AVROBIO (AVRO) Stock Up on Upbeat Data From Cystinosis Study

AVROBIO AVRO announced positive interim data from a phase I/II study, which is evaluating the safety and efficacy of AVR-RD-04, an investigational gene-therapyfor cystinosis, a rare but progressive genetic disease.

Initial results from the phase I/II study indicate that following administration of AVR-RD-04, participants produce and distribute functional cystinosin protein throughout the body, thereby preventing the accumulation of cystine crystals. A build-up of cystine crystal can cause progressive organ damage, including shortened lifespan. In fact, data from this study also showed key visual-motor integration, visual perception and motor coordination measures that were impacted by cystinosis to have stabilized and even improved in participants following administration of the gene therapy.

The phase I/II study, sponsored by the University of California San Diego (UCSD), is currently evaluating AVR-RD-04 in adult patients who were diagnosed with the infantile form of cystinosis, previously treated with cysteamine, the current standard of care (SOC) for cystinosis.

All patients administered a dose of AVR-RD-04, continue to remain off SOC. In fact, following discontinuation of the SOC, the average hand-grip strength of the participants was stable up to 27 months after being dosed with the gene-therapy candidate.

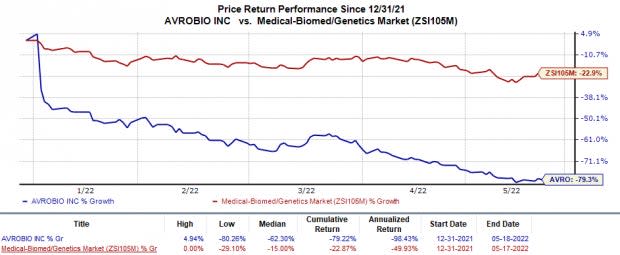

Shares of AVROBIO rose 4.7% on Tuesday (May 17) and again gained 5.4% in after-hours trading on that same day, following the above announcement. Yet, the stock has plunged 79.2% this year so far compared with the industry’s 22.9% decline.

Image Source: Zacks Investment Research

We note that AVR-RD-04 is designed to genetically modify a patient’s hematopoietic stem cells (HSC) to produce functional cystinosin protein as well as stabilize and even reduce the impact of cystinosis on different tissues.

Based on the above interim analysis of data, AVROBIO intends to self-sponsor a clinical study next year, evaluating the candidate. AVRO's current plan for AVR-RD-04 consists of a two-part strategy, which starts with a pre-renal transplant population followed by a post-renal transplant population. AVRO also plans to meet the FDA officials later this year to discuss its clinical strategy for AVR-RD-04.

AVROBIO, Inc. Price

AVROBIO, Inc. price | AVROBIO, Inc. Quote

Zacks Rank & Stocks to Consider

AVROBIO currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector are Abeona Therapeutics ABEO, Alkermes ALKS and Angion Biomedica ANGN, each of which has a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Abeona Therapeutics’ loss per share estimates for 2022 have narrowed from 34 cents to 33 cents in the past 30 days. Shares of ABEO have declined 48.1% in the year-to-date period.

Earnings of Abeona Therapeutics missed estimates in two of the trailing four quarters and met the same on the remaining two occasions, the average negative surprise being 8.2%. In the last reported quarter, Abeona Therapeutics missed on earnings estimates by 25%.

Alkermes’ loss per share estimates for 2022 have narrowed from 13 cents to 3 cents in the past 30 days. Shares of ALKS have risen 27.6% year to date.

Earnings of Alkermes beat estimates in each of the last four quarters, the average being 350.5%. In the last reported quarter, Alkermes delivered an earnings surprise of 1,100%.

Angion Biomedica’s loss per share estimates for 2022 have narrowed from $1.92 to $1.79 in the past 30 days. Shares of ANGN have plunged 57.9% in the year-to-date period.

Earnings of Angion Biomedica beat estimates in three of the last four quarters and missed the mark once, the average surprise being 58.1%. In the last reported quarter, Angion Biomedica missed on earnings by 9.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alkermes plc (ALKS) : Free Stock Analysis Report

Angion Biomedica Corp. (ANGN) : Free Stock Analysis Report

Abeona Therapeutics Inc. (ABEO) : Free Stock Analysis Report

AVROBIO, Inc. (AVRO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance