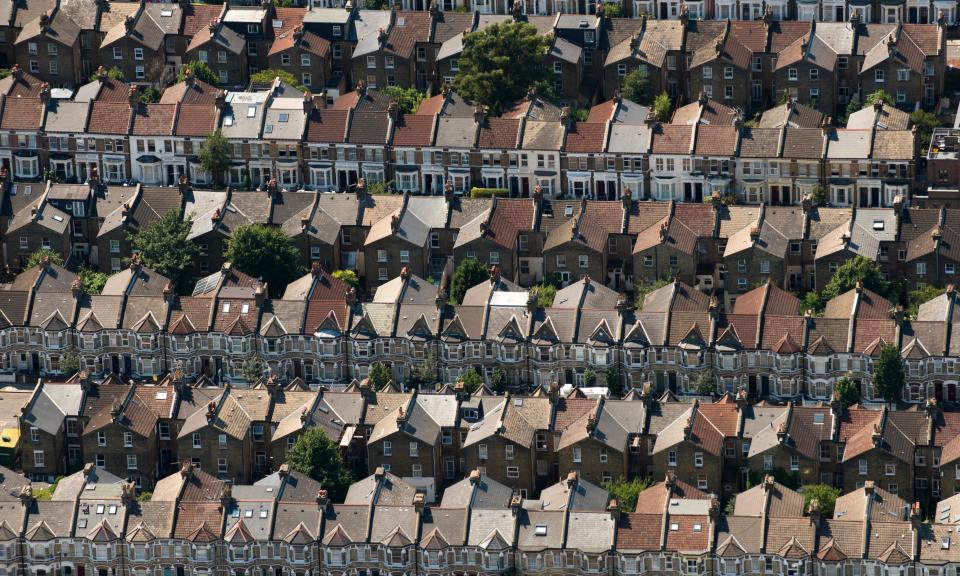

Average UK house sale price suffers first annual fall for 11 years

The average price of a home in the UK dropped by 0.1% in the year to September, official figures show – the first annual fall for more than a decade.

The Office for National Statistics (ONS) figures, which are based on completed sales, have shown annual price inflation slowing since July 2022, when the headline rate stood at 13.8%.

The ONS said the average cost of a UK home was £291,000 in September, after a 0.5% fall during the month.

Prices in London fell by 1.1% over the year and 0.3% over the month, to an average of £537,000. In north-east England, the region with the lowest prices, there was a 1.6% annual rise, to £163,000.

Across Scotland, prices were up by 2.5% year on year, to an average of £195,000, while in Northern Ireland there was a 2.1% rise, to £180,000.

The ONS cautioned against reading too much into the figures, saying they were subject to revision and that the number of sales available as a basis for its index was “considerably lower than historically … Revisions may be larger than usual in coming months.”

The ONS data lags behind other indices that are based on purchases at the stage when a mortgage has been agreed, rather than on completed sales. It also includes cash purchases.

Other indices have shown falls during the summer followed by slight increases in October as a shortage of stock led to buyers offering more to secure properties.

A slight easing of interest rates may also be helping would-be buyers, with mortgage deals recently edging back below 5%.

Related: New mortgage deal falls below 5% in ‘watershed moment’ for UK homeowners

This week, Halifax, First Direct and HSBC became the latest major lenders to cut rates, and Halifax now offers a five-year fixed-rate mortgage at 4.53% for borrowers with a 40% deposit.

Sarah Coles, the head of personal finance at the advice company Hargreaves Lansdown, said the fall in house prices had been expected.

“The market has proved incredibly resilient in the face of overwhelming headwinds, but mortgage rate hikes over the summer dealt the final blow, pushing prices into negative territory,” she said. “Even if these price drops don’t take hold, it’s still a really horrible time to be trying to sell a property.”

Tom Bill, the head of UK residential research at the property agency Knight Frank, said: “The footnote tells a more important story than the headline figures. Sales volumes have fallen by about a fifth, making it more difficult for the Land Registry to calculate its index, which is the real story of this slowdown.

“Price declines have been kept in check by hesitant buyers and sellers, but thin trading means house price data should be handled with care.”

Yahoo Finance

Yahoo Finance