Average price tag on a home at record high for four months in a row

The average price tag on a home has reached a record high for the fourth month in a row, jumping by £7,400 in May, according to a website.

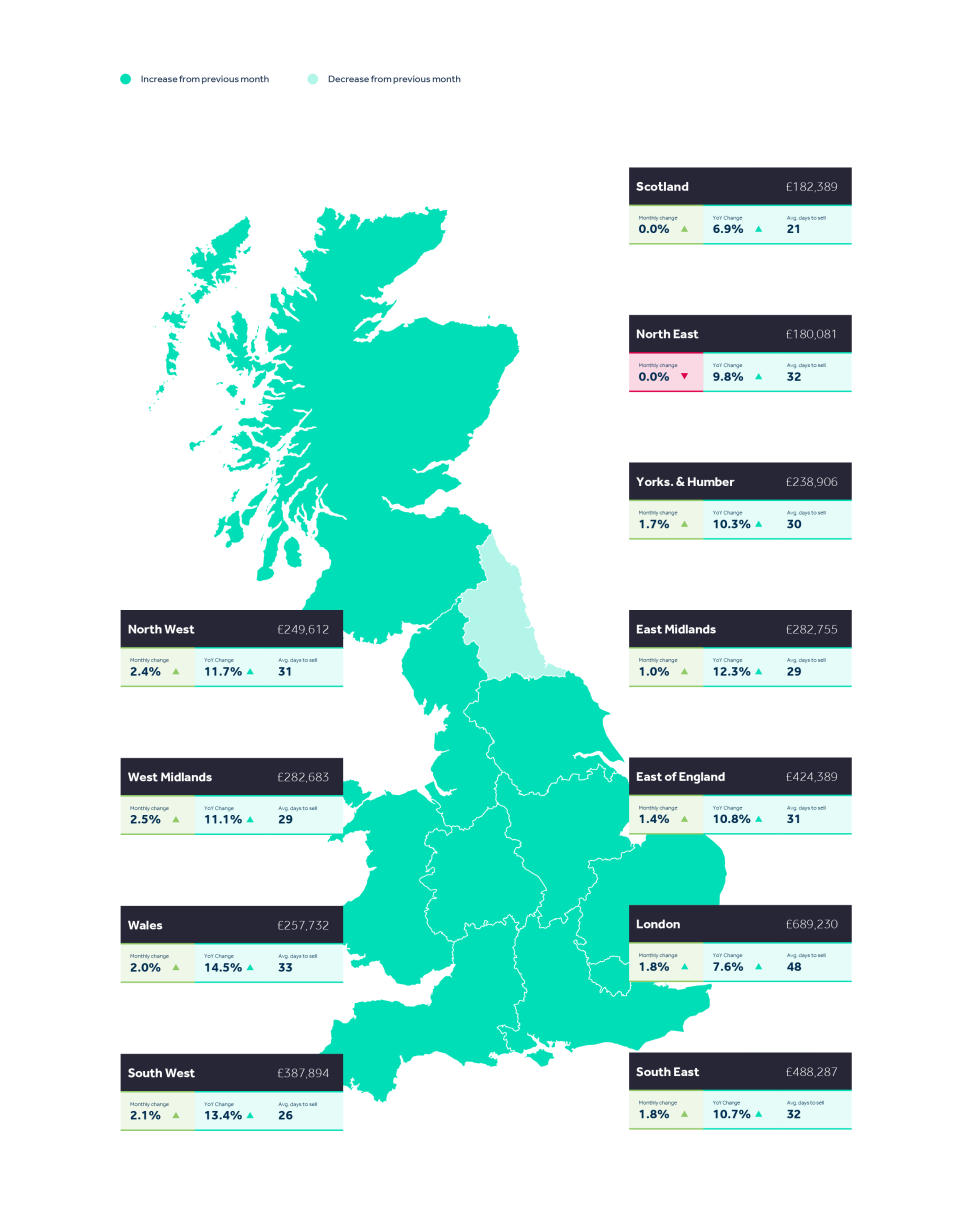

Across Britain, the average asking price for a property this month is £367,501, up from £360,101 in April, Rightmove said.

Frenzied market activity has led to cash house price increases over the past two years at levels Rightmove said it had never seen before in more than 20 years of tracking property values.

Average asking prices have soared by £55,551 in the past two years, compared with a £6,218 increase in the two years before the coronavirus pandemic, it added.

The number of buyers contacting estate agents is 14% down on the stamp-duty holiday-fuelled market of this time last year, but is still up by 31% compared with the more “normal” pre-pandemic market of 2019.

The number of properties available to buy is 55% down on the levels seen in 2019, meaning that supply and demand look likely to remain out of kilter for at least the rest of the year, Rightmove added.

The number of sales agreed is up by 12% in the year to date compared to 2019 even with restricted choice, though is down 17% compared with the “exceptional” market of the same period last year, it said.

Tim Bannister, Rightmove’s director of property science said: “What the data is showing us right now is that those who have the ability to do so are prioritising their home and moving, and the imbalance between supply and demand is supporting rising prices.

“Though demand is softening from the heady levels we saw this time last year, the number of buyers inquiring is still significantly higher than during the last ‘normal’ market of 2019, while the number of homes for them to choose from remains more constrained.

“We anticipate that the effects of the increased cost of living and rising interest rates will filter through to the market later in the year, and a combination of more supply of homes and people weighing up what they can afford will help to moderate the market.”

Rightmove’s report also quoted the views of estate agents.

John O’Malley, chief executive at Pacitti Jones in Glasgow, Scotland, said: “Whilst frenzied buyer activity has calmed down, the market is definitely holding strong and we are now seeing higher volumes of vendors feeling more comfortable about putting their property on the market before making an offer on another.

“Pricing remains very robust with substantial offers being made across the whole market.”

Aled Ellis, director at Aled Ellis & Co in Aberystwyth, Wales, said: “The property market is still buoyant in our area despite inflationary pressures and higher interest rates.

“The trend is set to continue as there is very little coming on the market, and when it does we agree a sale very quickly.

“Since Covid, we’re still seeing a lot more people are able to work from home, and wish to live in rural areas as long as the broadband connection enables them to do so.”

Yahoo Finance

Yahoo Finance