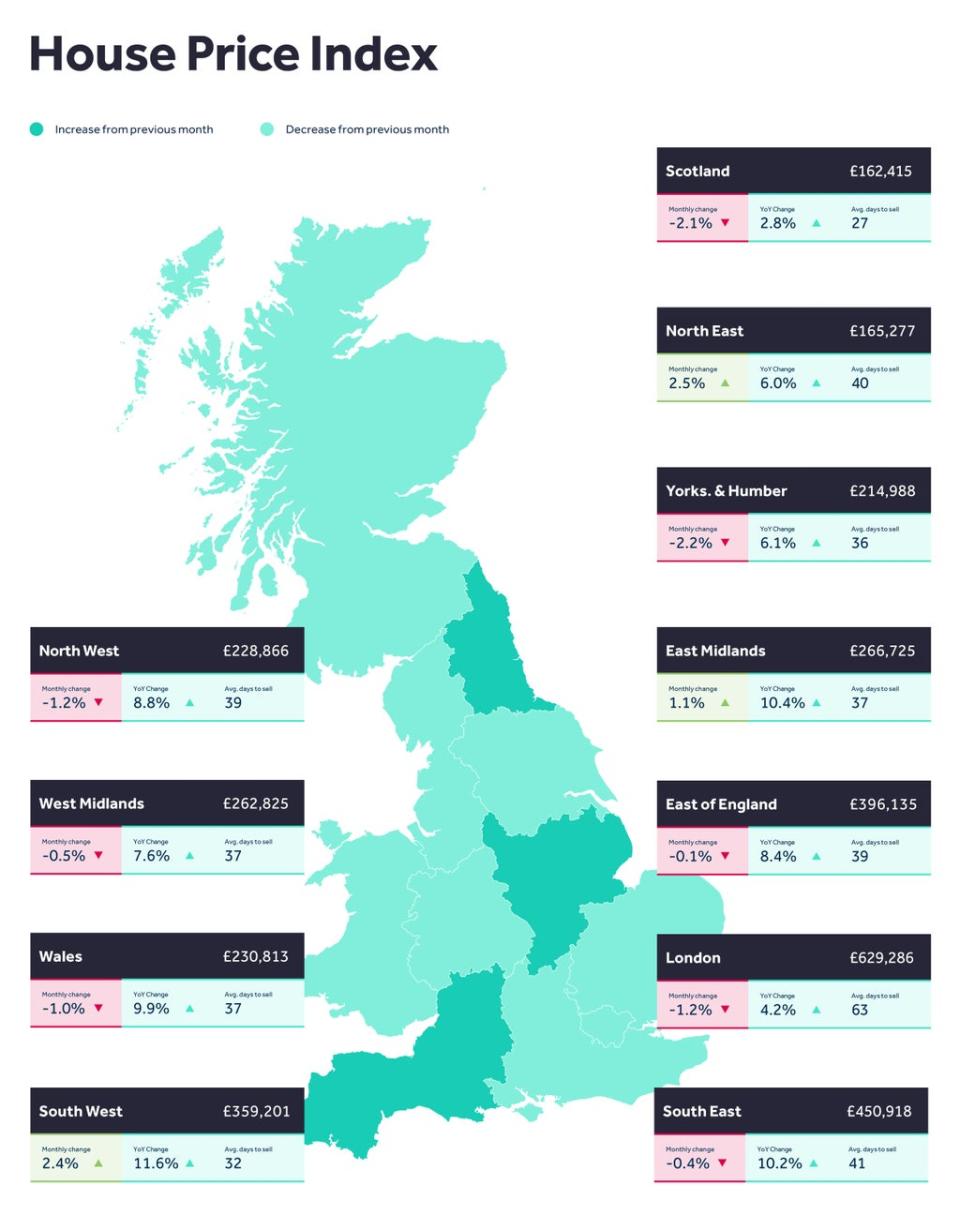

Across Britain the average asking price for a home this month is £341,019, Rightmove said.

The jump in average asking prices this month is driven by larger homes at the top of the property ladder as well as those typically bought by first-time buyers, it added.

All of the signs suggest that prices are likely to continue to rise until more choice is available

Tim Bannister, Rightmove

The average asking price for first-time buyer homes hit a new record of £214,176 in January, after a monthly jump of 1.4%.

The number of buyers inquiring about homes generally is 15% higher than a year ago, Rightmove said. But the average stock of available properties per estate agency branch is at a record low of just 12, it added.

However, there are early signs that a wider choice of properties is on the way, with the number of home valuation requests in the first working week of 2022 having increased by 44%, compared with the same period last year.

Tim Bannister, Rightmove’s director of property data, said: “All of the signs suggest that prices are likely to continue to rise until more choice is available.

“Three regions are in most urgent need of new supply, the East Midlands, South West and South East of England, as they are now at unsustainable rates of annual price growth above 10%.”

Roger Wilkinson, managing director at Wilkinson Grant & Co in Exeter, said: “Despite a slowdown in activity over the festive period, Covid uncertainty, an interest rate rise and creeping cost of living, 2022 has picked-up where 2021 left off – with continued high levels of buyer demand and not enough homes available to choose from.

“Having experienced house price growth in some Devon hotspots of as much as 20% in the last 18 months, the signals are that prices will continue to rise this coming year, but a new mood of buyer realism will slow such rampant house price growth.”

Chris Pearson director at Pearson Keehan in Hove said: “In the local area, Brighton and Hove continues to be as popular as ever, with an influx of buyers relocating from London and the surrounding areas looking for a lifestyle change. These numbers are continuing to increase since working from home has become more of an option.

“At present the demand certainly outweighs the supply, however we are optimistic that sellers are slowly returning to the market, as we have already seen an uplift in requests for property valuations in January.

“With competitive lending also still available it bodes well for the number of expected transactions, and we believe it to be another busy year ahead.”

Yahoo Finance

Yahoo Finance